Statistically speaking, US presidential elections are followed by a market rally regardless of which side wins.

To some, most notably Donald Trump, the election may not be over. Markets though have priced in that the process is concluded. The price surge following the vote count has seen all assets rise in value as risk has been placed back into the markets.

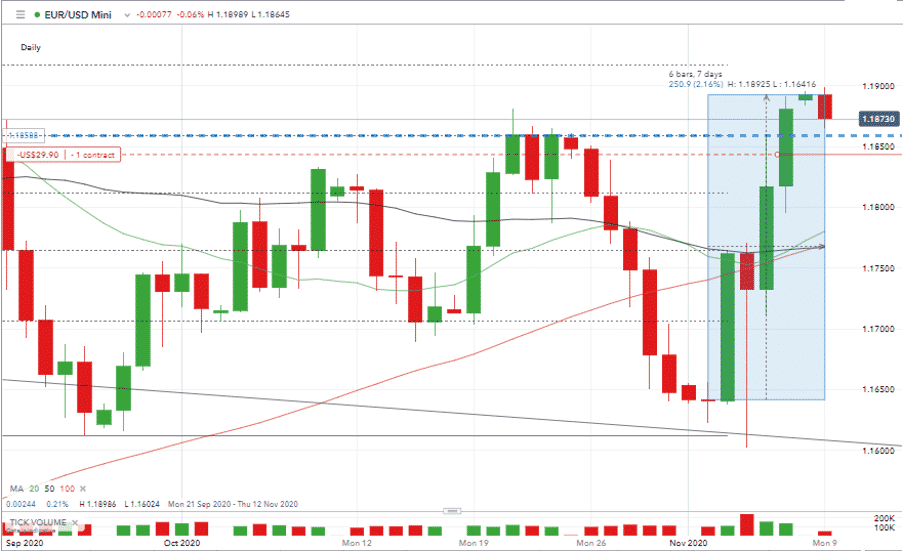

Source: IG

Weekly price change:

- EURUSD – +2.16%

- GBPUSD – +1.97%

- S&P 500 – +8.69%

- Gold – +4.41%

- Bitcoin – +12.53%

- WTI Crude – +11.03%

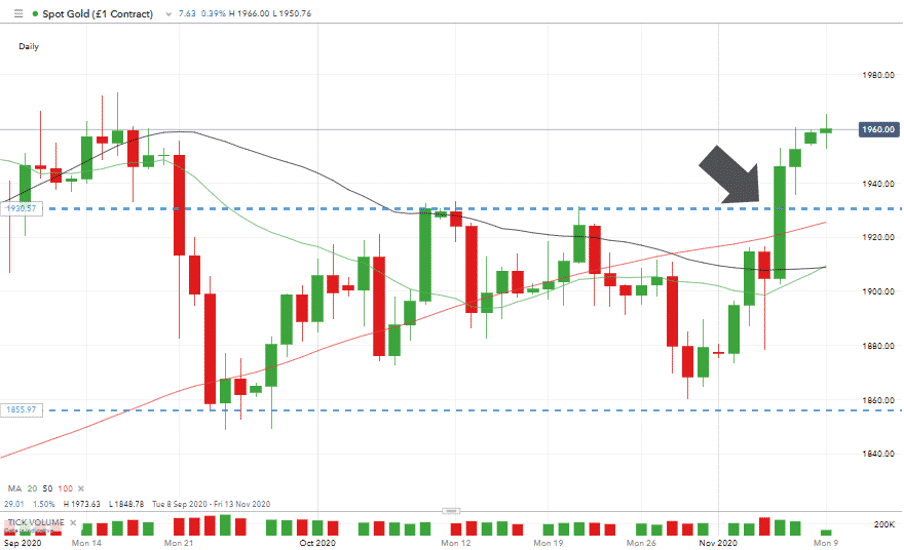

Gold’s move is particularly significant as this analysis outlines. It has finally broken out of a tight trading range.

Source: IG

There are understandable reasons for investor optimism. The comments made by world leaders also point to a sense of political relief that the result is confirmed. Their public backing of Biden now makes Trump’s efforts to challenge the vote even harder to imagine being successful.

Norbert Röttgen, Chairman of the German Foreign Affairs Committee, said he was, “very happy for all my American friends and for this great chance to revive our transatlantic friendship.”

French President Emmanuel Macron also posted a lively tweet, writing: “The Americans have chosen their President.”

South Korean President Moon Jae-in a tweet said: “Our alliance is strong and the bond between our two countries is rock-solid.”

Australian Prime Minister Scott Morrison issued a statement in which he said:

“The President-elect has been a great friend of Australia over many years.”

Source: CNN

Clarity – the votes have been counted and the threat of courtroom obstruction by the Trump camp has been tempered by international leaders coming out in support of Joe Biden.

Normalcy – Biden is the epitome of ‘business as usual’. He first ran for president in 1988. For many in the markets, never has boring been so exciting.

Internationalist – not only is Joe Biden part of the political establishment, but he’s also from the part of the establishment which has a firm eye on international co-operation. The president-elect has stated that he’ll sign the US back up to the UNFCCC Paris Agreement. It’s anticipated that his globalist view will feed through into improved world trade.

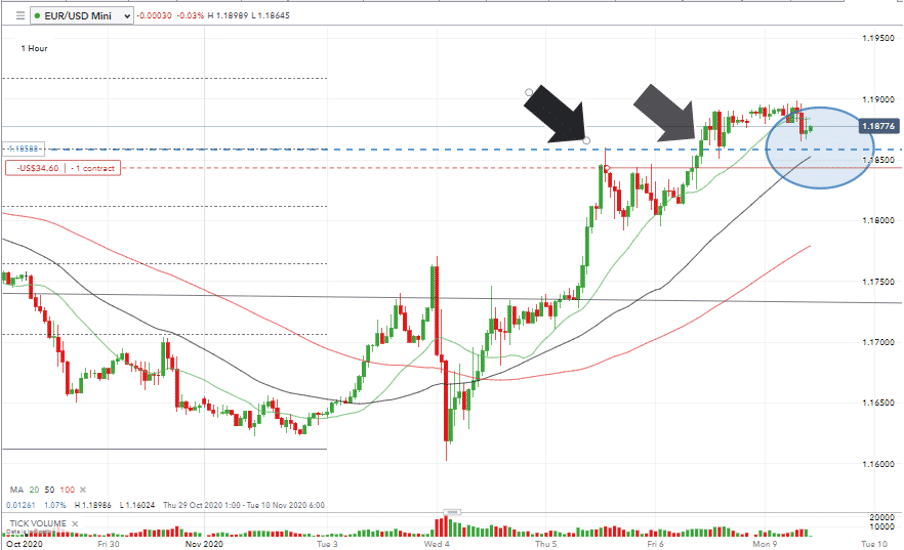

That is all very good; however, investors looking to find an entry point into the rising tide need to be aware of the current risks. The market rally has, to some extent, already taken place. Last week’s pick by Forex Trader analysts of the EURUSD support at 1.16 would have been a good entry point into long Euro.

Source: IG

With Monday’s European open seeing prices at 1.187 are there signs that EURUSD is overbought? The long- term resistance at 1.185 was touched on Thursday and finally broken on Friday morning.

Price is currently consolidating above the 1.185 level; however, it would not be surprising to see it at least kiss what is now a fundamental support level before deciding if it is to carry on upwards. The hourly 50 and 100 SMAs are all below 1.185, which opens the door to the potential of a price slide on the back of profit-taking.

Our analysis is based on a comprehensive summary of market data. We use a range of metrics with weighting given to simple and exponential moving averages and key technical indicators.Any information contained on this Website is provided as general market information for educational and entertainment purposes only, and does not constitute investment advice. The Website should not be relied upon as a substitute for extensive independent market research before making your actual trading decisions. Opinions, market data, recommendations or any other content is subject to change at any time without notice. ForexTraders will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk