The crazy events of the last week have once again catapulted meme stocks to the top of the financial news headlines. Crowd-sourced retail buying pressure of this size was last seen in January and at the time resulted in the GameStop share price rising by 1,034% in the space of four trading sessions.

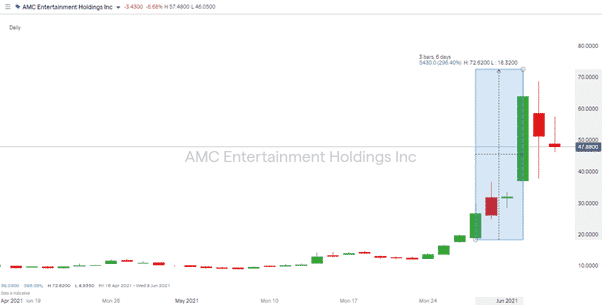

The price hikes associated with the May to June meme festival are relatively modest in comparison, but AMC, the stock that is currently the centre of attention, rose 296% over the course of four trading sessions last week.

AMC Entertainment Holdings – Daily Price Chart

Source: IG

The 296% price spike was less notable for the size of the gain, and more because it confirmed that lightning really can strike twice. The question for anyone who bought into AMC, or Bed Bath & Beyond and GME, is whether this story is going to end up the same way that GameStop did, with retail investors nursing heavy losses.

One factor that might, or might not, count against AMC holders is that there is a big news announcement in the ‘normal market’ due on Thursday. The US Consumer Price Index (CPI) data is hitting the markets just as many investors are getting twitchy about valuations and the risk of inflation.

How Will US Inflation Data Impact Meme Stocks?

With major US indices finishing the week strongly, there needs to be some kind of catalyst to take prices higher, and a looming inflation report is not one of those. With recovery from COVID-19 already priced in, the risk of inflationary pressures could signal a reversal in US fiscal and monetary policy. A break to new highs would in these circumstances signal both a bullish breakout and light-headed euphoria. Sideways trading during the first few days of the week would, on the other hand, suggest that investors are collecting their thoughts ahead of Thursday’s announcement.

This could play out in different ways. Will meme stocks thrive if their volatility attracts day traders looking to trade momentum as the broader markets drift into the CPI report? Or would quieter trading in the rest of the market take some heat out of the recent price surges? These two very valid questions have to wait their turn as meme stocks first work through their own peculiar scenarios.

What Is Driving Meme Stocks?

The incredible price spikes in meme stocks are being attributed to a certain range of factors coming into play. Small retail investors are buoyed by their ‘money for nothing’ stimulus cheques and willing to play market roulette until those cheques become a life-changing amount of money. Easy come, easy go.

At the same time, trading in US markets is virtually cost-free. While removing barriers to entry might be good for the industry in the long run, there is a risk that some smaller investors might get burned. Then there is the WallStreetBets phenomenon, which is as powerful as it is hard to really understand.

It’s a tough call. The more the establishment appeals for calm, the greater the resilience of the independent traders.

If you want to know more about this topic, please contact us at [email protected].

Are you ready to trade?

Sign up with Your capital is at risk

Your capital is at risk

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk