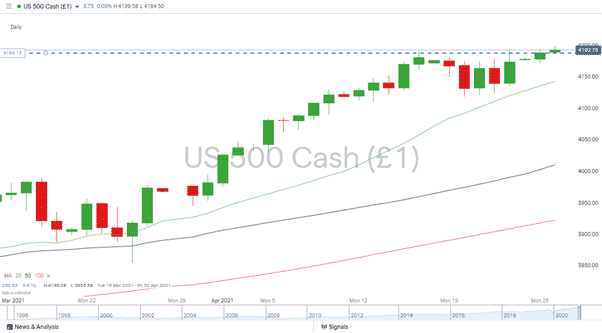

Two of the world’s most important stock indices posted record highs on Monday as positive earnings reports brought boom-time back to the markets.

The tech-heavy Nasdaq Composite was up 0.9% on Monday and posted a record close. At the same time, the S&P 500 index ran into the closing bell at a record 4188 price level.

Source: IG

The truth about earnings beats is that the game is skewed towards good news. With a third of US companies having reported so far this season, 84% have beaten analyst expectations. That is slightly more than normal, but the 2020 Q4 number for beats was also over 80%.

Positive earnings data is news that can be interpreted according to your preference, and for now, at least the response has been a positive one. Tesla bucked that particular trend; the firm ticked all the boxes in its report and was still down 2.5% on the day. That was attributed to less tangible concerns about “future prospects” kicking in but could be more to do with profit-taking.

Will the Nasdaq Breakout to the Upside?

Despite the euphoria, there has not yet been a confirmed breakout to the upside. The price action showed resistance levels being tested rather than smashed, but that could be about to change on Tuesday.

Round 2: Tuesday’s earnings reports – Alphabet, Microsoft, Starbucks and AMD will all be releasing their earnings reports after the closing bell. Given the way this earnings season is going, it’s not a question of whether they beat expectations but by how much. And if the numbers are strong enough to build solid upward momentum.

Round 3: Watch out for Wednesday’s US Federal Reserve interest rate decision. The market is pricing in that the Fed’s Chair, Jerome Powell, will take no action on rates and say as little as possible about winding in his stimulus policies. While the risk of him breaking from the script is low, the consequences of him doing so would be extreme.

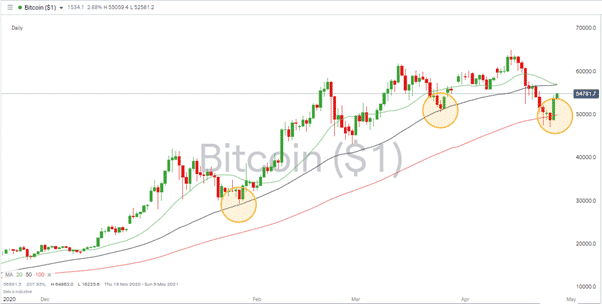

Bitcoin – A Measure of Market Mood.

Another sign that enthusiasm might be returning was Bitcoin’s uptick in price after a recent price fall. The crypto may one day revolutionise the world’s financial transaction systems but is currently an excellent barometer of sentiment among more speculative investors.

Source: IG

The likelihood of BTC’s bounce off the Daily 100 SMA was spotted here, and the 50 SMA is still a key resistance level, but Bitcoin’s ability to surprise should never be underestimated.

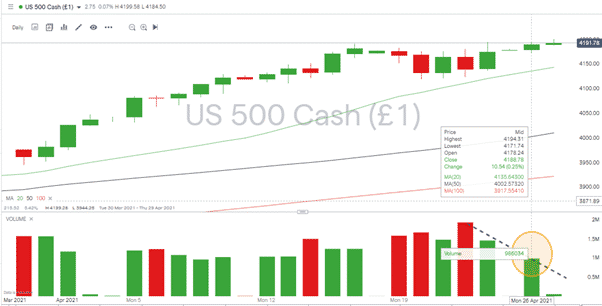

Will the Markets Go Down from Here?

The S&P 500 price chart flags up one amber light for the bulls. The strong performance on Monday came during light trading. Trade volumes were half of what they were last Thursday. As the bears were simply not playing it, there is still a chance for a face-off between buyers and sellers and only after that will we get a sign that the next move is confirmed.

Source: IG

If you want to know more about this topic please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk