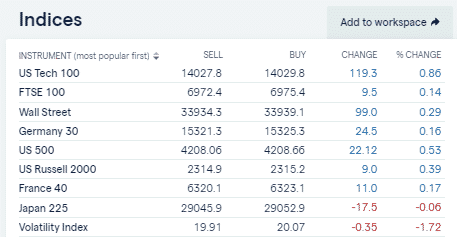

The US Federal Reserve has spoken. The two-day summit of FOMC officials ended with the interest rate decision and its accompanying statement confirming that it is changing as little as possible. That conclusion was largely priced in by the markets, and major indices were slightly up as a result.

Source: IG

The Fed’s policy has a global reach, so European indices followed their American peers, with only the Japan 225 lagging, due primarily to Covid concerns.

The big mover in the list of indices is the VIX Volatility Index, otherwise known as the ‘Fear Index’.

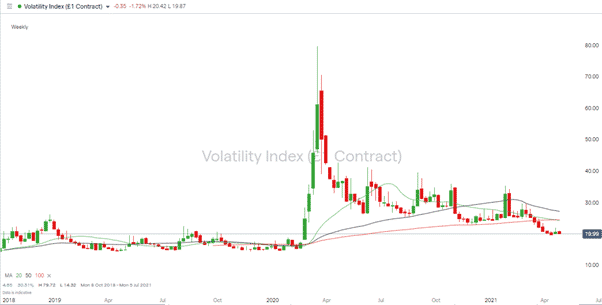

Volatility Index (VIX) Monthly Chart

Source: IG

The VIX index has dropped to levels last seen in February 2020, pre-pandemic. The intra-day price drop of 1.72% also broke the 20.00 price level, which is a huge psychological support. It was tested, and it held last week. Powell’s comments appear to be encouraging many to conclude that the financial markets are already out of the woods. Are they right?

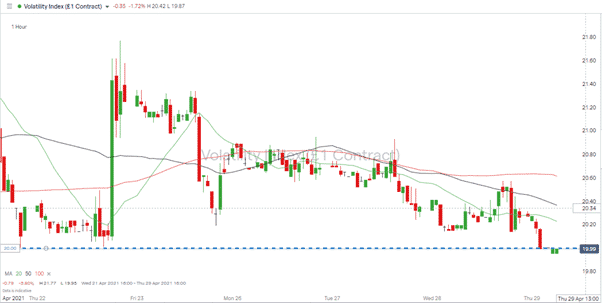

Volatility Index (VIX) 1H Chart

Source: IG

The Fed’s statement offered continued stability over growth, which explains why stocks gave it a lukewarm reception with the VIX plummeting. Most importantly, Jerome Powell and his team gave a clear indication that they are sticking with the status quo until they get actual confirmation, rather than forecast confirmation, that the economy is back to pre-Covid levels.

On the tricky subject of potential inflationary pressures, Powell said:

“We are also likely to see upward pressure on prices from the rebound in spending as the economy continues to reopen, particularly if supply bottlenecks limit how quickly production can respond in the near term. However, these one-time increases in prices are likely to have only transitory effects on inflation.”

The Fed will keep its zero-rate interest policy in place and continue its $120bn worth of monthly bond purchases even if inflation picks up.

He continued: “Inflation is on track to moderately exceed 2% for some time. I would note that a transitory rise in inflation above 2% this year would not meet this standard.”

With inflationary pressures currently an increasing concern in the investment community, that statement could come back to haunt Powell. A flood of “only transitory” memes on Reddit/wallstreetbets could be only months away if the inflation genie can’t be put back in the bottle.

What Next for the Financial Markets?

With the monetary policy outlook confirmed, all eyes will shift to the Fiscal initiatives of US president Joe Biden. At 9 pm (EST), he will address a joint session of Congress to expand on his “once in a generation” spending plans. The outcome for the $4trn spending proposal is harder to call than the Fed’s statement, which was largely priced in. Thanks to opposition from the Republican party, delays and amendments to the package could lead to an uptick in equity price volatility.

The uncertainty relating to the fiscal stimulus could also see the VIX pick up again. If it does haul itself back above the 20.00 price support level, then the path of least resistance could be upwards.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk