Bitcoin’s 3% week-to-date price increase represents a continuation of the mini-bull-run that started back on the 8th of September. It could still have legs.

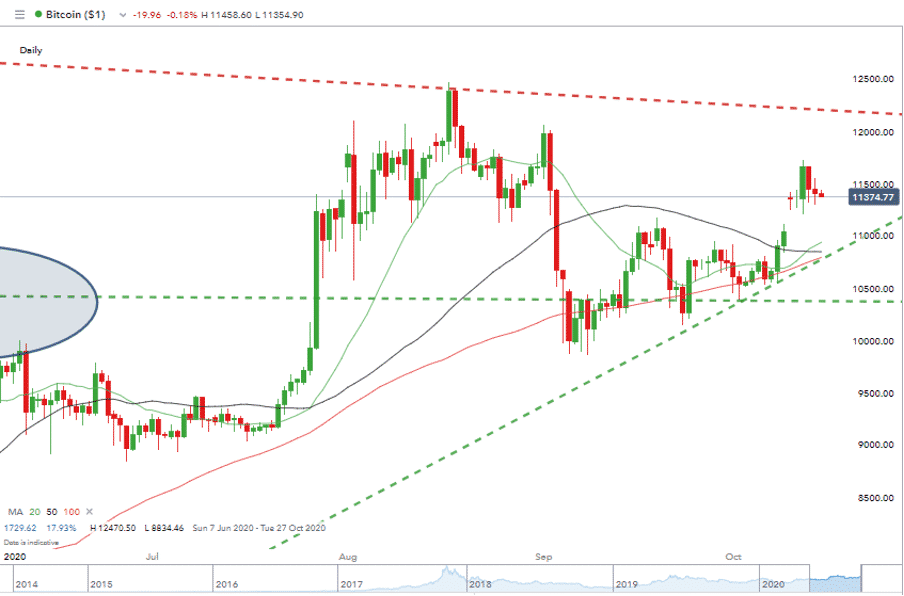

The longer-dated price chart of Daily candles picks out the 12th of March low as the start date of a bull-run which could have greater and longer-term momentum. The $12,000 price level is crucial and establishing the main resistance and support levels in that area offers clues on how price might move through and up.

- Big number resistance at $12,000

- August high of $12,470 is a test of ‘higher highs and higher lows’

- Geopolitical events are giving non-fiat assets a boost

The price hike from Friday’s close has left the Bitcoin price some distance above its 20, 50 and 100 Daily SMAs. These are all currently printing below $11,000. At the same time, the BTC price is showing every suggestion it’s looking at $12,000.

Bitcoin Daily Candles – June 2020

Source: IG

The supporting trend line is also currently positioned at the $11,000 level. The question that poses is whether to wait for a pullback to the considerable support at $11,000 or risk missing out.

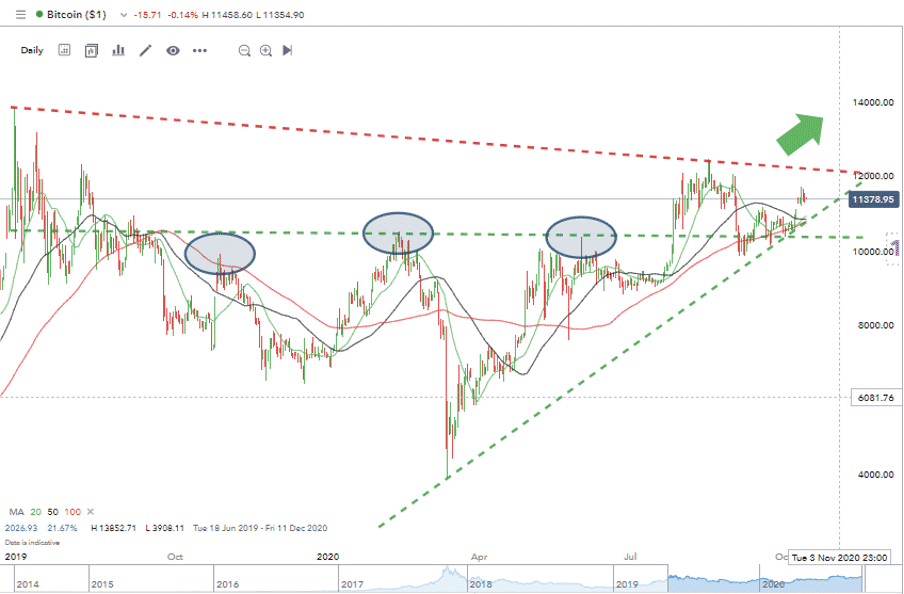

Bitcoin Daily Candles – June 2019

Source: IG

On a longer time-horizon, the price action points to an ascending wedge being formed.

The peak prices of October 2019, February and June 2020, were all in the $10,400 area offering secondary support below the $11,000 level. Resistance is offered by the descending trend line, currently at $12,200 and the psychologically important round number of $12,000.

With price holding a middle ground between two considerable support and resistance levels, it’s worth factoring in the fundamentals.

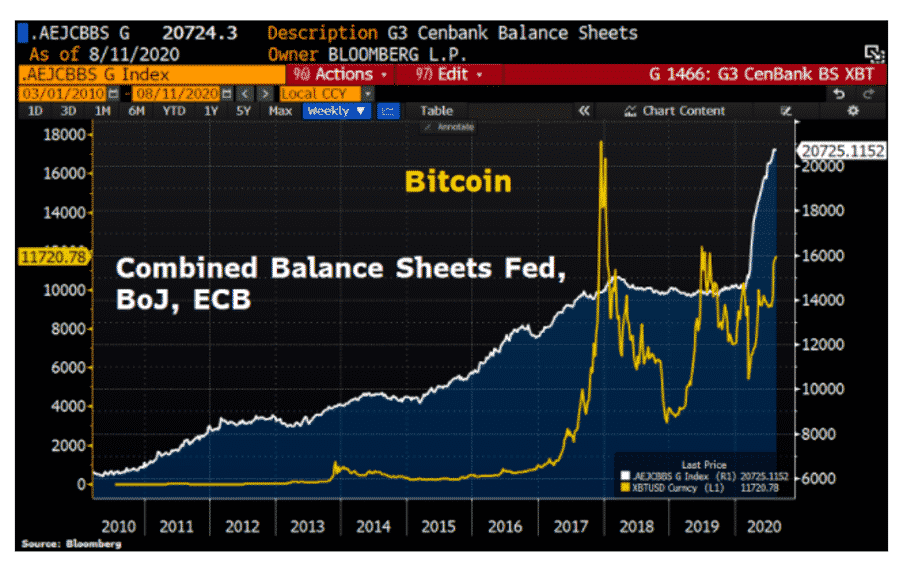

Cryptos may be the new kids on the block but they have a well-established role as being a hedge against the loose monetary policy of the central banks. The US Fed is leading the way in terms of printing more money while the Bank of England has taken steps towards implementing negative interest rates.

Non-fiat assets such as Bitcoin have risen in price whenever bankers pump more liquidity into the markets. Moves in the value of the combined balance sheets of the ECB, BoJ and Fed can be considered a leading indicator of the Bitcoin price.

The recent spike in central bank balance sheets is yet to see a corresponding jump in the BTC price; however, that doesn’t mean it’s not going to happen.

Source: Holger Zschaepitz Twitter / Bloomberg

- Covid’s influence on Bitcoin – The likelihood of an effective vaccine becoming available is still over the horizon. Claims that one will be ‘available in months’ have now themselves been made for several months. With seasonal peaks in infections looming there’s little reason to suggest the Fed’s purse strings won’t once more be loosened.

- The US Presidential election – A Biden victory would be seen as a trigger for expansion of US Federal spending. The recent uptick in the count for Trump risks being, too little, too late. Particularly with social distancing restricting the ability of party loyalists to get the Republican bandwagon rolling.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk