O Mario, Mario! Wherefore art thou, Mario? Shakespearian drama is alive and well in Europe once more, as the undaunted Mario Draghi, temporarily overshadowed in recent months by the Fed’s normalization process, has suddenly leapt back center stage with all guns ablaze. Markets, perhaps, had been mislead by mild policy statements from our impresario from the week before, but Mario has often used this clever ruse to heighten the dramatic impact when he later assumes the podium. His new stimulus package was indeed a surprise, but his press conference delivered both shock and awe.

One reporter’s headline that followed was more to the point: “Mario Draghi’s ‘Shock and Awe’ Market Campaign Morphs into ‘Shock and Aw Shucks’. The Euro’s never-ending rollercoaster ride had been out of commission since last December, but yesterday’s 15-Minute chart illustrated that the old days were certainly back with a flourish:

Before the day was completed, the Euro had traversed 400 pips in search of a new support position. You have to return to the first week in December to find the last time the combined currency moved so chaotically. This time around, however, analysts were anticipating a renewed attempt by Mario to weaken the Euro. Deflation, the enemy that had refused to retreat, had painted Draghi and the ECB into a corner, but no one expected a robust series of stimulus “bazookas”, as a few pundits have characterized Draghi’s latest assault wave.

These so-called bazookas achieved exactly what they were intended to do – The Euro quickly weakened over 100 pips, the “Shock and Awe” portion of the day’s proceedings. Then came the press conference an hour later. After his hair was coiffed and adequate makeup had been applied, the spotlights glazed and our undaunted award-winning actor entered stage left, as if his prolonged absence had done little to dampen his air of confidence. Yes, Mario Draghi does have stage presence. He commands attention and exudes charisma, but these worthy traits have never been enough to rescue Europe from its ongoing financial malaise.

You have to give the man credit. He has tried, but this time around, he could not contain himself. He had to look beyond the flurry of easing actions to console his German counterparts that austerity was not a thing to be forgotten. When questioned about the pessimistic view that central banks are unable to reverse global economic trends, Mario responded, “I think the best answer to this has been given by our decisions today. We have shown that we are not short of ammunition.” But he quickly recanted to assuage his German critics, “We don’t anticipate it will be necessary to reduce rates further.” This comment defused his previous statements and resulted in the “Aw Shucks” reversal.

What were the initial bombshells that blew out support for the Euro?

After the ECB’S announcement of new policy changes, one of the more agreeable headlines read, “Mario Draghi Throws the Kitchen Sink at Europe’s Economic Distress. Again.” The market expectation had been that there might be some minor tweaking or a postponement to a later date of possible policy actions. Instead of a single rate change, Mario’s “kitchen sink” included the following six actions going forward:

1) Reduced the primary refinancing rate down to zero from 0.05%;

2) Cut the deposit rate from -0.3 down to -0.4%;

3) Cut the marginal lending facility rate from 0.30 down to 0.25%;

4) Expanded its quantitative easing asset purchase program from 60 billion Euros a month to 80 billion Euros;

5) Expanded eligibility of asset purchases to include non-bank, investment grade, Euro corporate bonds for the first time;

6) Announced a new tranche of four Targeted Longer Term Refinancing Operations (TLTRO II) on a quarterly basis beginning in June of 2016.

The market reaction to more than expected stimulus was swift. The Euro plunged versus the greenback. Equities surged, although bonds remained tepid in their reaction. The market moves were decidedly an overreaction to Mario’s surprise package, but when he hinted at there never being another rate cut in the future, investors immediately hit the panic button. Whether you looked at the German DAX or the S&P 500, stocks immediately fell into lockstep with the pattern displayed in the above EUR/USD 15-minute pricing chart.

Why has the economy in Europe refused to respond to easing programs?

Since November of 2011, Mario Draghi has stared out the window of his posh ECB offices in Frankfurt, knowing full well that he would forever be surrounded by his harsh German economic critics. He may fear the debilitating effects of constant deflation, but the citizens of Germany have lived through many horrific periods of deflationary times, and they have no desire to re-visit any of them. After the events of Thursday, a cacophony of criticism came roaring across the Main River, directly at the new headquarters building of the European Central Bank and Mario’s safe haven.

