The US inflation data due to be released Thursday was picked out earlier in the week as the key feature to watch out for, and so it turned out. Trading during the first half of the week has been interesting enough, but most asset price moves have been muted, probably due to the Consumer Price Index (CPI) report looming over the markets.

Indices have most notably traded in a range that suggests that they are held by the gravitational pull of CPI data. As the deadline for the announcement nears, it is the optimists who are winning the day.

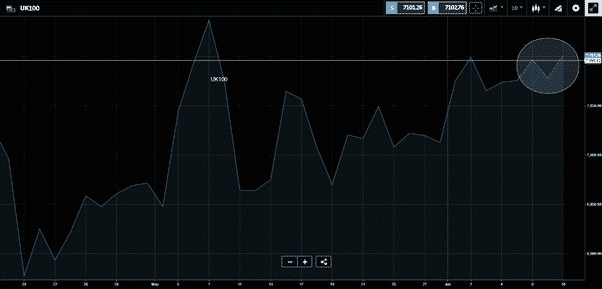

FTSE 100

Range-bound trading during the first half of the week focused on support at 7000 and resistance at 7089. Thursday’s open of European markets saw a break to the upside.

Source: eToro

The 7089 level will now offer support, but resistance at 7105 is already coming into play, and with further resistance at 7115, it might be that UKX consolidates until the CPI data is released.

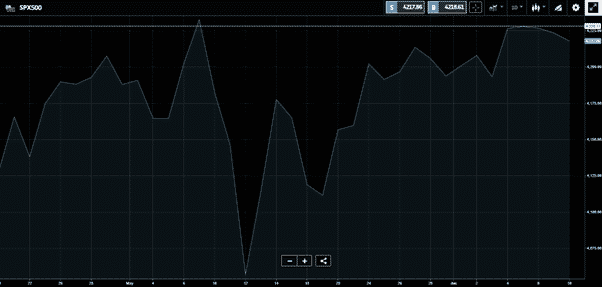

US Indices

All three major US indices also traded in a tight range on Wednesday and closed within 0.50% of Tuesday’s close. As with the European equity futures markets, a surge of buying pressure led to overnight gains, but the move in US indices was less confident. The S&P 500 is still challenged by the increasingly important resistance at 4228 with the May high of 4332 not far behind it. Bulls can take some comfort from price holding near all-time highs, and picking the direction of the next move looks little better than a coin flip until the CPI report is released.

Source: eToro

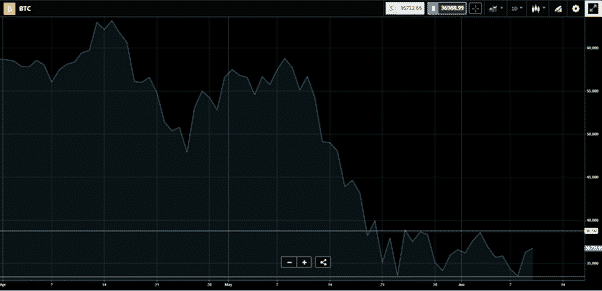

Bitcoin

It feels like old times again for fans of Bitcoin. News that El Salvador’s Congress passed a motion making BTC legal tender alongside USD took the crypto 8% higher. Other altcoins followed, but it has been a while since Bitcoin led the charge upwards while the broader market traded sideways. More good news came in the form of El Salvador authorities announcing that they are looking to mine the coins using geothermal energy sources from volcanoes.

Source: eToro

Resistance waits in the region of $36,740, but a break above that could take Bitcoin back to what it does best. The fundamental challenges and opportunities associated with the coin still remain, but those looking to buy at these levels would point out that the current news flow has been about as bad as it could be and looks largely already priced in.

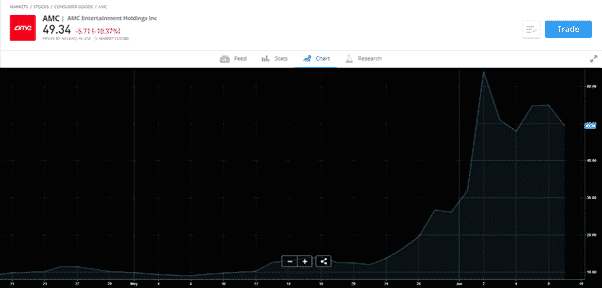

AMC & Meme Stocks

Another possible plus point for cryptos is that the meme stock frenzy looks like it might be beginning to burn itself out. The current centre of attention, AMC, announced its Q1 earnings and held its AGM on Wednesday. The adage ‘buy the rumour and sell the fact’ comes to mind. Despite the earnings-beating analyst forecasts and the Board of Directors being strengthened by the appointment of ex-Amazon execs, the price slipped below the key $50 price level. Down more than 10% on the day, Thursday looks likely to be a test for the Diamond Hands holders of AMC.

Source: eToro

If you want to know more about this topic, please contact us at [email protected].

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk