In line with the majority of analyst expectations, the US Federal Reserve hiked interest rates by 75 basis points on Wednesday. Marking a remarkable turn-around of approach from the dovish days of 2021, Jerome Powell and his team have ramped up their inflation-busting protocols and posted record-breaking interest rate rises. The guidance that further action will be “appropriate” is in line with previous statements and means other hawkish moves are likely.

As is often the way, the reaction can best be described as ‘buy the rumour, sell the fact’. Despite the Fed’s hawkish policy coming down the track as expected, the US dollar sold off soon after the announcement, moving from 107.12 to 106.07 in less than an hour. For the USD Basket Index, ‘business as usual’ wasn’t enough to maintain the bull run in the greenback, which dates back to May 2021.

There’s no doubting that the dollar can be identified as overbought on certain timeframes. However, forex moves driven by fundamental realignments such as those triggered in 2020 can build tremendous long-term momentum. This raises the question of what the key technical levels are following Wednesday’s rates news and the burst of selling activity.

US Dollar Basket and 106.00

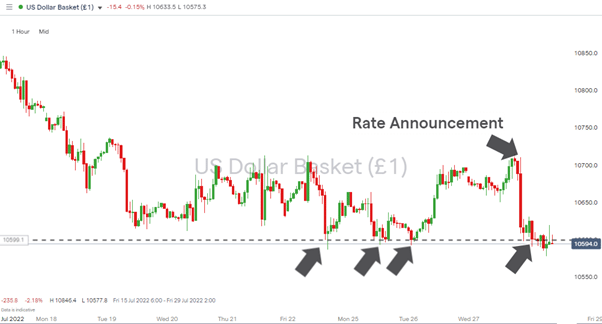

In Thursday’s early trading, it quickly became apparent that the psychologically important level of 106 is firmly in play. Price has flirted with this round number support for a week and tested and bounced on four occasions.

US Dollar Basket Index – Hourly Price Chart – Support at 106

Source: IG

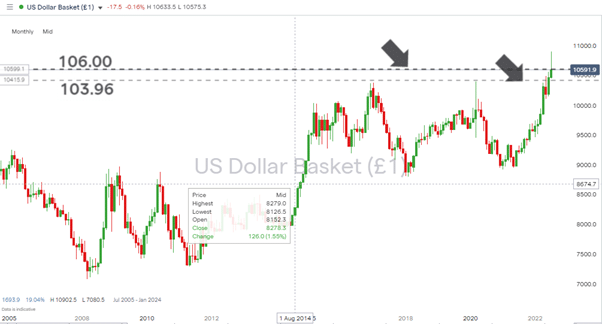

The next support level to factor in is 103.96, which marks the price highs of January 2017 and March 2020.

US Dollar Basket Index – Monthly Price Chart – Support at 103.96

Source: IG

To the upside, the most obvious resistance level is the multi-year high of 109.02 recorded on 14th July. That level can be cross-referenced to EURUSD being at parity, meaning the world’s most widely traded currency pair will have to experience a paradigm shift for that level to be broken.

US Dollar Basket Index – Daily Price Chart – 2022 – Resistance at 109.02

Source: IG

Fundamentals Will Still Drive Price

The technical analysis of price levels looks set to provide a channel in which price will trade as it responds to numerous fundamental factors.

Will the ECB finally take inflation seriously, or does the situation in terms of Russian fuel supplies rule out further rate hikes? The UK government is soon to be led by one of two Tory leadership candidates, both of whom have massively diverging views on economic policy. Will China relax Covid restrictions and spur demand for the Australian dollar and all the raw materials the country supplies to Chinese manufacturers?

Choppy sideways trading appears the most obvious outcome in the near future as investors decide which one of the many price drivers to prioritise.

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk