Monday’s dramatic shake-down of risk-on asset groups looks to have played itself out. High levels of price volatility are atypical for the week before the Christmas holiday, and after 24 hours of fierce selling pressure, it appears normality might be returning.

If this is going to signal a return to steady-as-she-goes long positions, then the news item to keep a close eye on is the US Coronavirus relief package and government spending package. The Covid Stimulus Bill which was finally signed off by US Congress on Monday passed legislation releasing $900 billion in coronavirus relief and $1.4 trillion in government funding.

US Stimulus

The detail of the US stimulus package shows that it offers something for everyone.

- $300 per week federal unemployment supplement through to mid-March

- $284 billion in Paycheck Protection Program and small business loans

- $600 direct payments to families

- $600 direct payments per child

- $8 billion for COVID-19 vaccine distribution

- Extension of cover to freelancers and gig-workers

- $20bn into COVID testing and track and trace programs

- $25bn rental assistance

- $45bn into transportation

Getting the bill approved means a significant hurdle has been jumped. Political in-fighting between respective parties slowed the bill down while 350,000 died and the economy suffered.

If the processing of the measures has a sense of inevitability about it, and a hint that it was already priced in, the comments from Joe Biden’s team offered further support to markets.

Spokespeople for the incoming president announced he’d look at introducing more measures when he takes office on the 20th of January. Nancy Pelosi stated:

“We advance this bill today as a first step … We are ready for the next step,”

Market Rally

There is now a relatively well-established play-book for markets to follow after any US fiscal or monetary stimulus is announced. The news of the US bill being passed caused markets to rally hard into Monday’s close.

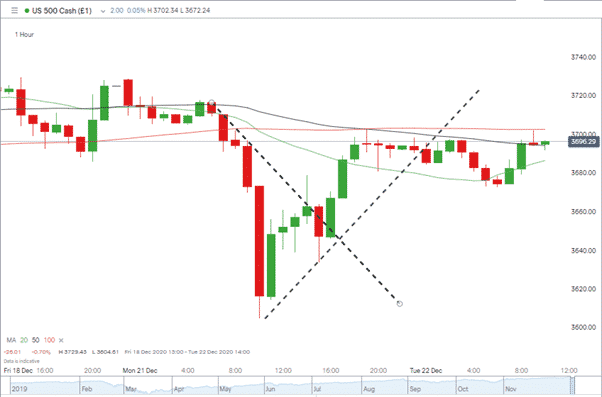

Hourly

Source: IG

S&P 500

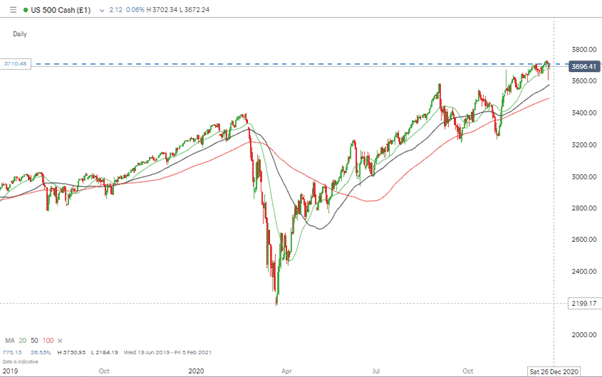

The technical outlook for the S&P 500 still has lots of bearish potential. Despite the US stimulus package, the index failed to break above the 3710 resistance level. Whether and when that price level is reached looks to be a pivotal indicator for how the index might trade into the year-end.

Daily

Source: IG

Scenario 1

Downward price action.

Target 1: November 9 high 3668

Target 2: December 11 low 3621

Target 3: September high 3587

Scenario 2

Never discount the Santa Rally. The rapid sell-off on Monday occurred on relatively low trading volumes. The upward price action scenario is based on the 9-month long primary uptrend and without a break of the support at 3650, the upward targets remain:

Target 1: Year-to-date high 3724

Target 2: Big number 3800

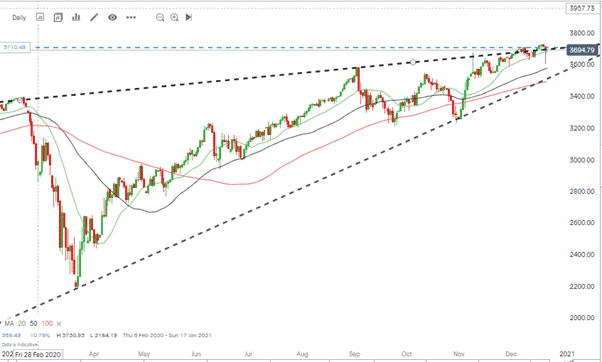

Daily

Source: IG

The rising wedge pattern in December has been broken to the upside. For a matter of months, price has spent far more time at the upper side of the wedge than the lower, Monday’s sell-off taking price into the middle of the pattern but not breaking into the bottom half and a long way (in relative terms) from breaking the supporting line.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk