How Significant Was Friday’s Sell-off?

Markets have started the week cautiously with technical indicators in a range of asset groups suggesting the path from here could be downwards.

On Friday, moves away from riskier asset groups such as equities and into the US Dollar were met with a recovery rally into the market close. However, the intraday slump did though feel more substantial than just profit-taking before the weekend.

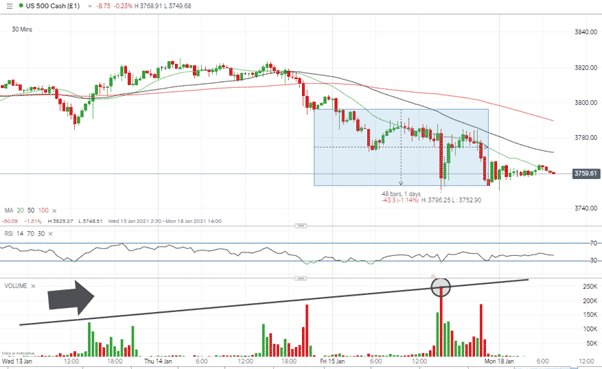

Between Thursday’s and Friday’s market close, the US 500 index fell in value by 1.14%

Source: IG

Friday’s price slide was also matched by an increase in volume after the previous four days had seen volume draining away.

Until Friday’s minor sell-off, equity prices had been trading sideways and the US 500 ended up down 1.97% on the week. A 2% fall over a week isn’t dramatic enough to generate news headlines but on the 30 min chart, the global bellwether for equities is printing prices below the 20, 50 and 100 SMA.

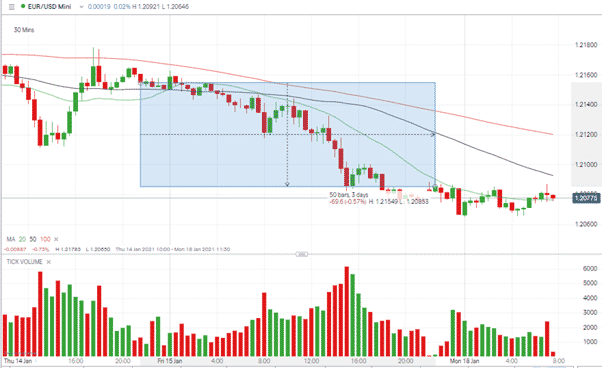

EURUSD

Over the same period, EURUSD matched the ‘risk-off’ move and gave up 0.57% of its value. This move wasn’t matched by an increase in trading volume but like the equity index, this currency pair shows bearish momentum with price below the three major SMA’s.

Source: IG

The Week Ahead – Big Data

With a mood of uncertainty hanging over the markets, these economic data announcements could be worth looking out for:

- Monday – China Q4 / Annual GDP Growth Rate

- Tuesday – Germany ZEW Economic Sentiment Index

- Tuesday – US Red Book

- Wednesday – UK – Inflation report, CPI, PPI, and RPI

- Wednesday – Bank of Canada – Interest rates decision

- Thursday – EU – ECB interest rate decision and Consumer confidence report

- Friday – UK, Germany, France, EU manufacturing and services PMI Flash reports

China’s GDP announcement was the first big data point of the week. It offers an insight into how interpreting such reports has been made harder by the Covid-19 pandemic.

Despite everything that happened in 2020, China’s economy managed to post positive annual GDP growth of 2.3%.

Bulls may want to be cautious about what looks at face value to be a ‘good number’. Monday’s news may not translate as increased prices in asset groups across the rest of the world. The UK economy is still forecast to post a fall in GDP of about 8%, and the China report does little to suggest that it needs adjusting.

China’s growth is less a case of a “rising tide lifting all ships”. The problem for service-based Western economies remains that they are ill-equipped to cope with pandemics.

The China data instead confirms that during 2020, consumers, even though housebound, could continue to place home-delivery orders that supported China’s manufacturing orientated economy.

If 2020 marked a shift towards societies becoming more virtual, then Q1 of 2021 could be when analysts digest and debate the impact of this. Uncertainty is now built-in, as there is less certainty about what the default reaction to news should be. From a trading perspective, there could be additional price volatility as each report comes through.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk