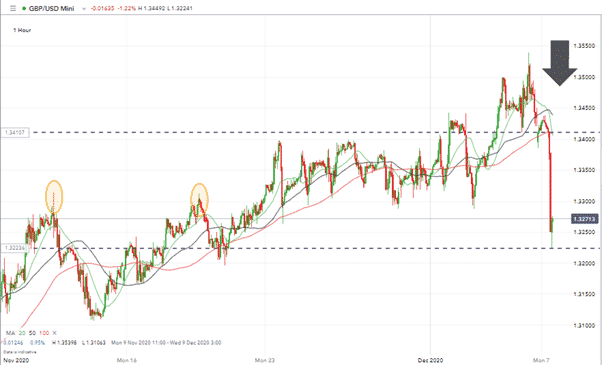

Currency traders will have watched Monday morning’s sell-off in GBPUSD and been reminded of the firm grip which the Brexit negotiations have on the price of cable.

Optimists will be reminding themselves that all successful negotiation processes involve a significant shake-down near the end of the talks. Last-minute shenanigans were after all probably the only guaranteed event in the year-long drama.

It does now look increasingly likely that the talks might break down.

The geographical location of Ireland means its economy stands to be one of the biggest losers from a no-deal scenario and its interventions in the process have always been solution orientated. The comment from Irish Prime Minister, Micheal Martin, that, “things are on a knife edge here and it is serious” probably provide the most reliable update from inside the meeting rooms.

How far will GBPUSD sell-off?

Monday’s GBPUSD sell-off gained momentum after the Asian markets closed. With so much depending on rumour and implication traders outside of Europe appear to be acknowledging they have little competitive advantage over those closer to the situation.

Source: IG

The slide in the pound started in the two hours before the open of the European exchanges. Sterling lost more than 1% against the dollar, levelling out in the region of 1.325.

Support levels include:

- 32003 March High and psychologically important

- 31571 Daily 50 SMA

- 30901 Daily 100 SMA

Any rapid-recovery faces the challenges of the following resistance points

- 33280 Daily 20 SMA

- 35156 2019 High

Further moves can’t be discounted during Monday’s session, Brexit news does have a habit of leaking into the markets. But both the UK and EU representatives have suggested the next update will come later in the day, possibly on Monday evening. It’s looking increasingly possible that the round the clock, 24/5 nature of the forex markets is likely to come into full effect this week.

What trading opportunities will a no-deal Brexit bring?

The whip-sawing GBPUSD market may have too much volatility for some. There are likely to be other opportunities from the way that the political negotiations are clouding the market.

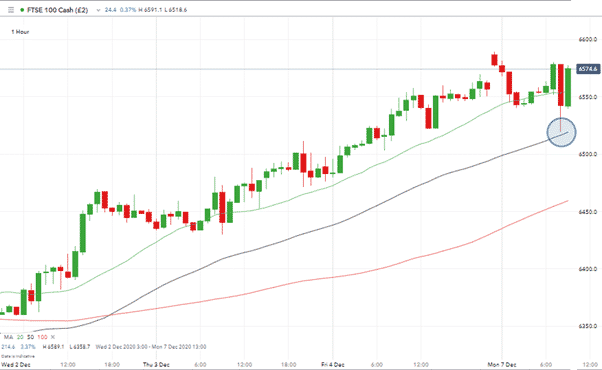

Is it time to buy the FTSE 100?

Increased odds of the UK tumbling out of the EU without a trade agreement caused a sell-off in UK blue-chip companies as well as GBPUSD. That looks like a possible anomaly.

Since the result of the referendum in 2016, the FTSE 100 has demonstrated a negative correlation to the price of GBPUSD. With a large part of that index being multinationals, their overseas profits are inflated by a fall in the price of sterling.

The immediate sell-off in the FTSE 100 on Monday morning possibly reflected negative sentiment clouding minds. There may have also been some profit-taking and stop-loss triggering after the indices multi-day bull run but it’s possible that some dip-buying will begin to take effect.

Source: IG

The RSI on the 5-minute chart has already touched 30, showing signs of the equity index being oversold in the very short-term. The week-to-date low of 6520 also marking the 50 SMA on the 1-hour chart making this a fundamental support level.

Source: IG

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk