- ECB interest rate decision is the big data point for major forex pairs.

- Unemployment, GDP, and inflation data from the US, UK, and Eurozone are also due this week.

- US earnings season moves into top gear with Microsoft, Apple, and Amazon among the firms updating investors on their trading records last quarter.

After a relatively quiet five days in terms of news flow last week, the currency markets can expect a return to higher levels of price volatility this week. Short-term price consolidation patterns that formed in the markets of sterling, euro, and yen currency pairs have left major currency pairs at key price levels, leaving the potential for some big news releases to trigger new trends. Inflation and unemployment data from the US, Eurozone, and UK will offer an insight into the health of the global economy, and the ECB will provide a view of the mood among central bankers when it reveals its latest interest rate decision on Thursday.

US Dollar

Inflation remains the key topic of interest for traders of the US dollar, and this week sees the US PMI report released on Tuesday but, more importantly, the Core PCE inflation report released on Friday. The Core PCI is regarded as the price index that Jerome Powell and his colleagues at the Fed give the most significant weight to when making decisions on interest rates, and any deviation from the 0.3% month-on-month gain can be expected to be followed by changes in the price of dollar-based currency pairs.

Big corporations, including Alphabet, Microsoft, Snap, Visa, Coca-Cola, and Spotify, all release their latest quarterly earnings reports on Tuesday. Thursday is another day in the earnings season calendar, with Amazon, Ford, Intel, and Merck sharing their updates.

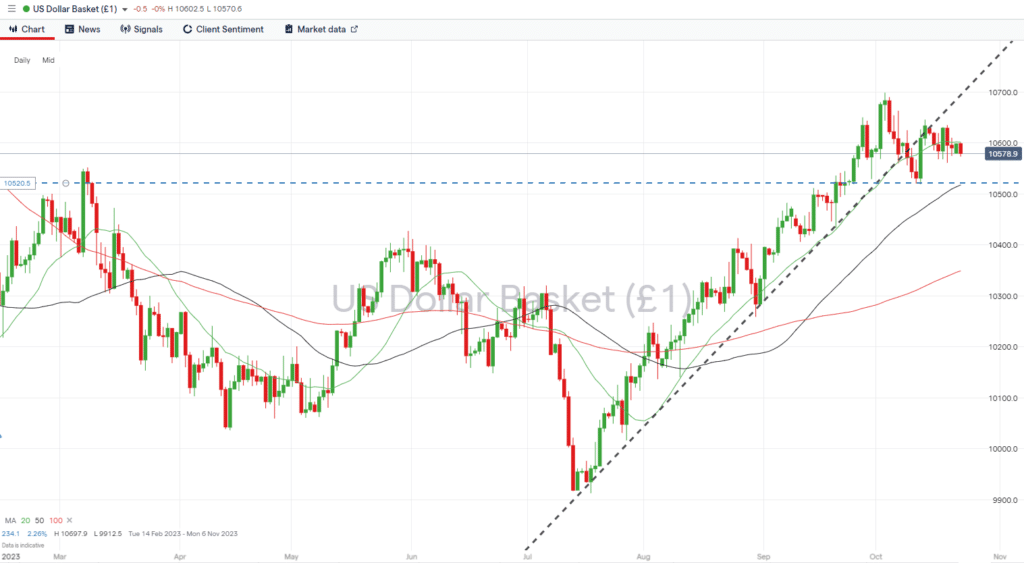

The break of the long-term trendline in the US Dollar Index price chart that occurred on 9th October was followed three days later by price revisiting that key indicator, but since then, the dollar has formed a sideways trading pattern. The inflation data due out this week could act as a catalyst for the DXY to reconnect with the trendline, which is currently in the region of 106.84. Any suggestions in that report the inflation is cooling faster than expected would bring into play the support level formed by the price low of 105.19 printed on 12th October.

US Dollar Basket Index – Daily Price Chart – Trend Line and Support

Source: IG

- Key number to watch: Friday 27th October 1.30 pm (BST) – US PC Index (September) – prices forecast to rise 0.3% month-on-month and Core PCE to increase 0.3%.

- Key price levels: Support at 105.19, which marks the intraday price low of 12th October.

EURUSD

Euro traders are in for a busy week with key inflation data due out of Germany in the build-up to the ECB announcing its interest rate decision on Thursday. France’s GDP numbers are due to be released on Friday. The consensus among analysts is that the ECB will keep Eurozone interest rates unchanged at 4.5%, so any deviation from that can be expected to trigger price moves.

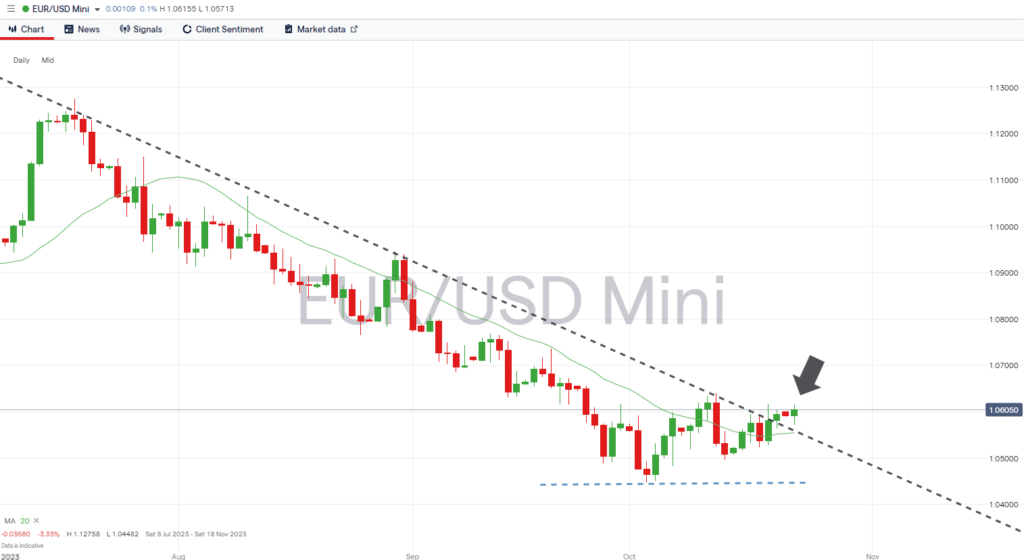

The price of EURUSD has broken through the downward trendline dating from 18th July, suggesting the long-term fall in the euro’s value could be about to reverse. A re-test of that key metric, which is currently in the region of 1.0550, can’t be discounted, but as long as price trades above the trendline, there is room for further upward movement. A break of the support level of 1.04482, formed by the intraday low of 3rd October, would suggest further downward movement in EURUSD.

Daily Price Chart – EURUSD – Daily Price Chart – Support and Resistance

Source: IG

- Key number to watch: Thursday 26th October, 1.15 pm (BST) – ECB interest rate decision – analysts forecast rates to remain unchanged at 4.5%.

- Key price levels: The 20 SMA (1.05543) on the Daily Price Chart has converged with the downward trendline. The close proximity of these two key metrics suggests considerable price support can be expected in this area.

GBPUSD

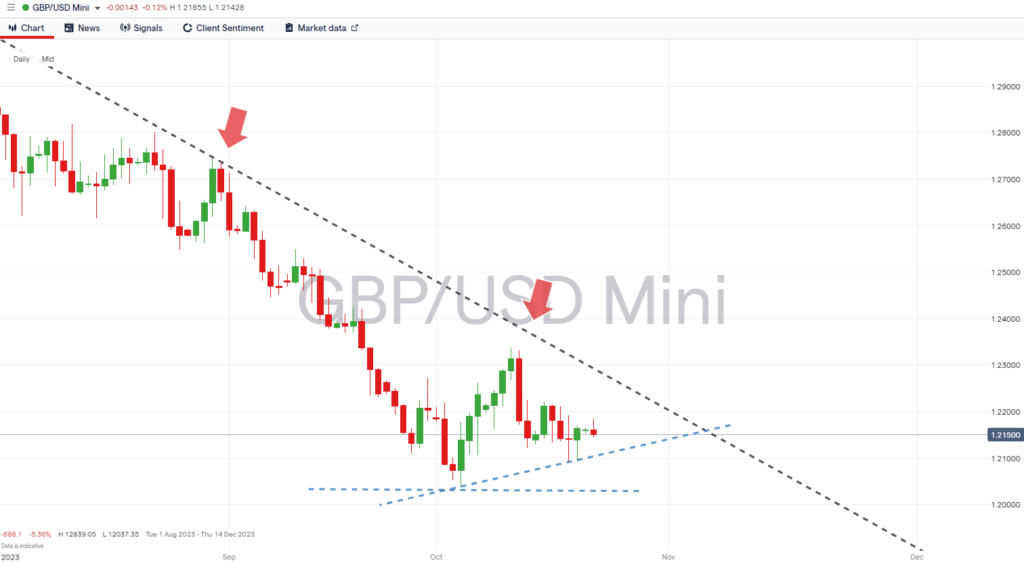

This week’s big news announcement for traders of sterling-based currency pairs is the UK jobs report, due on Tuesday. The unemployment level is expected to remain unchanged at 4.3%, and any signs that the labour market is proving to be robust could be good news for the pound as it would point to the economy continuing to overheat and further interest rate rises from the Bank of England.

Daily Price Chart – GBPUSD – Daily Price Chart

Source: IG

- Key number to watch: Tuesday 24th October, 7 am (BST) – UK unemployment rate expected to be unchanged at 4.3%.

- Key price level: Resistance from the downward trendline, which currently sits in the region of 1.2290 and support from the price low of 1.20373 recorded on 4th October. That support level also sits just above the psychologically important 1.2000 price level. Additional support is likely in the region of 1.20901, which forms a swing-low price pattern if the low of 4th October is taken to represent the beginning of a new upward trend.

USDJPY

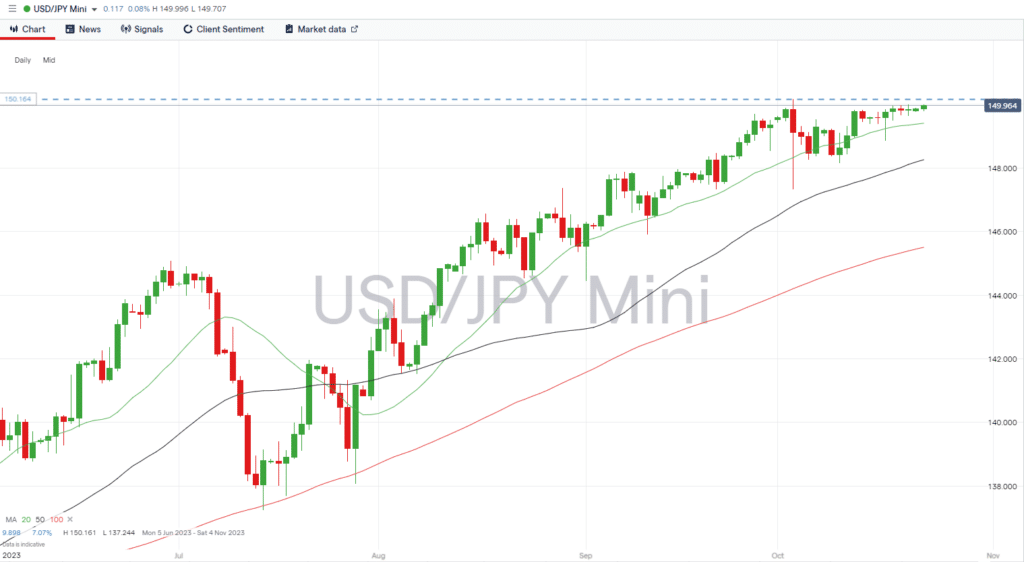

Japan releases its PMI manufacturing and services sentiment reports on Tuesday. Analysts are forecasting the two sectors will show diverging fortunes, with the manufacturing index expected to rise and the services PMI predicted to fall.

USDJPY – Daily Price Chart

Source: IG

- Key number to watch: Tuesday 24th October, 1.30 am (BST) – Japan PMI (September). Manufacturing expected to rise to 49 from 48.5, and services to fall to 52.9 from 53.8.

- Key price level: 150.16 – Key resistance level formed by the year-to-date high recorded on 3rd October. 20 SMA on the Daily Price Chart to offer support in the region of 149.40.

Trade EURUSD with our top brokers:

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.