Pfizer’s announcement that it had cracked the vaccination code sent markets flying on Monday. The severe aftershocks continued through Tuesday and only by Wednesday European open had some price consolidation begun to take place.

One of the interesting features during the start of the week was the divergence within different asset groups.

- Tech stocks plummeted while mainstream indices started a multi-session price climb

- Bitcoin held firm while gold gave up a dollar

- EURUSD fell 1% in value whilst GBPUSD climbed by the same amount

Not only was the vaccine news a surprise but it caused different asset groups to fragment. Some lockdown premium was built into tech-stocks that cater to the housebound. While they would not have been expected to benefit from the vaccine directly, the extent of the sell-off surprised some. The good news was firmly in the airline, travel and hospitality sectors.

Breakout moves?

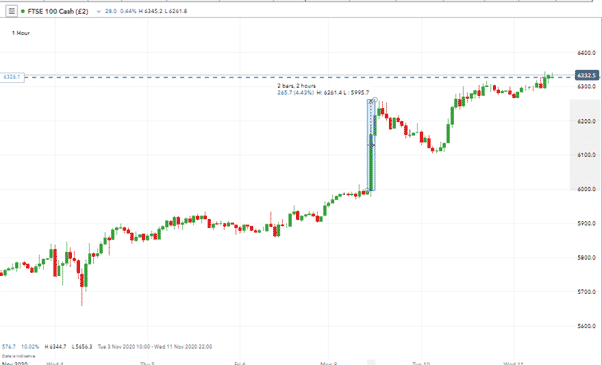

Taking mainstream stock indices as an example, the FTSE 100 rose by 4.43% in the space of two hours.

That surge was coming on the back of a week of price rises which had been taking the index into overbought territory.

That’s Why Stop-losses are Recommended

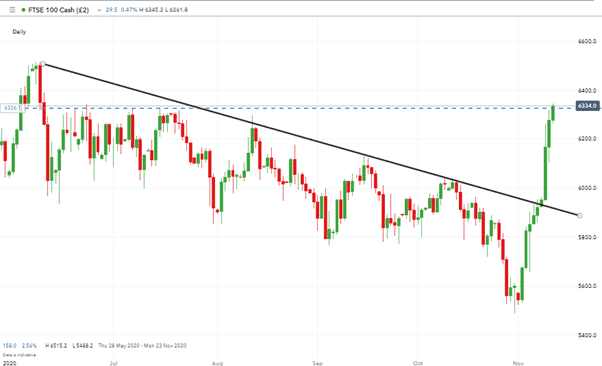

The move was a salient lesson in how fundamental events can trump technical analysis. The hope is that those who went short had stop-losses set just above the trend line.

There were justifiable reasons for betting against stocks. The result of the US presidential vote looked priced in and an increase in the number of COVID cases was due to climb up the rankings on the news reports.

Time to Remove the Emotion from Trading

The last two weeks had a heap of ‘known unknowns’ and even without the Pfizer curve-ball volatility, the levels had significantly picked up.

Those traders who were caught by one of the various market shifts would do well to remember emotional trading is bad trading. A period of sitting on hands might ultimately help the trading P&L.

Prices appear to have stabilised at their new levels. The flow of news is due to reduce in the next few days, so this could be a time for developing and testing strategies rather than trading them using real cash.

Which Way Next?

Now is not a bad time to be following rather than trading the markets as there are a lot of interesting patterns forming. It could well be that markets are approaching a crossroads.

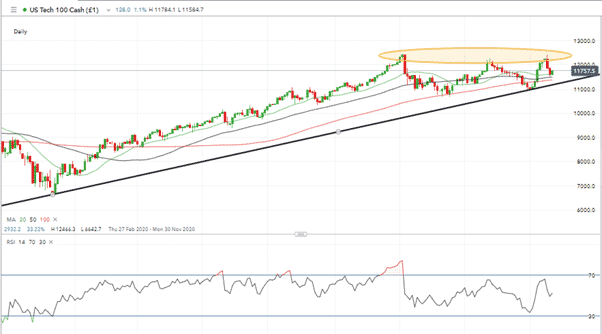

The Nasdaq 100 has been a significant leading indicator through 2020. It’s approaching a long term and noteworthy supporting trend line at around 11211.

At the same time, a possible head and shoulders price pattern is forming over the months of September and October.

The correction over Monday and Tuesday took the Nasdaq 100 as low as 11594 where it bounced off the 20 SMA. On a daily chart, the tech index is also still trading above the 50 and 100 SMA.

If market sentiment shifts to consider that the vaccine is good for tech as well as high street names the sell off could prove to be a dip worth buying.

Any information contained on this Website is provided as general market information for educational and entertainment purposes only, and does not constitute investment advice. The Website should not be relied upon as a substitute for extensive independent market research before making your actual trading decisions. Opinions, market data, recommendations or any other content is subject to change at any time without notice. ForexTraders will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk