- The US Non-Farm Payroll jobs report is due out on Friday.

- Analysts suggest wage growth and job creation could both be slowing down.

- The Eurozone CPI inflation report and Fed Minutes will offer insight into the approach central bankers might take regarding interest rates.

The coming week may be foreshortened by exchanges being closed for the New Year holiday; however, a stack of important economic updates is due to be released in what should be a busy period for forex traders. The US Non-Farm Payrolls jobs report due Friday forms the cornerstone of the data surge. Eurozone inflation and an update from the US Federal Reserve can also be expected to act as a catalyst for currency price moves.

US Dollar

The US NFP jobs report is forecast to show 150,000 new jobs were created in December, down from 199,000 in November. At the same time, the overall unemployment rate is expected to climb from 3.7% to 3.9%. This cooling off in the labour market is perhaps unsurprisingly expected to be mirrored by a fall in wage inflation, with average hourly earnings rising in December by 0.3%, compared to 0.4% in the previous month.

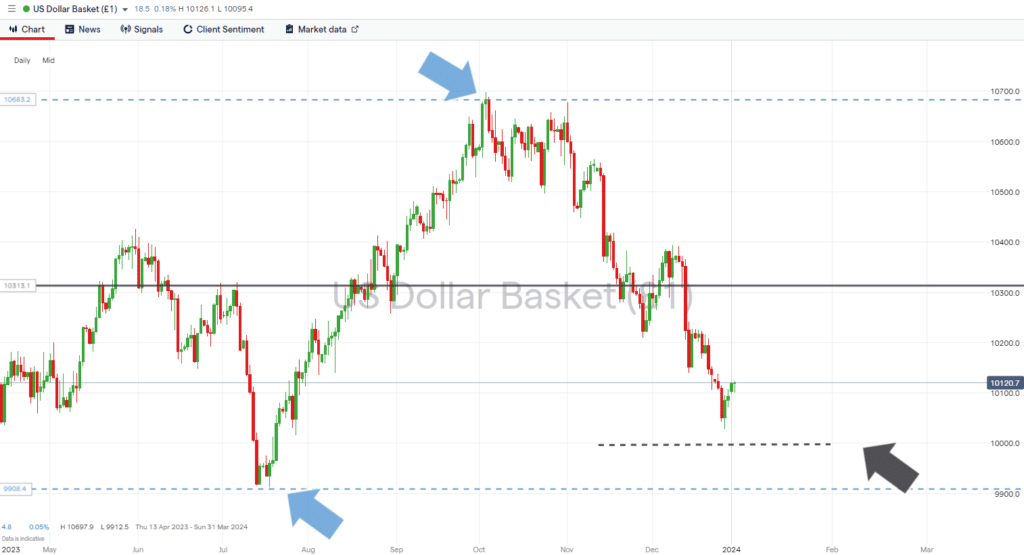

The sustained move away from the US dollar, which can be tracked in December’s US Dollar Basket Index price chart, could have enough momentum to carry on into the new year. That is thanks to a weaker jobs market, leaving room for the Fed to cut interest rates and further reduce the attraction of the greenback. Dollar bears may not have things all their own way due to uncertainty about when those interest rate cuts might commence and how many might be in the pipeline. Different analysts suggest there could be between three and six rate cuts in 2024, and that range of potential outcomes makes establishing the fair value of the dollar more difficult. It also means that the release on Wednesday of the minutes of the last Fed meeting can be expected to cause an uptick in price volatility.

US Dollar Basket Index – Daily Price Chart – Parity Price Level

Source: IG

Key number to watch: Friday 5th January 1:30pm (GMT). US Non-Farm Payrolls (December): Analysts forecast new job creation and month-on-month wage inflation to both fall.

Key price levels: 100.00 – Last week’s price low of 100.27 has brought the parity price level back into play.

EURUSD

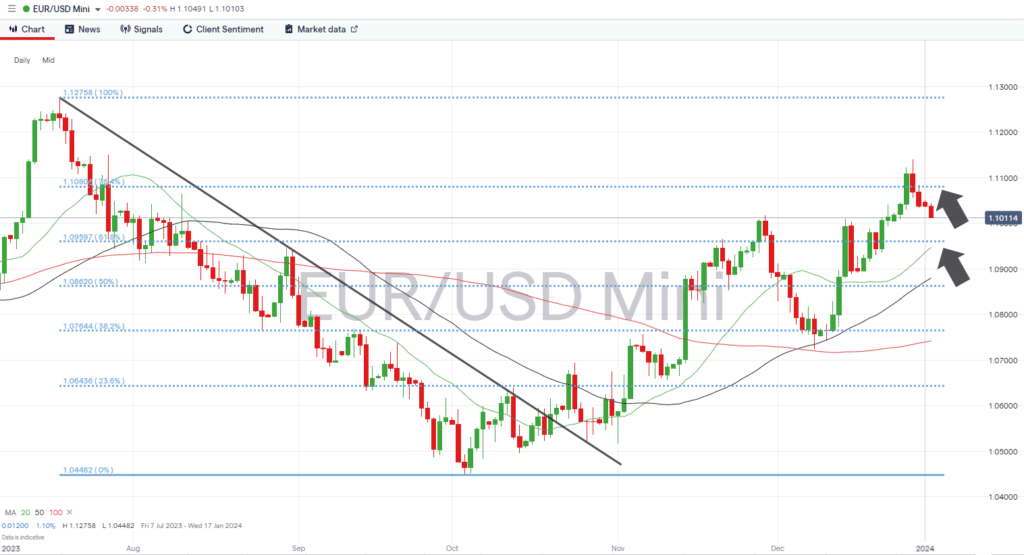

The ECB can be expected to give a lot of consideration to the Eurozone inflation number, which will be released on Friday. Year-on-year inflation is expected to be 2.5%, still higher than the 2.4% year-on-year reading reported in December’s CPI data. That leaves the ECB facing the prospect of holding interest rates at a higher level for longer than the US Fed and could result in more price rises in EURUSD.

Further insight will be offered by Germany’s unemployment report, which is due to be released at 8:55am on Wednesday. Unemployment in the Eurozone’s most important economy is expected to remain unchanged at 5.9%, with any deviation from that number likely to trigger trading opportunities in euro-based currency pairs.

Daily Price Chart – EURUSD

Source: IG

Key number to watch: Friday 5th December 10:00am (GMT). Eurozone Inflation (December). Analysts forecast inflation to rise 2.5% year-on-year and core CPI to slow from 3.6% to 3.2% on a year-on-year basis.

Key price levels: 1.09597 and 1.10800 – support and resistance formed by the 61.8% and 76.4% Fib retracements, respectively.

GBPUSD

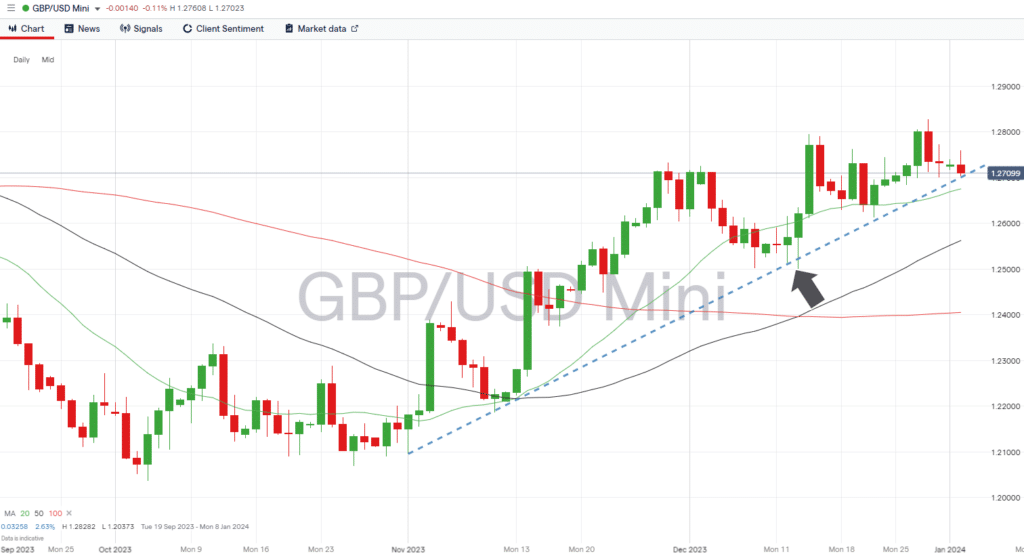

The coming week is a quiet one regarding UK-specific news, but price levels in sterling-based currency pairs, including EURGBP and GBPUSD, can be expected to be influenced by events in the Eurozone and the US.

Friday will be the busiest day of the trading week thanks to Eurozone inflation and US jobs numbers being released on that day. The Fed minutes, which will be shared with the markets on Wednesday evening, will allow traders to gauge the extent to which the UK and US central banks are diverging on interest rate policy.

Whilst the supporting trendline dating from 1st November continues to hold, the path of least resistance for GBPUSD appears upward. Resistance can be expected in the region of the psychologically important 1.3000 price level and the intraday price high of 1.28282, recorded on 28th December.

Daily Price Chart – GBPUSD – Daily Price Chart – Trendline support

Source: IG

Key number to watch: Friday 5th January 1:30pm (GMT). US Non-Farm Payrolls (December): Analysts forecast new job creation and month-on-month wage inflation numbers to fall.

Key price level: 1.28282 – Price high printed on 28th December.

USDJPY

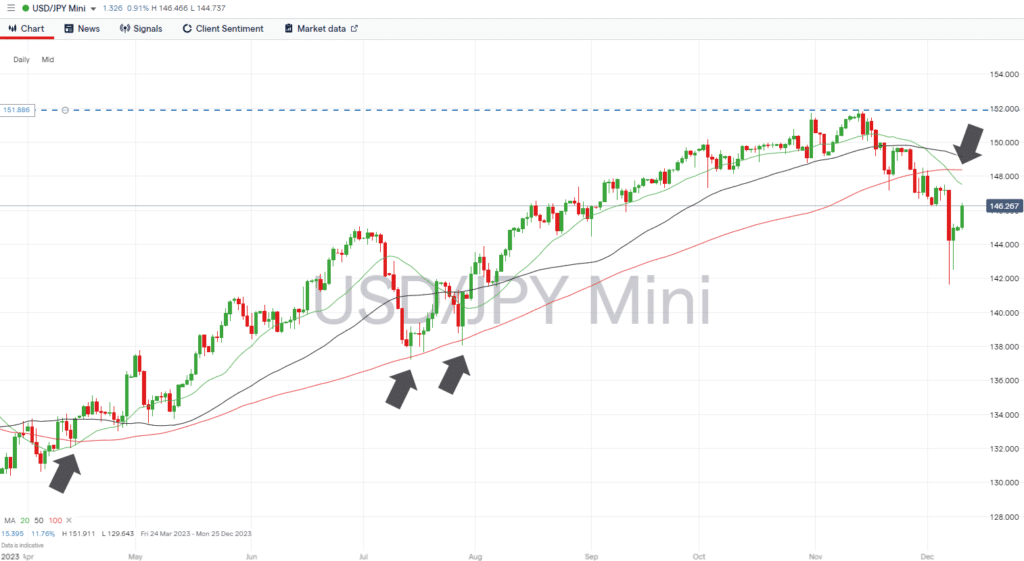

Suggestions that the Bank of Japan could finally be moving the country out of a negative interest rate environment have resulted in the yen gaining in value against the US dollar by more than 6% in less than two months. Japan’s consumer confidence report, released at 5am on Friday, will allow investors to gauge the extent to which the BoJ is taking the Japanese consumer with them on that journey.

With the SMAs on the Daily Price Chart forming a pattern which can only be described as bearish, there would need to be a significant surprise in the consumer confidence report if the nosedive in USDJPY is to be reversed by fundamental factors. Relative dollar strength is more likely to be triggered by the Non-Farm Payroll jobs report due out of the US on Friday. Technical analysis factors could also come into play. The RSI on the USDJPY Daily Price Chart sits at (36.1) pointing to dollar-yen being oversold on that timeframe.

USDJPY – Daily Price Chart – Bearish SMAs

Source: IG

Key number to watch: Friday 5th January 1:30pm (GMT). US Non-Farm Payrolls (December): Analysts forecast new job creation and month-on-month wage inflation numbers to fall.

Key price level: 142.84 – Region of the 20 SMA on the Daily Price Chart. This metric has guided the recent downward price move, and the price has not closed above it since 17th November 2023.

Trade EURUSD with our top brokers:

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.