- The US Federal Reserve raises interest rates by a widely expected 25 basis points.

- The rate hike was accompanied by ‘dovish’ guidance.

- EURUSD finds strength on belief that this could be the point where the Fed pivots.

Jerome Powell, Chair of the US Federal Reserve, delivered a widely expected interest rate rise of 25 basis points on Wednesday, but his accompanying statement has caused a stir in the forex markets.

Risk-on currencies such as the euro have bounced on the news, leaving currency investors considering the short, medium and long-term prospects for EURUSD if this is indeed the moment that the Fed’s policy pivots.

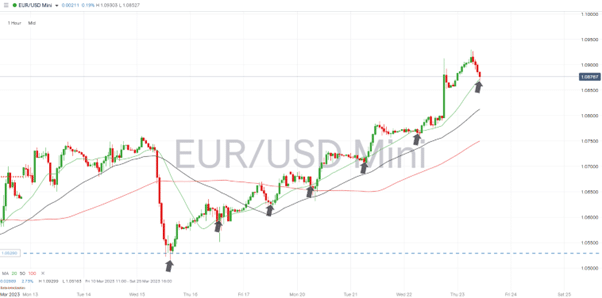

EURUSD Short-Term Forecast

The path of least resistance for EURUSD now appears to be upwards. Buying pressure has been building since last week, when EURUSD bottomed out at 1.05163 on Wednesday 15th March. This can be largely put down to the increasing likelihood of Powell and his team responding to pressures in the banking sector, and taking their foot off the pedal to ensure that no other banks follow SVB and Credit Suisse into positions of vulnerability.

Since Thursday 16th, price on the Hourly Price Chart has tracked the 20 SMA, and until that trend reverses, many will be catching buying opportunities when price retraces back to the key 20 SMA metric.

EURUSD – Hourly Price Chart 23rd March 2023 – Short-Term Forecast

Source: IG

Also Read: EURUSD Forecast and Live Chart

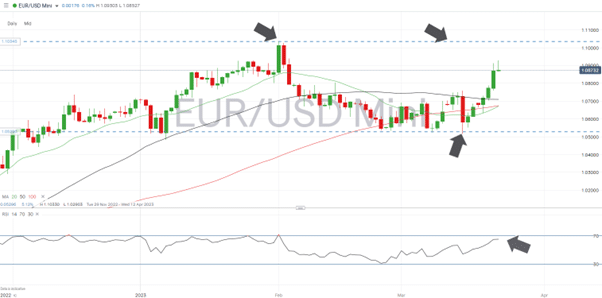

EURUSD Medium-Term Forecast

Should EURUSD continue its upward trajectory, the next major price resistance point is 1.10330, which was the price high printed on 1st February. There’s nothing like a year-to-date high to trigger traders to start banking profits on a long position, and the close proximity to the psychologically important 1.10 price level means that selling pressure can be expected to build in this region.

With the RSI on the Daily Price Chart currently at 65.4, there isn’t much room for further upward movement before the market begins to look ‘oversold’ on that timescale.

EURUSD – Daily Price Chart 23rd March 2023 – Medium-Term Forecast

Source: IG

EURUSD Long-Term Forecast

On a longer-term timescale, EURUSD can be seen to be funnelling into the end of a sideways wedge formed by two key metrics, the 20 and 100 SMAs on the Weekly Price Chart. Since November 2022, each weekly trading session has ended with price closing between those two key metrics. With them now converging, a breakout to one side or the other looks imminent – the direction of that break being a strong indication of intent regarding longer-term price moves.

From a technical perspective, there is a lot of resistance in the region of 1.10, but if this is the moment that the Fed pivots, it would represent a fundamental shift in risk appetite, which should be sufficient for price to break through. The minutes of the FOMC meeting that took place on Wednesday will be released on 5th April, and will provide investors with greater detail on the conversations that took place behind closed doors.

EURUSD – Daily Price Chart 23rd March 2023 – Long-Term Forecast

Source: IG

People Also Read:

- BoE Raises Interest Rates, Says Inflation to Fall Sharply For The Rest of 2023

- Markets Braced for Euro Interest Rate Announcement – Something’s Got to Give

- US Dollar Weakens as Nonfarm Payrolls Data Comes in at +311K

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk