A mixed bag of technical analysis data points towards an uptick in price volatility this week and the offer of a range of trading opportunities. Several equity indices markets look primed to rebound and test previous highs. Forex markets are also forming interesting price patterns.

Potential for Increased Price Volatility

The previous trading week and the run into the end of the month were notable for little happening. Only one of the major asset groups in the Forex Traders Technical Analysis matrix moved in price by as much as 1%. When the relatively sedate and blue-chip heavy FTSE 100 is more volatile than Bitcoin, then you know it’s a quiet week in the markets.

| Instrument | 27th April | 3rd May | Hourly | Daily | % Change | |

| GBP/USD | 1.3870 | 1.3806 | Strong Buy | Strong Buy | -0.46% | |

| EUR/USD | 1.2008 | 1.2010 | Neutral | Strong Buy | 0.02% | |

| FTSE 100 | 7,031 | 6,961 | Strong Buy | Strong Buy | -1.00% | |

| S&P 500 | 4,180 | 4,189 | Strong Buy | Strong Buy | 0.22% | |

| Gold | 1,786 | 1,773 | Neutral | Strong Buy | -0.73% | |

| Silver | 2,603 | 2,590 | Strong Buy | Strong Buy | -0.50% | |

| Crude Oil WTI | 63.19 | 63.14 | Strong Sell | Strong Buy | -0.08% | |

| Bitcoin | 57,385 | 57,908 | Buy | Sell | 0.91% | |

Source: Forex Traders

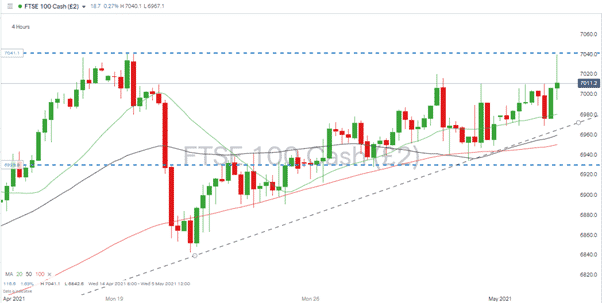

FTSE 100 – Ready to Bounce

The FTSE 100 ended the last week of April trading in the middle of the 6930 – 7040 price range and by Tuesday had signalled intentions to push higher. A price spike early on Tuesday to 7039 was momentary, but the next resistance level test will offer comfort to the bulls.

The Bank of England gives its update on interest rates on Thursday. As long as unexpected leaks don’t filter into the markets, there could be opportunities to buy any dips which visit the supporting trend line.

Good news appears priced in but weekend polling results from the Hartlepool by-election predict a shock-win for the incumbent government. Political stability, particularly in terms of a more pro-business party being in control, could offer support to upward price moves.

Source: IG

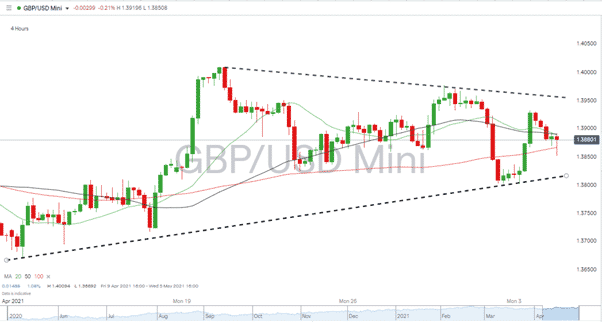

GBPUSD – Under Pressure

The Bank of England is not expected to increase interest rates on Thursday. Also, any news of it scaling back its Gilt-buying programme looks likely to be caused by there being little left to snap up, rather than any return to more hawkish policies.

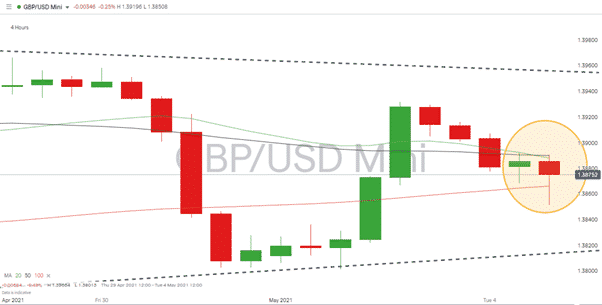

As a result, sterling looks under pressure. The wedge pattern it has been forming since the beginning of April is currently pointing sideways rather than up or down: the weak fundamentals are working in unison with the 4-hour moving averages. Price on Tuesday looks to be capped by the 20 and 50 SMA, with the former intersecting the latter (downward) during Tuesday’s Asian session.

Source: IG

Source: IG

Weakness in sterling is usually positive for the FTSE 100 as many members of the index make substantial profits overseas. The double-whammy of a price slide in GBPUSD and the other catalysts for UK equity price rises coming into play makes the FTSE 100 index the market to watch again this week.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk