Markets finished last week firmly in a ‘risk-on’ frame of mind. Stocks, commodities and non-USD currencies all moved into bullish territory in terms of technical indicators. The uncertainty which characterised September’s price moves made way for a more positive outlook in a wide range of asset groups.

Market Update

Stocks – Market News

• Asian markets had a mixed start to the week. The Hong Kong Hang Seng equity index was up 2.29% on Monday, but the Japanese Nikkei 225 was down -0.17%.

The mixed messages from the Asian trading sessions carried into the European open. Asian traders were wise to the risk of following the buying patterns only to find European and American traders taking profits later in the day.

Metals – Market News

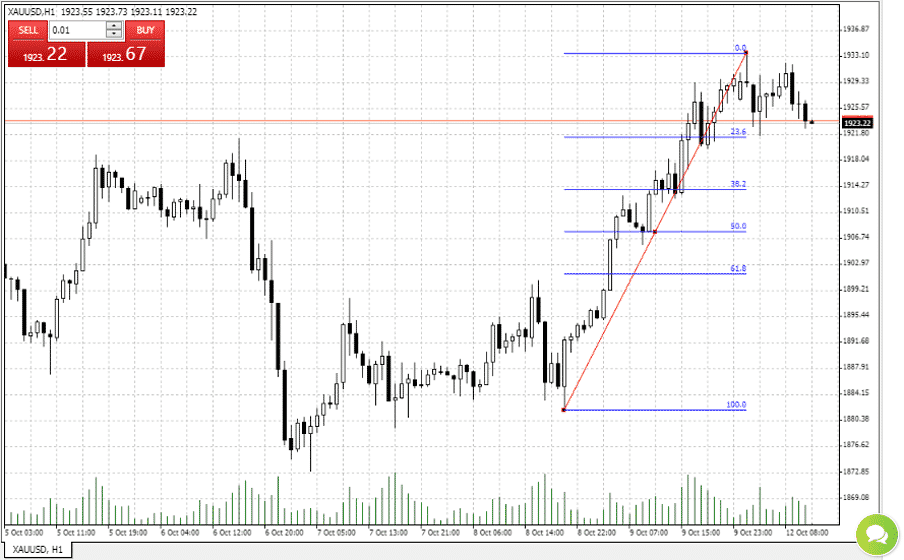

- Price action in gold and silver hints that they could have started one of their breakout patterns. Fans of the metals will be familiar with how both can build momentum and click through price levels on the way to their next target price. The main issue is deciding on trade entry points.

- As of Monday morning, the price of gold ($1925.22) is where it was on Friday afternoon. Support 1 is at $1921.98, Support 3 at $1917.87.

- Such price consolidation is a characteristic of the metal and there’s nothing bearish about the indicators.

- The Hourly SMA has provided support and could be the indicator to watch. The kiss of that line in the early hours of Monday marking the week-to-date low at 1921.66. Price support in that region was also provided by the 23.6% Fib.

Source: FXTM

Energy Commodities – Market News

- Geo-political risk rather than technical indicators continue to guide the price of crude with Azerbaijan and Armenia engaging in a will-they won’t-they military stand-off.

- It’s hard to get a clear picture of how political uncertainty will impact price. Still, the increased volatility and price increase of 6.84% last week will be a tempting proposition for many.

Trade of the Week

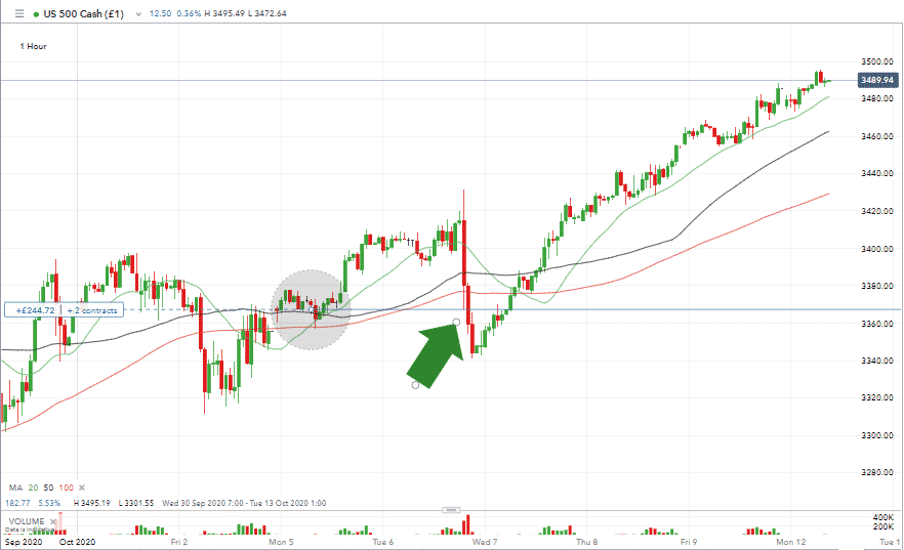

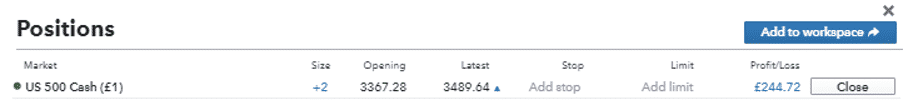

Last week has been firmly signed off as a successful opportunity to ‘buy-the-dips’. Our desk put on a buy of the US 500 stock index one hour before the European stock markets opened on Monday the 5th of October. With an opening price of 3367.28, it caught the pre-market exuberance and was mostly in positive territory throughout the week. Only trading underwater in the overnight trading of Tuesday evening and Wednesday morning.

Source: IG

In the morning session on Monday the 12th, the total percentage return on the US 500 position is +3.74%. The two-unit purchase trade, put on using IG, generating a profit in cash terms of £244.72 in the space of one week.

Source: IG

The obvious question to ask is whether there is any juice left in the move towards risk. The countdown to the US presidential election has started in earnest. With 22 days until votes are cast, those looking for this week’s trade might have less conviction than the position our desk put on last Monday.

Gold’s role as a defensive asset is not as strong as some would suggest. It’s hard though to look past the metal’s price action, dollar weakness, and the chance that it be seen as some kind of security as the election nears.

A position in gold could be a useful marker. Our buy-in small size for $1923.15 is one for the Demo Account, but it should help keep track of the markets.

Our analysis is based on a comprehensive summary of market data. We use a range of metrics with weighting given to simple and exponential moving averages and key technical indicators.

Any information contained on this Website is provided as general market information for educational and entertainment purposes only and does not constitute investment advice. The Website should not be relied upon as a substitute for extensive independent market research before making your actual trading decisions. Opinions, market data, recommendations or any other content is subject to change at any time without notice. ForexTraders will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

PAST PERFORMANCE IS NOT ALWAYS INDICATIVE OF FUTURE RESULTS.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk