- The US Non-Farm Payroll jobs report due on Friday is the key data point of the coming week.

- Analysts predict payrolls will fall to 150,000 from 187,000 last month and the unemployment rate to hold at 3.8%.

- Average hourly earnings are expected to increase 0.3% month-on-month.

- Any deviation from those forecasts can be expected to trigger price moves in all the major currency markets.

US dollar strength continues to be the underlying theme of the currency markets, with EURUSD currently testing the key 1.04823 support level and the GBPUSD downward price channel showing few signs of reversing. The US Non-Farm Payrolls jobs report, due to be released on Friday, is always an important milestone in the trading month, and September’s numbers could offer clues as to how far the current trend has left to run.

US Dollar

The Non-Farm Payrolls employment report, released on the first Friday of every month, often sets the tone for the following week’s trading. After this September, which saw EURUSD and GBPUSD give up 2.48% and 3.70% in value, respectively, Friday’s report is the most important item on the coming week’s economic calendar. The jobs report will be a crucial indicator of whether the rush to the dollar is likely to continue or if a reversal could be about to form.

ISM Purchasing and Services data will also offer an insight into the health of the US economy, and big corporations will kick off earnings season next week. There is also the backdrop of the US Federal budget and a possible government shutdown to consider, but for now, the NFP is the most likely catalyst of the next price moves.

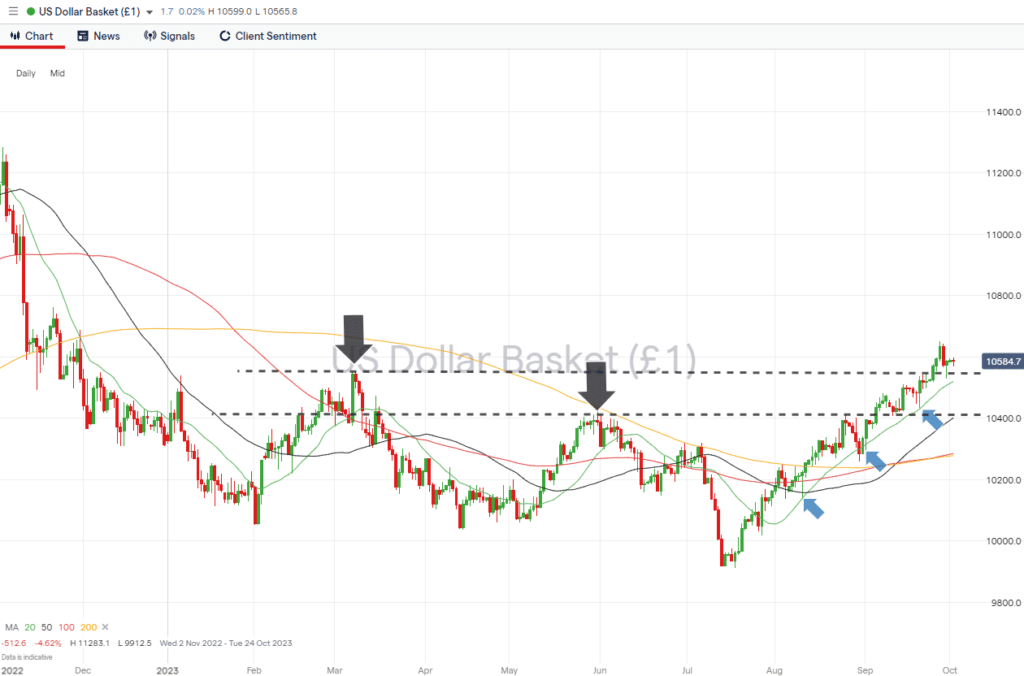

Daily Price Chart – US Dollar Basket Index – Daily Price Chart – 20 SMA

Source: IG

EURUSD

The coming week is quiet in terms of euro-specific data releases, but updates from other regions look set to influence the value of euro-based currency pairs. Due on Friday, the NFP number out of the states will very likely impact prices in the largest currency market in the world – the Eurodollar. Before that, on Tuesday, the interest rate decision due to be announced by the Reserve Bank of Australia will influence EURAUD price levels. However, comments from that central bank can also be taken as a guide regarding the mood of the rest of the central bank peer group.

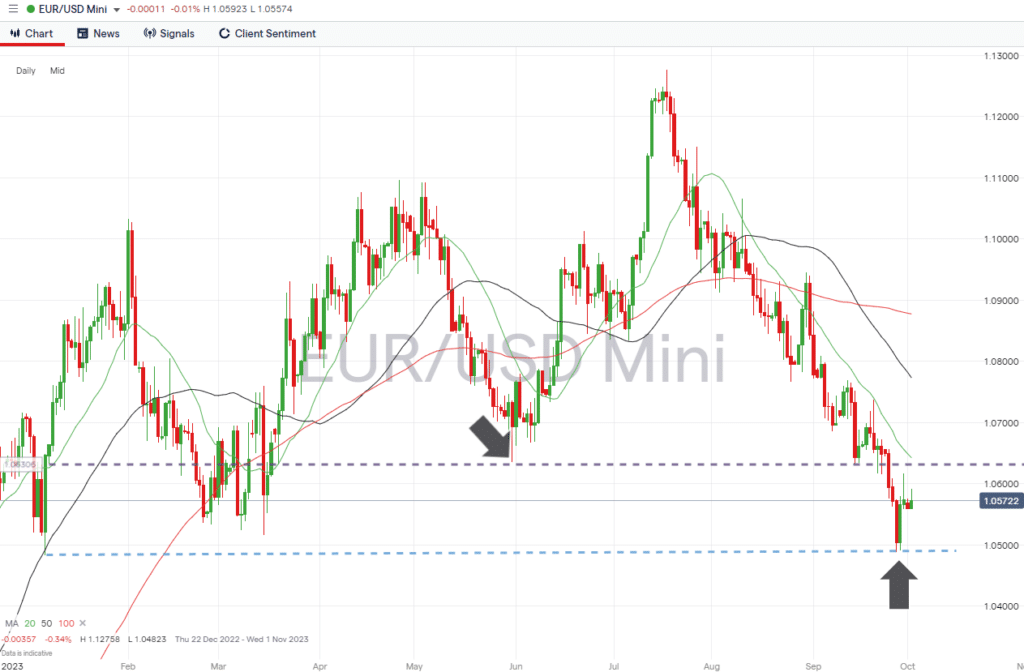

Daily Price Chart – EURUSD – Daily Price Chart – 1.04823

Source: IG

EURUSD has started the week trading midrange between two significant support and resistance price levels. To the downside is the 1.04823 support level, which marks the price low of 6th January. That still represents the current year-to-date low for EURUSD, but the tests of that level on Wednesday (1.04880) and Thursday (1.04910) suggest that bearish momentum is still strong.

Whilst the bounce off that level was strong enough for traders to think a trend reversal could be imminent, there is also resistance to further upward moves in the region of 1.06351. That price level relates to the swing-low price pattern formed on 31st May and previously acted as support between 14th and 25th September.

GBPUSD

As with the euro, traders of sterling-based currency pairs will see prices influenced by announcements from other regions rather than UK authorities this week. The run-up to the release of the NFP jobs report could see GBPUSD continue to trade within a range formed by key support/resistance price levels.

Price level 1.23081 marks the upper end of the current price channel and is the low price recorded during the swing-low price move of 25th May. This level didn’t offer as much support as expected when it was breached on 21st September, and with the RSI on the Daily Price Chart at 29.09, there are signs the market is oversold and is due a bounce.

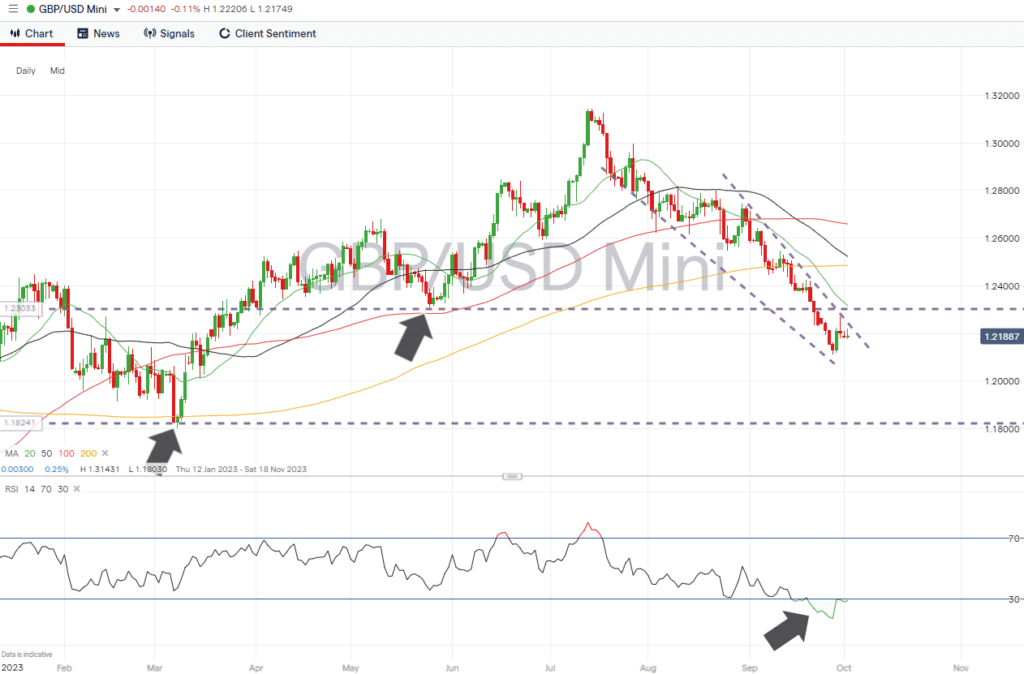

Daily Price Chart – GBPUSD – Daily Price Chart

Source: IG

The downward trend, which started on 13th July, has formed a price channel which has trendlines which have been barely tested over a period of weeks. That leaves plenty of room for the price of GBPUSD to continue to weaken and move towards the major support level of 1.18030, which marks the year-to-date price low of 8th March.

USDJPY

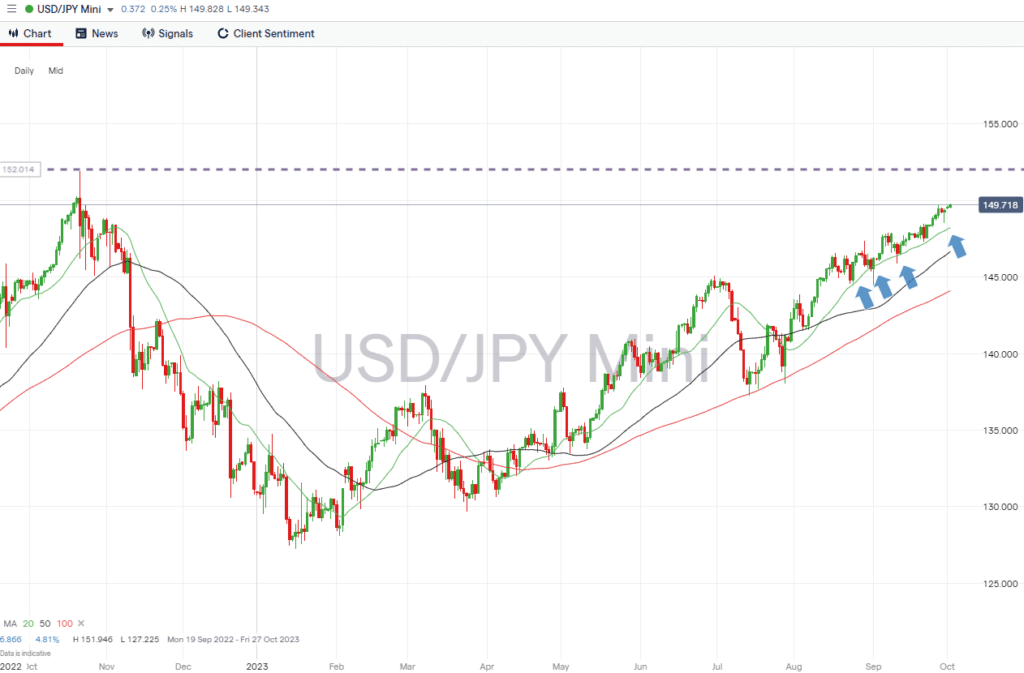

The recent decision by the Bank of Japan to continue with its dovish approach to interest rates has left room for USDJPY to track upwards, guided by the 20 SMA on the Daily Price Chart. That metric remains the key indicator, and until price breaks through that level (currently 148.21), there is room for a test of the multi-year price high 151.946 printed on 21st October 2022.

Daily Price Chart – USDJPY – Daily Price Chart

Source: IG

Monday sees the Japan Tankan Index number for Q3 be released. Analysts forecast that the index will rise to 7, but as with the other major currency pairs, the major news event of the week is the NFP employment report due on Friday.

Trade EURUSD with our top brokers:

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.