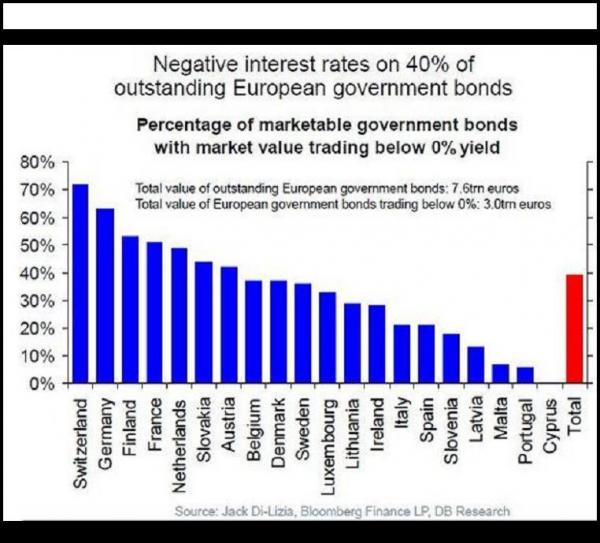

The European Monetary Union may be unified around a common currency, but the ability to enact and enforce policy edicts from a central administration point has always been lacking. Trying to rule by consensus has apparent disadvantages, which become more pronounced as time goes by. There does not exist a mechanism for re-allocating benefits across the continent when weaker members are in need. The answer today is to issue sovereign debt and more debt and live in the hope that it will be paid back over time. Returns on this debt have increasingly gone negative, as this chart demonstrates:

These funds were supposed to have been primarily earmarked for infrastructure projects and for loans to small to medium-sized businesses, each designed to create jobs, but unemployment remains a nagging problem in the region. Debt-to-GDP ratios vary widely, as does the productivity of workers, a sore point for Germany. On average, German workers are twice as productive as the workers from the rest of Europe combined. German exports have benefited from a weaker national currency (the Dmark would be considerably higher in value than the Euro today, an obstacle for exports), but these benefits have not been shared. Deflation only exacerbates the situation, but, for the time being, Germans continue to press for austerity and budgetary soundness.

Our intrepid Mr. Draghi, however, is continually being squeezed between the German “rock” and the hard places across Europe. There is only so much that a central bank can do, although Mario has been very adept with his bluster and mastery of theatrical skills. Cheap credit does reduce costs for businesses, but it can create asset bubbles, as well. In the absence of sweeping governmental reforms, the debate that somehow got swept under the rug, central bankers are left with monetary policy changes that could pose a more disconcerting risk of destabilizing the entire global financial system.

What were the ramifications for other global financial markets?

At the last G20 meeting in Shanghai, the cries of “Currency Wars” were heard once again, especially from U.S. officials. Negative interest rates are viewed as one common way to lower a national exchange rate, but Mario denies that any ulterior motives influenced his recent actions, “We’re not in that war at all.” Central bank policy divergences continue to drive a wedge between valuations of the U.S. Dollar and all other major and minor currency pairs associated with it. The Fed has embarked on an interest rate normalization process that could take years, but no one else seems so inclined.

Global markets would prefer that the contagion of negative interest rate policy (NIRP) be contained in Europe. If it spreads to other markets, it could be disastrous. The insidious nature of NIRP is that banks are caught in the middle. If they pass along the negative returns to their account holders, there will surely be a revolt, especially in Germany where savers are more in abundance. As a result, bank margins have come under pressure, and bank stocks took another beating after the ECB announcement.

The Euro crested at 1.122, but today it has coasted back down to a new support level at 1.115. The S&P 500 index also rebounded, impervious to the European goings on, at least for the moment. The good news is that the ECB is desperately trying to accelerate growth prospects in the region, but the bad news is that we have heard this same rhetoric before, and not just once. Mario is best known for his quip that he would do “whatever it takes”, a Clint Eastwood-esque remark that forever branded him as a power to be reckoned with in financial circles.

Were previous attempts at QE and the use of other monetary tricks just another round of smoke and mirrors from an accomplished showman? The European economy has been stuck in a ditch for several years, perhaps, the reason that Mario pulled out the stops this time around. There is, however, a potential downside. As one analyst put it, “Mr. Draghi may still be able to procure a few more kitchen sinks to throw at Europe’s economic problems. But each additional one may start to get a little more expensive, and a lot harder to throw.”

Concluding Remarks

Mario Draghi may have grabbed another fifteen minutes of fame, but he is still in search of that little “blue pill” that will cure the persistent impotence of central bank policymaking overtures. The growing pessimism that the ECB and others have run out of bullets, despite their proclamations that “ammunition” is plentiful, is warranted. With the exception of the Fed, nearly every major global central bank on the planet is still treading far down the trail of quantitative easing with very little in the way of positive economic results to show for it.

Deflation is the global culprit from the perspective of these bankers, and their market manipulation tactics have failed to reverse the steady fall in oil and other commodity prices. Denial can be cruel at times, and, in the case of commodities, near-zero interest rates have propelled drilling and mining efforts further down a black hole than unencumbered market forces would have ever allowed. The fear that the wolf is at the door and will soon blow our house of cards down is palpable and real.

Did Mario and his ECB buddies go too far out on a limb? They are definitely surrounded by a chorus of German critics at the moment. Financial markets are settling down now in preparation for a weekend of somber reflection. Is it time to prepare for any aftershocks that could likely occur in the week ahead? We suspect that this story has more legs, so proceed with caution.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk