The oil market in 2024 is anticipated to face a complex set of dynamics influenced by global economic activities, geopolitical tensions, and production adjustments. Key insights from various analyses highlight a generally bearish outlook with some potential for price fluctuations due to unforeseen factors. In this article we analyse the insights highlighted in February’s OPEC report.

Economic and Supply Considerations

The global economy’s slow momentum is expected to persist into 2024, affecting demand growth for oil. Oversupply issues, weak prices and moderate demand growth suggest low oil prices could be a significant trend for the year. The United States’ oil production is projected to continue its growth, albeit at a slower pace, contributing to the supply side’s pressure on prices. However, the Organization of the Petroleum Exporting Countries (OPEC) and its allies face challenges in influencing oil prices due to increased output from non-member countries.

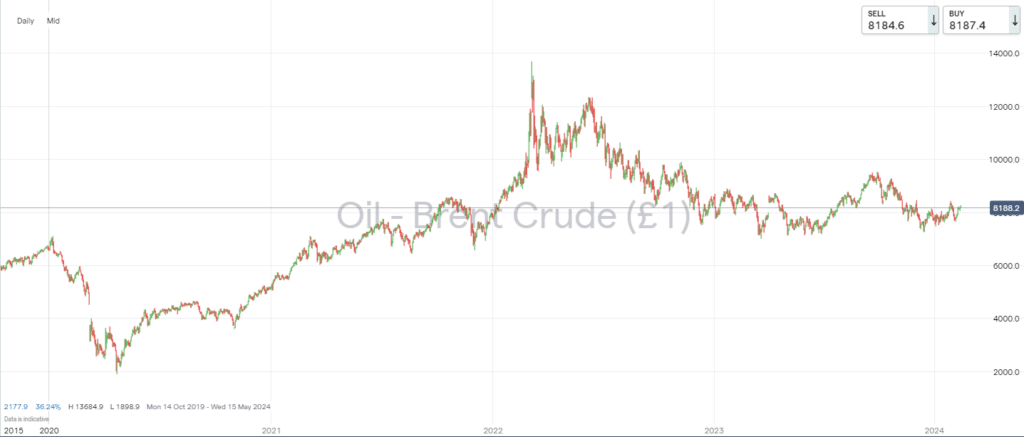

Analysts foresee ample supply in the market due to the slowdown in global economic activities. Couple this with rising production from key players such as the US, Brazil, Guyana, Norway, and Canada. Goldman Sachs and the International Energy Agency (IEA) have adjusted their forecasts, predicting Brent oil to average around $80-$81, with technical analyses suggesting support levels in the mid-$60 range for Brent crude if a global recession materializes.

Price Projections and Geopolitical Factors

Top U.S. banks predict a median Brent price of $85 for 2024. They cite demand growth and potential supply disruptions as key factors. Goldman Sachs has adjusted its forecast to $70-$90 per barrel, and Citigroup predicts an average price of $75, taking into account the slower demand growth and higher U.S. output.

A Reuters poll indicates that international oil prices are likely to hover around $80 a barrel, with weak global growth capping demand. The survey suggests Brent crude could average $82.56 in 2024. Geopolitical tensions are a potential support for prices, despite the uncertainties around the ability of OPEC+ to sustain supply cuts.

Insights from OPEC’s February 2024 Report

The February 2024 edition of the OPEC Monthly Oil Market Report revealed significant trends and movements in the oil market. This provides crucial information for traders and speculators. The report highlights the rebound of crude spot prices in January 2024, following three months of declines. This phenomenon is driven by a strengthening in market fundamentals and easing of futures selling, which bolstered spot prices. Notably, geopolitical tensions and heightened risks in Eastern Europe, including attacks on oil infrastructure in the Baltic Sea, have introduced a risk premium into the market.

January 2024 saw the OPEC Reference Basket price rise by $1.04, marking a 1.3% month-on-month increase to stand at $80.04/b. This uptick in prices reflects a broader market response to supply disruptions and sustained demand, particularly from Asia-Pacific refiners, with China’s renewed demand significantly buoying the value of Dubai crude.

Futures Prices and the OPEC Report

Crude oil futures also showed a positive trend in January 2024. Futures prices rallied to nearly three-month highs driven by an improving economic outlook and escalating geopolitical tensions. The report details an increase in speculative activities, with money managers raising NYMEX WTI net long positions by 68.2% between the weeks of 2 January and 30 January 2024, reflecting a growing optimism in the market.

The futures market structure shifted. The forward curves of ICE Brent and DME Oman steepened, and NYMEX WTI flipped into backwardation in the third week of January. This shift indicates a change in traders’ perception of the supply and demand outlook. It suggests tighter market conditions and supporting higher prices for front-month contracts.

Moreover, the OPEC report underscores the impact of supply outages. These include a significant reduction in oil production in North Dakota due to extreme cold weather, and geopolitical developments on market sentiment and pricing. Add to this robust demand, particularly from Asia-Pacific buyers, and higher refining margins. These factors have led to a bullish sentiment in the oil market.

Conclusion

Following the February OPEC report, the consensus among analysts points towards a year of challenges. Prevailing economic headwinds and ample supply are likely to keep prices moderated. While geopolitical risks could introduce volatility, the overarching expectations lean towards relatively stable but low oil prices, barring significant disruptions. The global economy’s health remains a critical determinant. The oil market’s trajectory in 2024 will be closely tied to broader economic indicators and geopolitical developments.

Don’t Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading.

These tips could help make you a better trader – and we’re giving them away for free!

Related Articles

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk