The Christmas break has brought seasonal cheer for the bulls. Risk assets across the board have seen a significant uplift in price with only precious metals losing value. A classic rotation into riskier assets appears to be taking place, with UK assets, in particular, prospering from the Christmas Eve announcement that a Brexit deal had been agreed.

US WTI Crude oil, EURUSD and the S&P 500 were all up in the 23rd–29th December period. Posting respective gains of 0.95%, 0.47% and 0.52%, they demonstrated a groundswell of optimism regarding the prospects for 2021.

The UK though was the market that benefitted most from the holiday break. The FTSE 100 rose in value by 2.64% and GBPUSD by 1.78% in the same period.

It was Bitcoin that once again provided the fireworks. An eight-day price hike of almost 11% left many wondering when or if the recent surge in the crypto markets might come to an end.

Gold and silver completed the picture. Down 0.74% and 1.79% respectively, they might not have generated a return for those holding long positions in the precious metals. However, the move does provide a confirmatory signal for the move into risk.

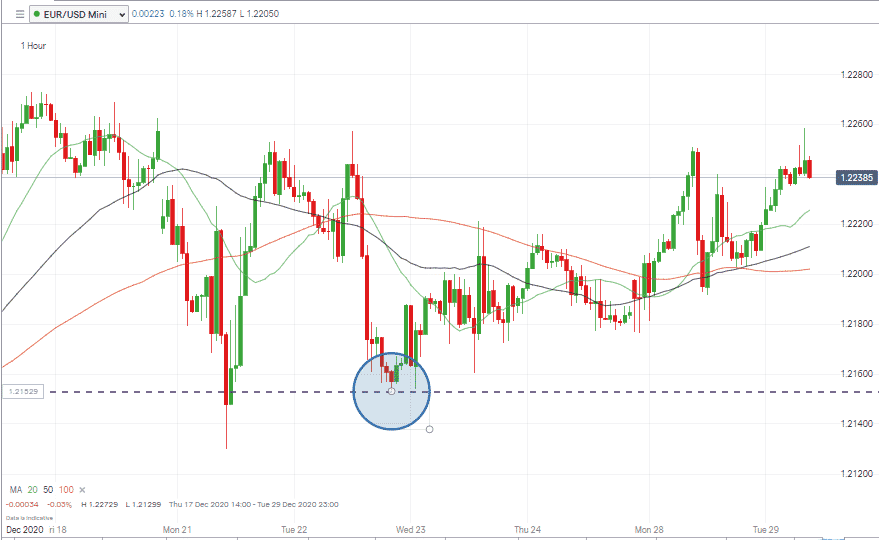

Trading signals for EURUSD

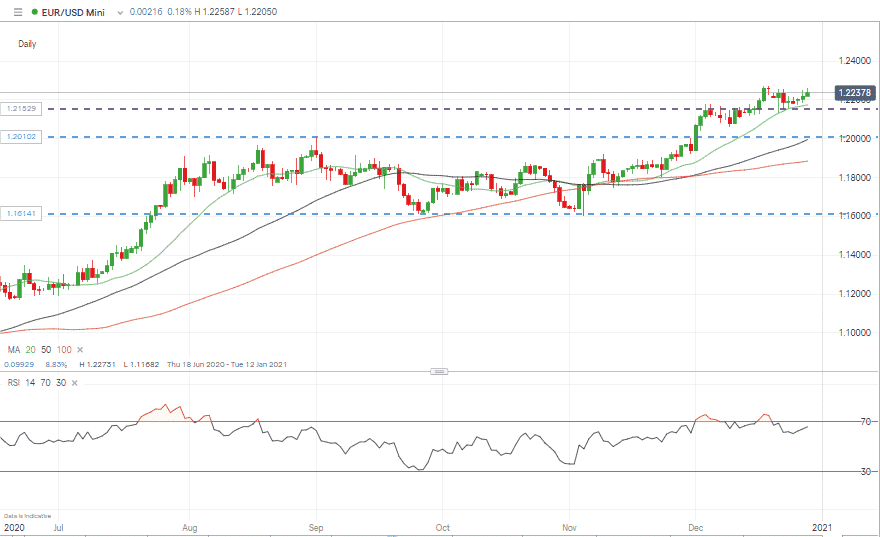

The so-far relatively modest move in EURUSD might signal that there is still momentum for the current up-move.

Source: IG

For those looking to take a long position and catch the upward move in EURUSD:

- The 1.2215 low from Wednesday the 23rd marks one support level.

- Trading above the 20, 50 and 100 SMAs on the hourly chart also provides support at 1.22256, 1.22111 and 1.22020.

- The Daily 20 SMA at 1.21750 offers another level at which any stop-loss could be set.

- Daily RSI is also offering support to the EURUSD bulls.

Source: IG

First and second price targets would be 1.2250 and 1.2270. Early trading on Tuesday saw price test 1.2250 (the week to date high), but fall away. A potential entry level for those looking for a pull-back before further upward motion.

Whether the alternative scenario comes into play appears to depend on trading volumes. Quiet in the markets in the run-up to year-end could mean the path of least resistance is upward. The downside risk comes from an external news shock in which case short positions entered into below 1.2215 would have target prices of 1.2200, 1.2190 and 1.21750.

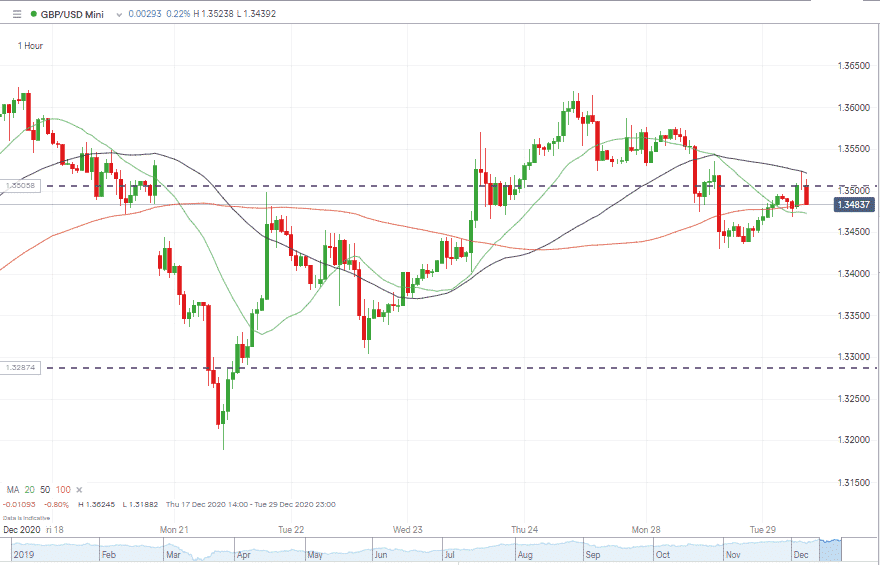

Trading signals for GBPUSD

Cable looks likely to offer greater price volatility and trading volumes than EURUSD. The risk-return on trades in that market are derived from gradual deciphering of what the EU-UK trade deal does, and doesn’t, mean for trading relations between the two neighbours.

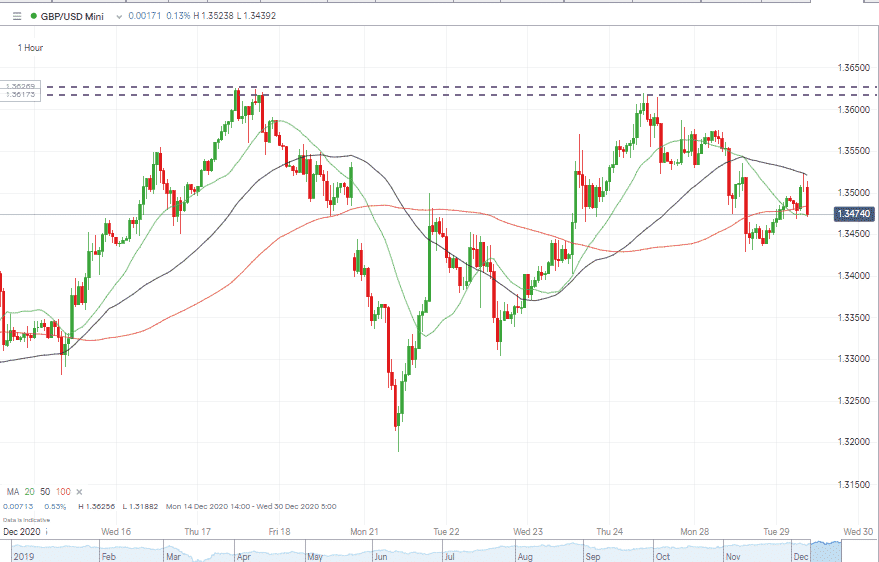

Trading in GBPUSD at the start of the week can only be described as choppy.

Source: IG

The Hourly 50 SMA has so far formed a reliable cap on price rises. If price can break that level, then a test of last week’s highs around the 1.36 level could be on the cards.

Source: IG

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk