Low volume summer markets could be about to be shaken up. After several weeks of relatively low trading volumes and quite stable prices, macro and stock-specific news are back on the agenda. These upcoming news events are worth watching out for this week.

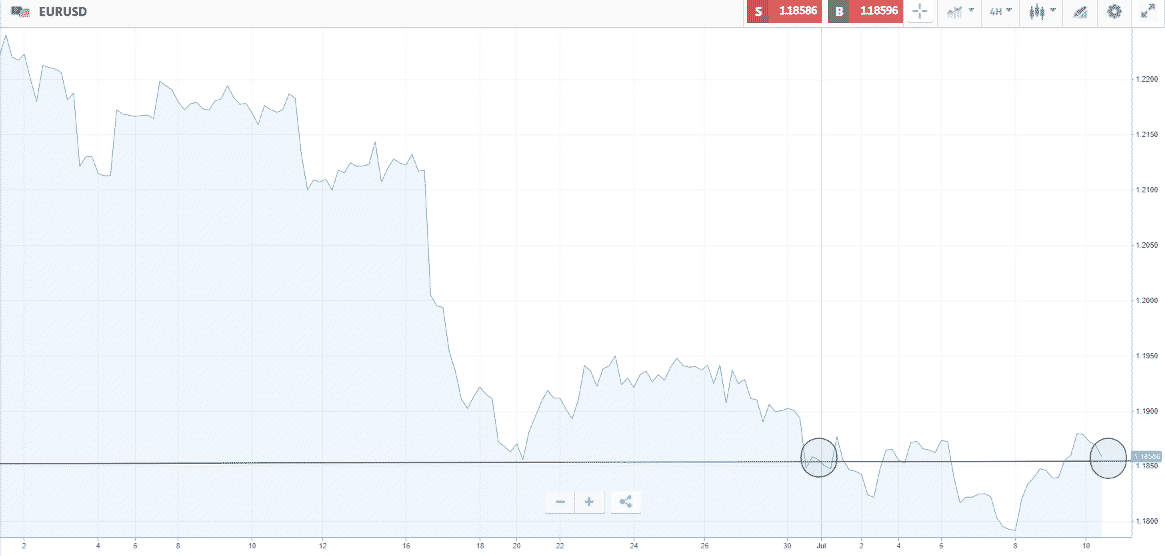

EURUSD – 4hr Price Chart

Source: eToro

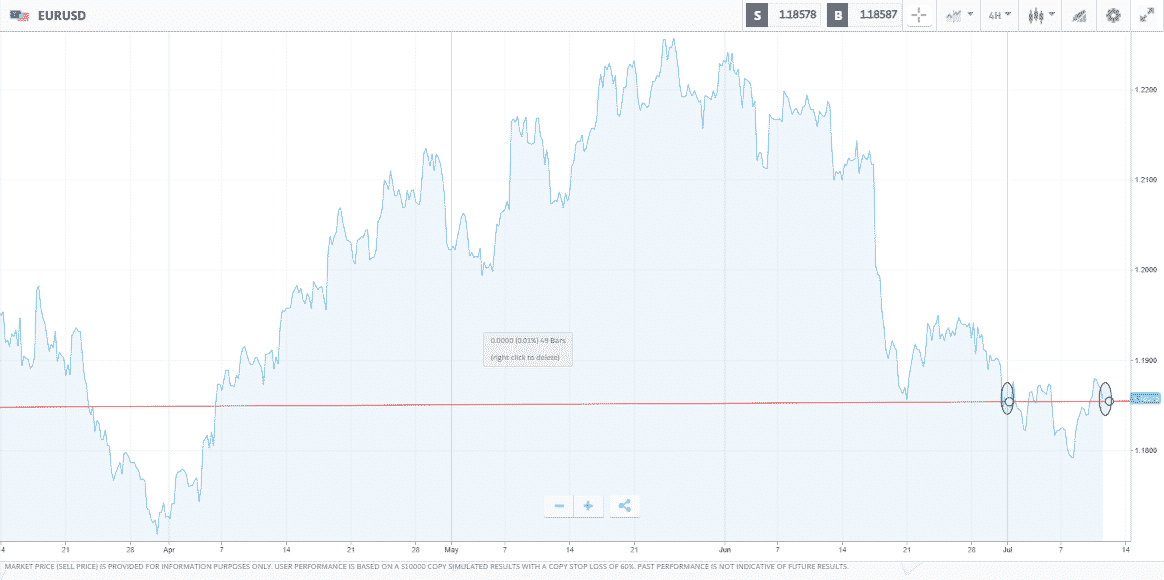

EURUSD – 4hr Price Chart

Source: eToro

Markets Coming Off the Back of a Quiet Week

The performance of key asset groups over the last week (Monday to Monday) highlights how little has changed. There was some price movement between the two data points; however, EURUSD, possibly the best barometer of forex market activity and a market that has been on the skids since the beginning of June, was only one tick away from unchanged on the week. GBPUSD showed a small gain of 0.35%, while Bitcoin, S&P 500, and the FTSE 100 all hovered within 0.50% of the previous week’s prices. Only the precious metals posted any kind of price move.

Instrument | 5th July | 12th July | Hourly | Daily | % Change |

GBP/USD | 1.3839 | 1.3887 | Neutral | Buy | 0.35% |

EUR/USD | 1.1867 | 1.1866 | Neutral | Strong Sell | -0.01% |

FTSE 100 | 7,114 | 7,093 | Strong Buy | Strong Buy | -0.30% |

S&P 500 | 4,342 | 4,360 | Strong Buy | Strong Buy | 0.41% |

Gold | 1,790 | 1,801 | Strong Sell | Neutral | 0.61% |

Silver | 2,656 | 2,593 | Strong Sell | Strong Sell | -2.37% |

Crude Oil WTI | 74.85 | 73.74 | Neutral | Strong Buy | -1.48% |

Bitcoin | 34,111 | 34,232 | Strong Buy | Sell | 0.35% |

Source: Forex Traders Technical Analysis

Macro New Events – Week of the 12th of July

The first potential boost for price volatility comes from the swathe of economic updates lining up to mark out the week.

Monday 12th July

- US Consumer Inflation Expectations

Tuesday 13th July

- Germany Consumer Price Index (Final)

- US Consumer Price Index

Wednesday 14th July

- UK Consumer Price Index

- UK Producer Price Index

- UK Retail Price Index

- US Producer Price Index

- Bank of Canada Interest Rate Decision

Thursday 15th July

- Australia Unemployment Rate

- UK Unemployment Rate

- US Weekly Jobless Claims

Friday 16th July

- Bank of Japan Interest Rate Decision

- US Retail Sales

- US Business Inventories

Corporate Earnings Events – Week of the 12th of July

The US earnings season is back – that usually results in price action picking up. The big banks will be leading the way, with some investors approaching their earnings release dates with some trepidation.

On the upside, the removal of restrictions on them paying dividends or announcing buy-backs could see cash returned to investors. On the other hand, stellar results are not expected. The impressive proprietary desk trading of the last nine months was helped by investment banks having an inside line on the market’s health at a critical time; that advantage is wearing thin. The consensus among analysts is that Q2 results for the financial firms will beat expectations, but not by much. Any deviation from this could result in significant price moves across the equity markets.

Tuesday 13th July

- Goldman Sachs

- JPMorgan Chase

Wednesday 14th July

- Bank of America

- Wells Fargo

- Citigroup

Thursday 15th July

- Morgan Stanley

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk