- US Non-Farm Payrolls jobs report dominates the coming week

- Central banks in the US, Japan, and UK also update on interest rates

- Eurozone and Germany GDP and inflation data due to be released

Heightened levels of price volatility look set to persist in the forex markets this week as a range of important news announcements are to be released. The US Non-Farm Payroll jobs report released on the first Friday of every month is a significant signpost for investors and will wrap up a week that is busy regarding other announcements. GDP, sentiment, and inflation data relating to the Eurozone will likely trigger price moves in euro-based currency pairs, and interest rate updates from the US Federal Reserve, Bank of England, and Bank of Japan could impact prices in sterling and yen markets.

US Dollar

The update from the US Federal Reserve on interest rate policy due on Wednesday is predicted to see US rates remain unchanged at 5.5%. Any deviation from that figure can be expected to trigger price moves in dollar-based currency pairs; however, it is the additional commentary provided by Fed Chair Jerome Powell to which many traders will give the most attention. The press conference, which follows the 6 pm (GMT) interest rate decision, will offer a chance for the Fed’s officers to provide guidance on the US central bank’s longer-term view on monetary policy. After months of consistently hawkish rhetoric from the Fed, even a suggestion that rates might soften in the future could see renewed appetite for risk-on assets and a fall in demand for the dollar.

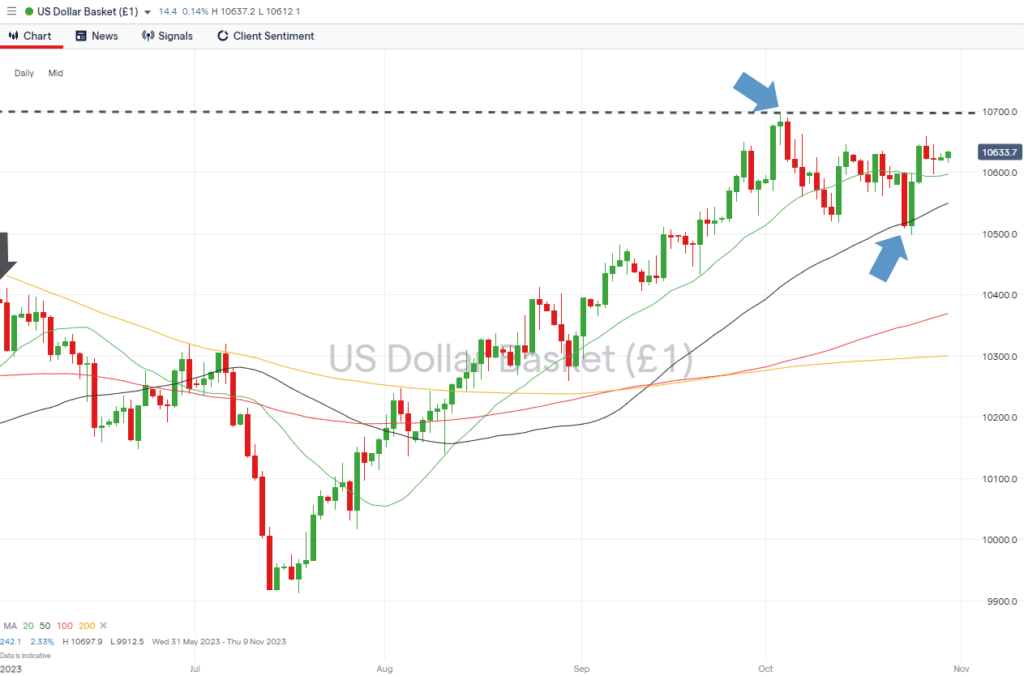

The key metric in terms of support levels of the US Dollar Basket Index is the 50 SMA on the Daily Price Chart. That SMA was tested last Monday and Tuesday, but price bounced off the 105.19 level and finished the week at 106.21. That leaves room for price to push on further and test the current year-to-date high of 106.97 recorded on 3rd October.

US Dollar Basket Index – Daily Price Chart – Year-to-date highs and SMA Support

Source: IG

- Key number to watch: Wednesday 1st November, US Federal Reserve interest rate decision 6 pm (GMT). Followed by a press conference.

- Key price levels: Support at 105.49, which marks the region of the 50 SMA on the Daily Price Chart. Resistance offered by the year-to-date high of 106.97.

EURUSD

Euro traders are in for another busy week with key inflation, sentiment, and GDP data due from Germany and the ECB. The ECB left interest rates unchanged at 4% last week, an announcement which followed ten consecutive rate rises. However, signs that the major economies of the Eurozone could be overheating or stalling would increase the likelihood of rates being adjusted the next time the ECB meets.

Germany’s inflation data is released on Monday, quarterly GDP figures are out on Tuesday, and the US Non-Farm Payrolls jobs report due on Friday is significant enough to influence the price of euro-based currency pairs. The interest rate decision by the Fed on Wednesday is another crucial data point. It can be expected to trigger price moves in the world’s most actively traded currency market – EURUSD.

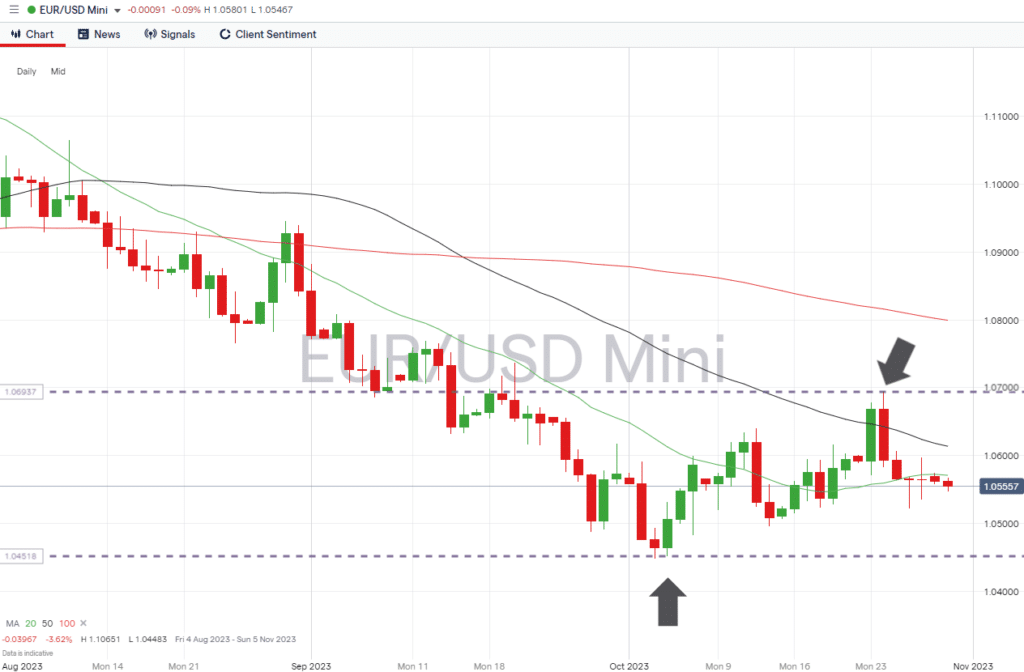

Price levels in EURUSD are currently trading mid-range between two key support and resistance levels. The year-to-date low of 1.04483 hasn’t been tested since it was recorded on 3rd October, and to the upside, resistance can be expected in the region of last week’s price high of 1.06951. With updates due this week, traders can expect some form of a move away from the 20 SMA on the Daily Price Chart, which has guided price since last Wednesday.

Daily Price Chart – EURUSD – Daily Price Chart – Support and Resistance

Source: IG

- Key number to watch: Wednesday 1st November, US Federal Reserve interest rate decision 6 pm (GMT). Followed by a press conference.

- Key price levels: Support from the year-to-date low of 1.04483 and resistance in the region of 1.07.

GBPUSD

The Bank of England updates its interest rate policy on Thursday. While analysts are forecasting rates will remain unchanged at 5.25%, the hotter than expected inflation reports released over recent weeks leave a slim chance of a rate rise. A rate hike would catch many traders off-guard and trigger additional support for the pound.

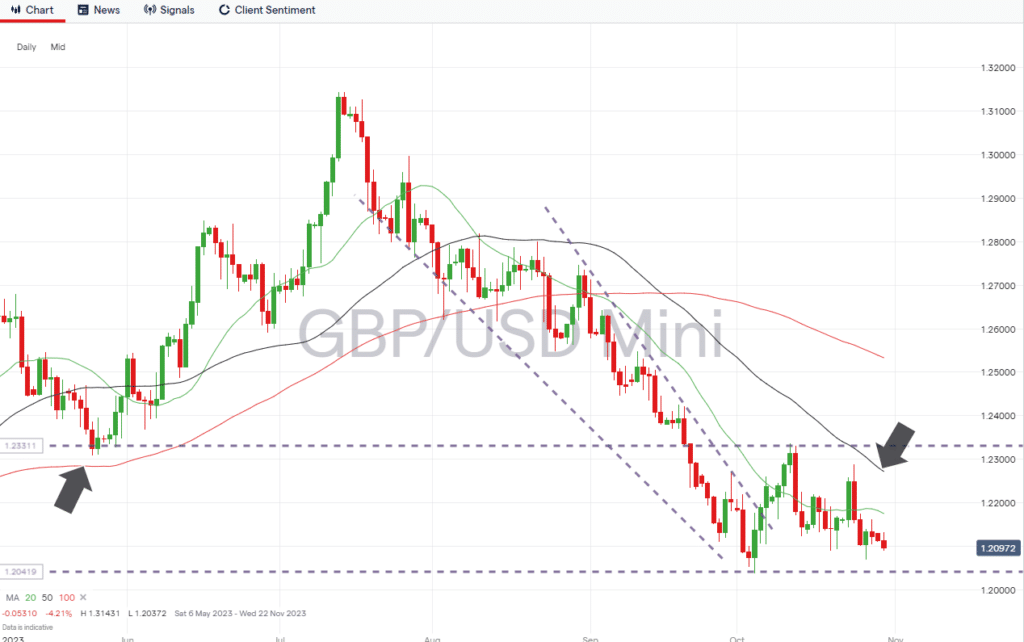

The price of GBPUSD hasn’t closed above the 50 SMA on the Daily Price Chart since 2nd August, and as long as that metric remains unchallenged, there is room for a test of the current year-to-date low of 1.20372.

Daily Price Chart – GBPUSD – Daily Price Chart

Source: IG

- Key number to watch: Thursday 1st November 12.00 pm (BST) – Bank of England interest rate decision.

- Key price level: support level formed by the year-to-date low of 1.20372.

USDJPY

The Bank of Japan is the first of the three major central banks to update on interest rates this week. It makes its decision on Tuesday, but like the Fed and the BoE, it is expected to leave interest rates unchanged.

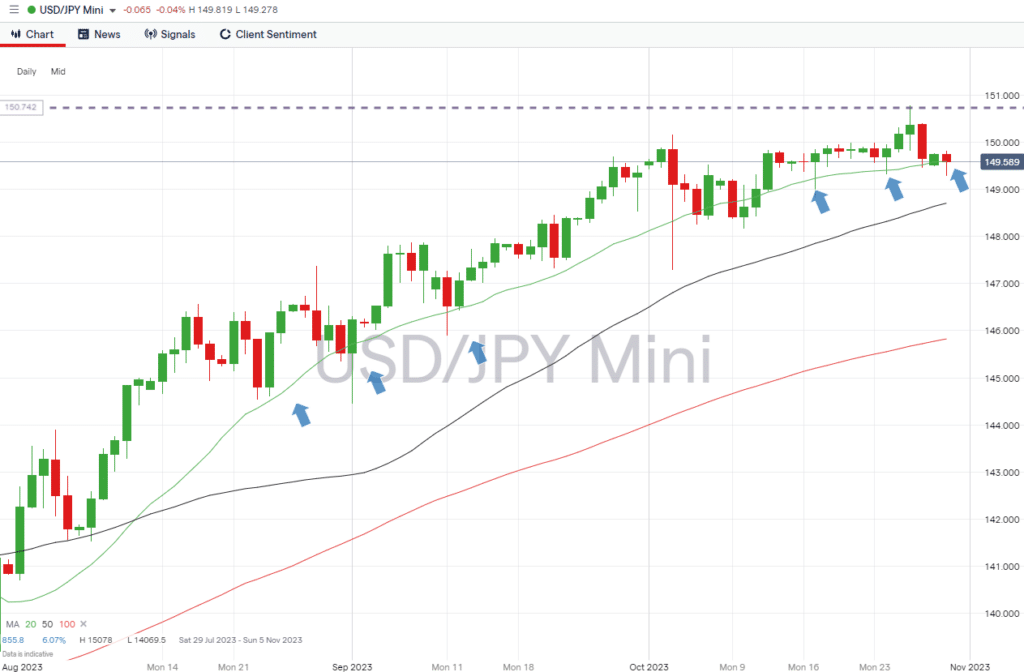

A test of the resistance level of 150.78 appears likely due to price currently tracking the gradual rise of the 20 SMA on the Daily Price Chart. That test could come sooner than expected should the BoJ surprise the markets with a rate rise on Tuesday.

USDJPY – Daily Price Chart

Source: IG

- Key number to watch: Tuesday 31st October 3.00 am (BST) – Bank of Japan interest rate decision. Analysts predict rates to remain unchanged at -0.1%.

- Key price level: 149.59 – Region of the 20 SMA on the Daily Price Chart, which has guided price since early August.

Trade EURUSD with our top brokers:

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.