It’s a busy week in terms of economic reports, with Wednesday and Thursday being the days to watch.

Wednesday – US Federal Reserve Interest Rate Announcement

Thursday – US Q1 GDP Report

There appears no chance of a US interest rate hike and little chance of a change in fiscal policy. Markets are also pricing in that the commentary which comes in the press conferences will also remain the same. Any deviation from that would unsettle the markets. With the recovery still in its infancy, Jerome Powell and his team are likely to be particularly careful about the language they use.

US Fed – Upcoming Meeting in Focus

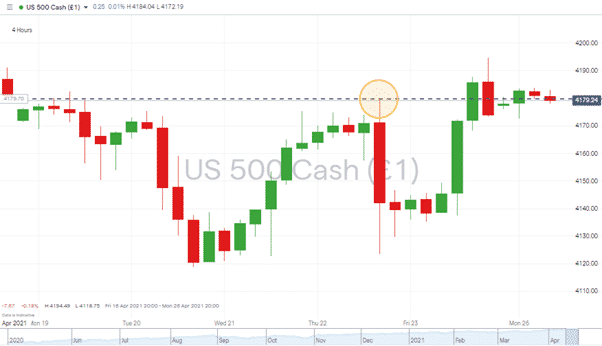

The benchmark index for global equities, the S&P 500, has reflected the unwillingness of investors to make any big calls before the announcements. On a week-to-week basis, the index is flat, treading water at 4,180 but showing a degree of weakness in the interim.

US 500 Index – Weekly Price Chart – UNCH

Source: IG

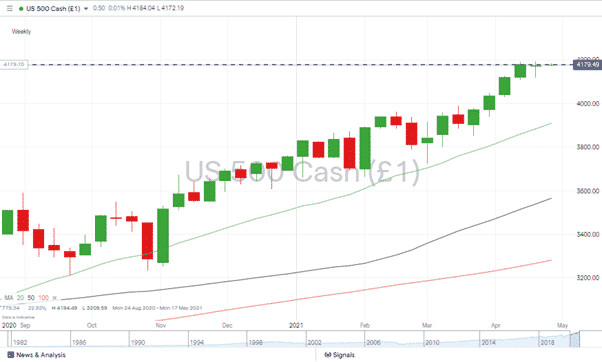

The kiss of 4180 on Thursday of last week was followed by an end of the week surge. That tested the level again, but 4180 is proving to be a significant resistance/support price level. This appears to be all about investors wondering if further all-time highs are justified, given the long-term moving averages are so far below current price levels.

US 500 Index – Weekly Price Chart – With Moving Averages

Source: IG

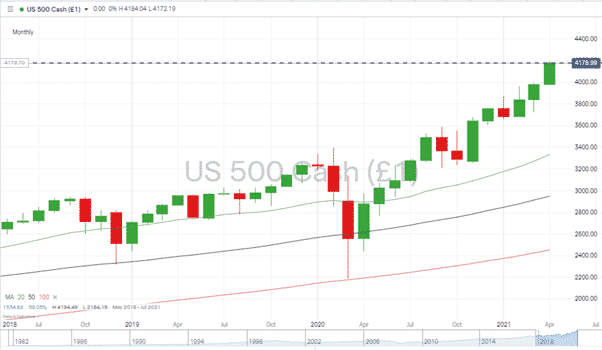

US 500 Index – Monthly Price Chart – With Moving Averages

Source: IG

While all eyes will be on the Fed, there are also a heap of curveballs to look out for on other days.

Monday – Ifo German Business Confidence

Tuesday – Bank of Japan Interest Rate Decision

Tuesday – China Industrial Profits

Wednesday – Japan Retail Sales

Wednesday – Wholesale Inventories

Thursday – US Initial Jobless Claims

Thursday – Pending Home Sales

Friday – US Personal Income and Spending Report

Friday – US Chicago PMI

USDJPY

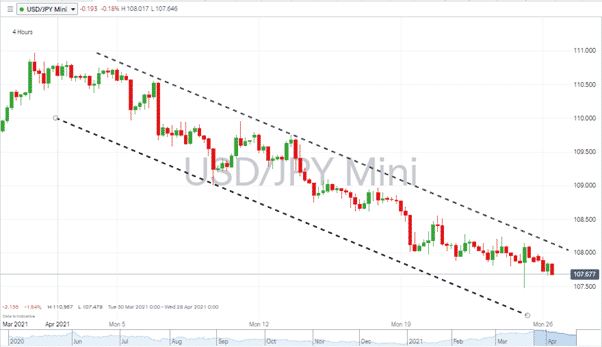

The relatively low volatility US-Yen currency pair has been a centre of attention lately. The moves might not be as dramatic as cryptos or equity indices, but for some, they’re easier to spot.

USDJPY 4h Price Chart – The Trend is Your Friend?

Source: IG

The fact that US and Japan central banks are reporting within 48 hours of each other could trigger short-term whipsawing in price, but possibly more interestingly, a sign of which direction will be chosen for the next longer-term price trend. With GDP, retail sales and jobless numbers also thrown into the mix, there is every chance USDJPY could be the market to watch.

What Do Comments from the Bank of Canada Mean?

Netflix dominated market headlines last Wednesday thanks to its earnings report confirming it had missed Q1 new subscriber targets. News about the challenges facing the streaming service spilt into mainstream news and overshadowed a potentially more significant announcement from the Bank of Canada.

On that same day, the Bank of Canada became the first central bank to break ranks and turn hawkish. The bank signalled it could hike interest rates as early as next year and the increased likelihood of bond sales tapering back sooner than expected. With the US sharing a land border with its neighbour, it could be a Canadian chill wind that causes the Fed to scale back its loose-money policies earlier than the equity and forex markets expect.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk