As traders, we always have to keep one eye open for the potential of fraudulent activity, while the other is firmly focused on Market Risk, the “Mother” of all risk issues. Experts have been predicting the end to our current secular Bull market for years, but the hype has been escalating over the past several months. Fear does sell newsprint or Internet page views, but the consensus expects the precursor of any cratering in global bond and stock values to be violent swings in volatility in the foreign exchange market.

Perhaps, the desire to cry wolf is human nature, something that never leaves us from our childhood days, but analysts are digging deep to find a dead canary in the forex coal mine. Are global bond and stock markets reaching a peak or precipice, if you like? The track record of these prognosticators of gloom and doom has not been good. They have hailed the end of this Bull market in 2012, 2013, 2014, and now, just to hedge their bets, they are sure that 2016 will be filled with dark days for sure.

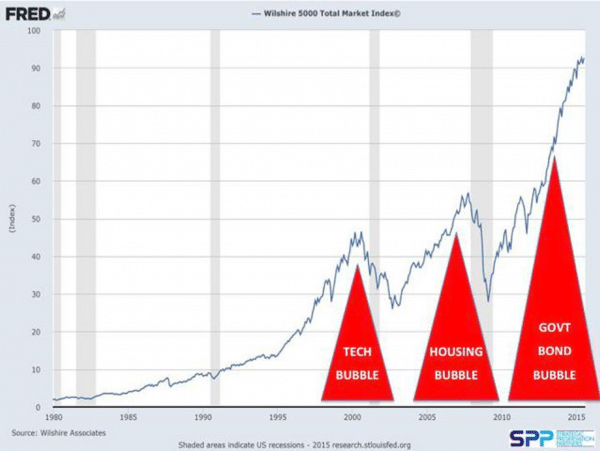

What should we do? Caution is called for, but not panic in the streets, just yet. Yes, central bankers are worried that $11 trillion of cover-trade over hang could suddenly unravel and cause a liquidity crunch of monstrous proportions, but only time will tell on that one. As for right now, the “Award for the Best Chart” this week goes to Kirk Bostrum, a hedge fund manager that is more than edgy at the moment. Here is his chart:

While the majority of the public is easily swayed in their opinion of the market by changes in 30 stocks on the Dow or by at least 500 in the S&P Index, the best way to truly evaluate the health of the overall domestic stock market in the United States is by tracking the 5,000 issues in the Wilshire Index. Even a newcomer to the art of Technical Analysis would find the above chart as troubling, or even scream that the wolf is at the door. The Tech and Housing bubbles were mere bumps in the road, when one compares them to the impending Government Bond bubble on the near-term horizon.

To repeat another cogent phrase that has been bandied about lately, “The larger the asset bubble, the less people will see it.” The near-vertical slope of the recent trend has been fueled by Zero Interest Rate Policies (ZIRP) across the planet. By the latest accounting, some 47 central banks have engaged in this practice in the first half of 2015 alone, following the Fed’s lead of course, in a last ditch attempt to jump start their domestic economies into a higher gear. The new excess liquidity, as the story goes, was intended to ignite new business ventures, but, unfortunately, investors had other intentions. It went straight into pumping up stock and bond values worldwide.

The most recent and largest example of this phenomenon has been in China. The Bank of China has been desperately trying to defuse a real estate bubble and achieve a soft-landing for its economic travails of late, but the new funds merely pumped up stock values on the Shanghai Composite, which then promptly collapsed more than thirty percent with possibly more to come. If you extend the long-term trend line in the above chart, then the Wilshire Index could reasonably find a bottom at the 40 level, a fall of mammoth proportions approaching sixty percent.

What happened to the dire predictions for 2015?

The doom and gloom folks had nearly lost all credibility before the start of this calendar year. Accountability, however, rarely bothers these types. No one ever remembers that they were wrong, but, if they were correct, then they could boast about their enormous prowess for decades to come in their soon-to-be lucrative newsletters, such are the rewards at stake. After licking their wounds for three years, 2015 was a lead-pipe cinch, to be the year of all years. Price-to-Earnings ratios were through the roof, and even more credible P/E measures that adjusted for inflation and other factors were screaming that a peak had been reached, but nothing happened.

The next sure thing was that corporate earnings were to behave like they were in some kind of recession, i.e., resembling a recession definition of economic growth being negative for two succeeding quarters. The last two earnings seasons have come and gone, and the predictions of an earnings recession have gone with them, hopefully, never to be heard from again. This does not suggest, by any means, that analysts are not jittery. The concern is palpable. No one wants to be long in stocks or in foreign-issued bonds with low liquidity when the balloon goes up. Despite the wish of central bankers, the rush to exits will not be orderly. There will be blood in the streets.

Lastly, the next indicator that assured everyone that 2015 was “IT” in capital letters was the latest count of the number of days in this Bull market cycle. By last May, our current Bull had run from 2009 through 2,250 consecutive days, ranking it third in the all time Hit Parade of rampaging bulls. Surely, there would now be a stumble, as all the other indicators were signaling, but, alas, we are one hundred days later and still counting. In case you are curious, the second spot is 2,607 days. We have a ways to go to get there, but, as many analysts contend, there is still steam in this engine.

What are the latest “canaries in the coal mine”?

As Kirk Bostrum points out in his analysis, the canary metaphor is a useful one to remind us to be as cautious as a miner going deep into unexplored dark places. You need something to alert you that oxygen has left the room. Canaries may have done the trick in days of old, but, fast forward to the present, and we are once again looking for anything that will tell us to head for the exits, at least before the herd catches onto the calamity at hand.

Bostrum lists, in his opinion, three disturbing “canaries” that he has uncovered from the shadow regions. The first one is obvious. It has to do with the situation in Greece and the never-ending series of bailouts and threats of default. The size of the Greek tragedy will not bring down the global economy on its own, but the ongoing consensus regrets that the Greek problem is a surefire signal that there is something awry in the Euro experiment. Some vital ingredient is missing in the EU that prevents it from dealing with major financial woes. If and when contagion spreads, how will officials deal with a Spain or an Italy or even a France for that matter?

Number Two on his Hit List is a bit more obscure. With ZIRP firmly ensconced in the mind of every global investor, there has been a race about the globe to ferret out higher and higher returns, resulting in higher and higher risks taken in low liquidity investments, typically government issued bonds. These can be national and municipal in nature, but the demand has yet to be quenched. The tell-tell signs will more than likely appear on the periphery, namely the emerging market sector where the need is greatest, but the risk even greater. Analysts have been predicting massive municipal bond defaults for some time, but they have rarely materialized. Per Bostrum, “Earlier this week, however, Puerto Rico defaulted on a municipal bond interest payment. It was the first time ever for a U.S. commonwealth.” Oops! Is this the tip of the municipal iceberg?

Number Three is also subtle. When in doubt, watch what the billionaires do for guidance. Back in January of 2012, George Soros quipped, “We are facing an extremely difficult time, comparable in many ways to the 1930s, the Great Depression…The best-case scenario is a deflationary environment. The worst-case is a collapse of the financial system.” In recent financial statement filings, Mr. Bostrum noticed that Soros had secured $1.1 billion of put options for the S&P 500 Index, obviously making his move to short the stock market in a big way. It might not be wise to take one position out of context and draw substantive conclusions. The Soros’ option play may only be one part of a bigger strategy, but it is difficult to ignore such a major move in the marketplace.

Concluding Remarks

Our Bull market is still on the run, some 2,350 days without a 20% or more correction. It is also quickly approaching 1,500 days without a 10% correction, as well, a common occurrence in healthy market trends when a portion of investors take their profits and new investors then jump on board. But these times, they are different. ZIRP, QE, and their eventual unraveling will carry consequences. Interest rates need to rise, and, as bond values fall, capital will seek safe havens, whether in the traditional form of U.S. Treasuries and precious metals or other hard assets that retain their value and liquidity.

Attempts to find similar historical perspectives have not yielded any nuggets of value. The best advice from the history books comes in the form of old market adages, such as, “Bull Markets tend to climb the staircase slowly, while Bear Markets often jump out of the window.” Our current Bull, as the previous chart so perfectly illustrates, is not climbing “the staircase slowly.” His stamina has been astonishing, and many investors have regrets for getting off his back too early. Fortunes were lost, but as we always know in the forex world, there is always another opportunity around the corner.

When will a 10% or even a 20% correction come? As Yogi Berra has said many times, “It’s tough to make predictions, especially about the future.” If you are in stocks and bonds, it is best to ensure that your issues can easily be liquidated at acceptable price points. A cautious step would be to re-order your portfolio along these lines. If you are a forex trader, however, the issue is how long must we salivate? Any major market correction will rock foreign exchange, creating a wild stream of volatility filled with profit opportunities. Are you with a broker that can handle major swings? Does he have the capital adequacy necessary to weather a forex perfect storm? Stay tuned!

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk