- Increased volatility expected in sterling-based currency pairs.

- Key data on UK inflation and unemployment set to be released.

- Bellwether stock Tesla due to share its quarterly earnings as investors react to US inflation news.

- Netflix, Johnson & Johnson and big US banks due to update investors as earnings season gathers pace.

Last week’s US CPI inflation report jolted investor risk appetite and left major currency pairs trading mid-range between important price levels. The September figures on the US CPI report showed that on a year-on-year basis, the index rose 3.7%, which was the same number as found in the August report. Price inflation may have stalled, but questions remain about how long it might take to return to lower levels and the Fed’s 2% target rate.

With few reasons to suggest that the Fed will be rushing to deviate from its hawkish policy on interest rates, the US dollar had a strong run into the end of the week, which leaves the markets in major currency pairs finely poised. The coming week sees earnings season build momentum with updates due from major corporations. Those could act as a catalyst for further price moves, and traders of sterling-based currency pairs can expect increased levels of price volatility as inflation and unemployment reports are released in the UK.

US Dollar

This week, traders of the US dollar will see the release of a selection of Tier-2 grade economic reports. While none have the same significance as the key CPI and Non-Farm Payrolls statements, they will shed further light on the state of the world’s most important economy. In the background, stock market sentiment can be expected to adjust to the earnings updates that are due to be released by major multinationals. Price moves in major stocks such as Netflix and Tesla have the potential to impact trading behaviour in other asset groups, including the currency markets.

The US Empire State Manufacturing Index report due out on Monday is followed by US retail sales on Tuesday, housing starts on Wednesday, and existing home sales on Thursday. The reports relating to the housing market will be closely followed given the influence that this sector has on the rest of the economy. Analysts are forecasting that existing home sales numbers will fall a not inconsiderable 2.1% on a month-on-month basis, with any deviation from that figure likely to result in price moves in US currency pairs.

Major corporations including Goldman Sachs, Bank of America Corp, Johnson & Johnson, United Airlines and Lockheed Martin all release their quarterly earnings reports on Tuesday. In the run into the end of the week, other household names such as Netflix, Tesla, Procter & Gamble, American Airlines, Alcoa and American Express will open their books for inspection.

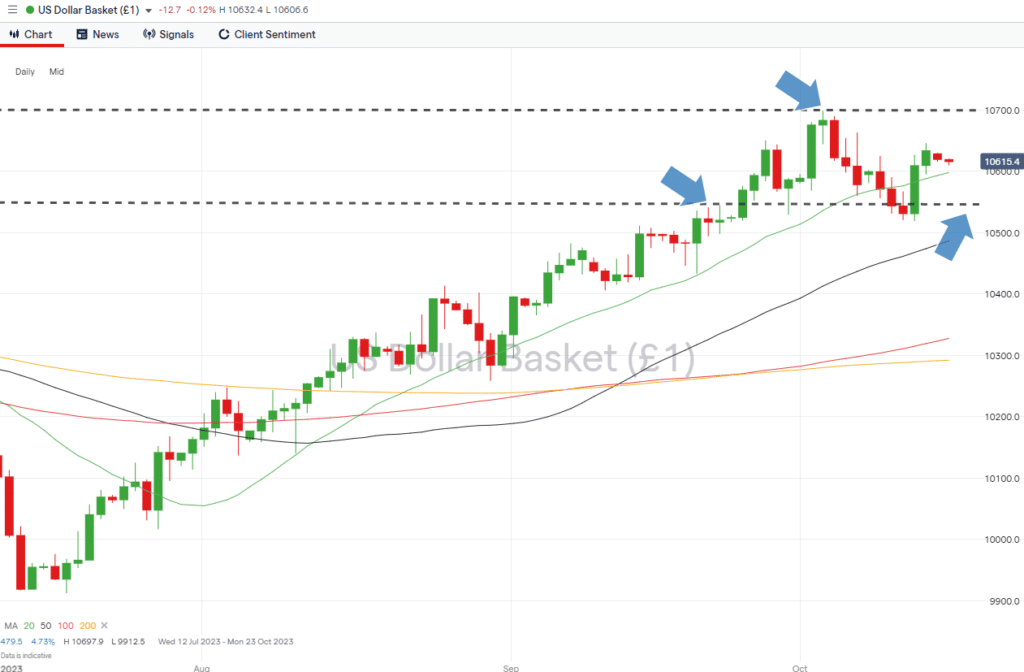

US Dollar Basket Index – Daily Price Chart – Mid-Range

Source: IG

- Key number to watch: Thursday 19th October 3:00pm (BST) – US existing home sales (September) – analysts forecast sales volumes to fall 2.1% on a month-on-month basis.

- Key price levels: Support at 105.46, which marks the intraday price high of Friday 22nd September, and resistance in the region of 106.97, which is the current year-to-date high.

EURUSD

The German ZEW Index report for October will be released on Tuesday, with that number forecast to fall to -16 from 11.4 in the previous month. The absence of any other major eurozone news announcements doesn’t necessarily mean that it will be a quiet week for traders of euro-based currency pairs. Updates from the UK on inflation and unemployment will influence price levels in EURGBP, and earnings season news could trigger price moves in EURUSD.

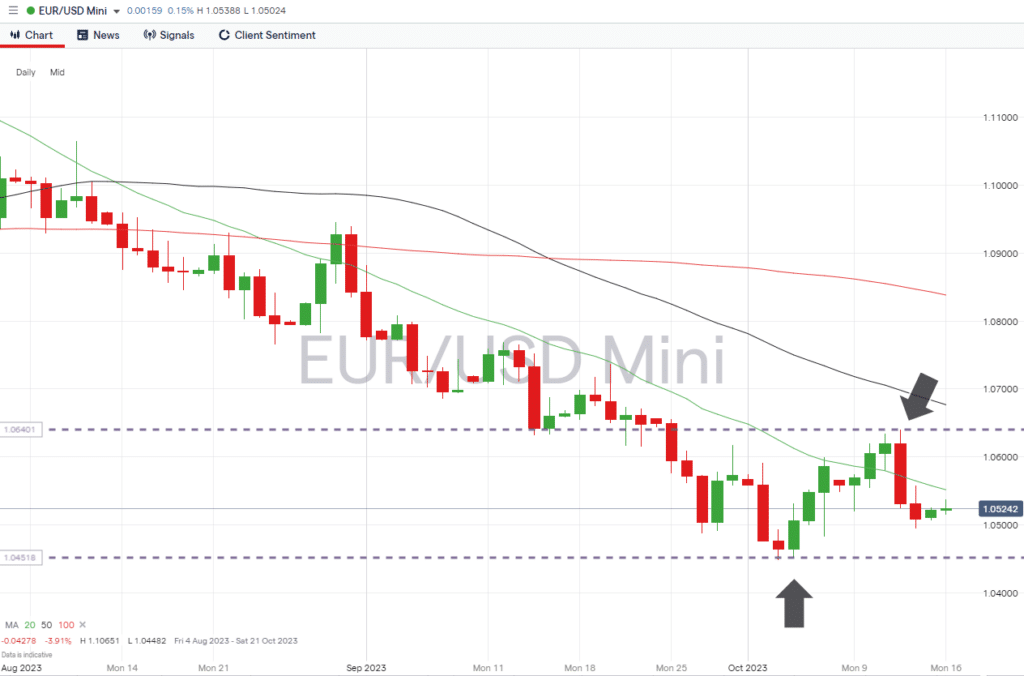

Daily Price Chart – EURUSD – Daily Price Chart – Support and Resistance

Source: IG

- Key number to watch: Tuesday 17th October 10:00am (BST) – German ZEW Index (October).

- Key price levels: The 20 SMA on the Daily Price Chart continues to guide EURUSD’s downwards price move. Currently in the region of 1.05519, that metric sits mid-range between the support offered by 1.04482, the new year-to-date low printed on Tuesday 3rd October, and resistance in the form of the price high of Thursday 12th October (1.06397).

GBPUSD

GDP data out of the UK last week surprised to the upside and triggered a rise in the price of GBPUSD as investors adjusted to the likelihood of the Bank of England keeping interest rates higher for longer. Growth in August was 0.2%, mainly thanks to a strong showing by the service sector, and this week sees UK unemployment numbers (Tuesday) and CPI inflation data (Wednesday) provide more pieces of the jigsaw.

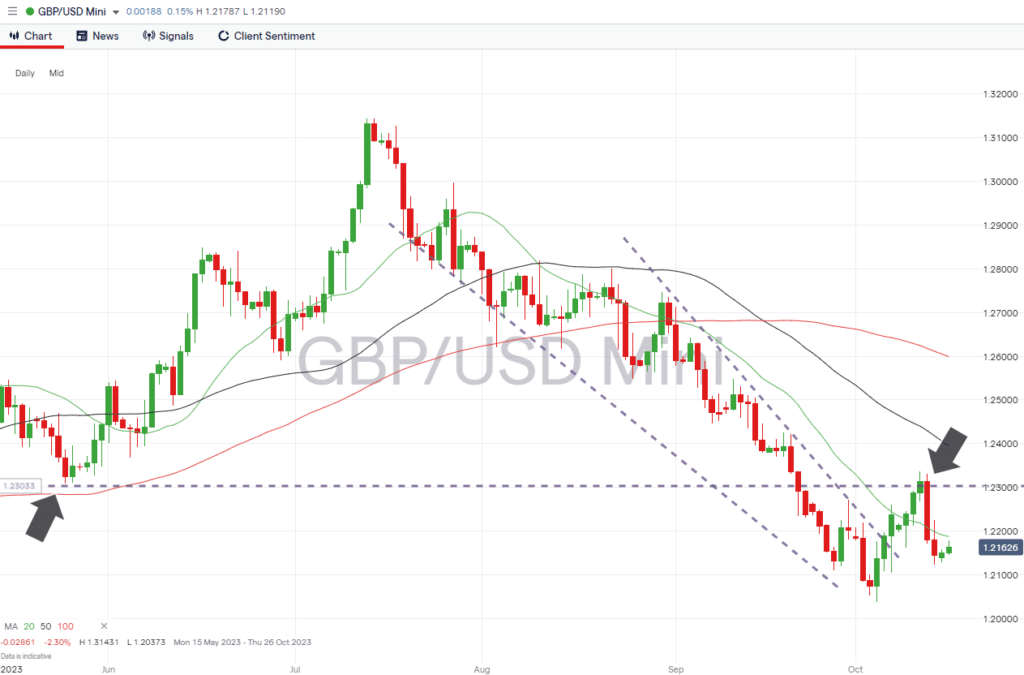

Daily Price Chart – GBPUSD – Daily Price Chart

Source: IG

- Key number to watch: Wednesday 18th October 7:00am (BST) – UK CPI (September) – analysts predict price growth to be 6.5% year on year, compared to 6.7% year on year in August.

- Key price level: Resistance in the region of 1.23081, which marks the pivot of the swing-low pattern recorded on 25th May.

USDJPY

Traders of yen-based currency pairs can expect an uptick in volatility as Friday’s Japan CPI inflation report nears. The release of China GDP figures on Wednesday will also likely steer price moves given the close trading relationship between the two countries.

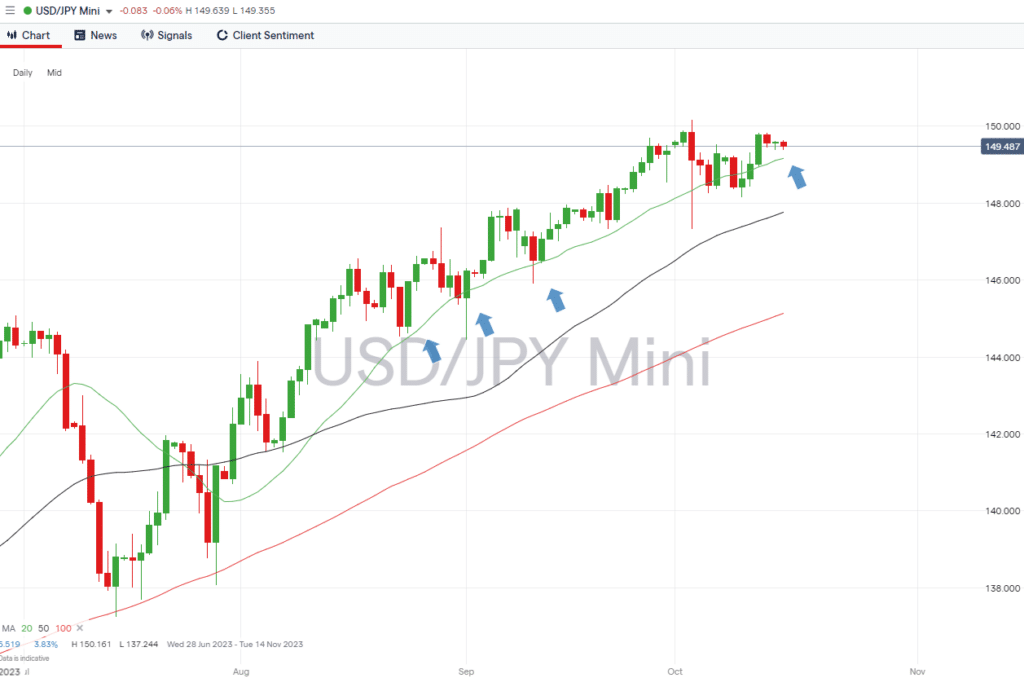

USDJPY – Daily Price Chart

Source: IG

- Key number to watch: Friday 20th October 12:30am (BST) – Japan CPI (September). CPI expected to be 3.1% year on year down from 3.2% year on year in August.

- Key price level: 149.16 – Region of the 20 SMA on the Daily Price Chart. This key support level was tested last week, but held firm, which indicates a continuation of the dollar-yen bull run.

Trade EURUSD with our top brokers:

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose

Founded: 2007 51% of eToro CFD traders lose

Founded: 200751% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to take the risk of losing your money.