With some significant news announcements due this week, there will be many looking to tap into the best research available in order to manage risk. There is also a need to ensure access to the markets is reliable.

Monday Morning Market Jitters

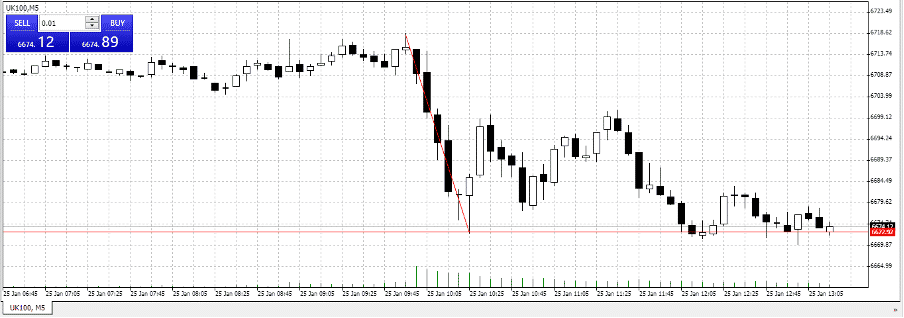

The fun has already started. Soon after the European markets opened on Monday morning, they were having the jitters. Overnight gains in Asia were followed by a fall in equity indices worldwide. The UK’s FTSE 100 posted a +50 basis points fall in value within the first 20 minutes of trading.

Source: FP Markets

Was this a gap fill from Friday’s London close? Possibly, and while price action still looks bearish, it has held at the 6670 level.

US Fed Announcement and Janet Yellen

There could be more uncertainty this week. The US Federal Reserve will be meeting on Tuesday and Wednesday. In line with standard Fed policy, an announcement on the conclusions of the FOMC is due to be delivered by Fed Chair, Jerome Powell at 2.30 pm Eastern Time on Wednesday.

Background noise associated with the Biden presidency will also play a part in keeping up market volatility levels. The approval by the US Senate of Janet Yellen as Treasury Secretary gives a glimpse of what’s to come.

Yellen is a firm advocate of Keynesian economics and the US government does look prepared to spend its way out of trouble. Of course, Yellen spent four years in the hot-seat at the US Fed (2014-18) and might be seen by many as having the knowledge base to get the most out of turning both monetary and fiscal taps on at the same time.

The intention might be to support the American Main Street economy. However, such a move will have far-reaching consequences for the global financial markets.

This review of broker FP Markets notes that the market for the quality of the firm’s research is one of its best features. The ‘Week Ahead’ report is possibly the pick of the crop. It’s not investment advice and is instead more general but it’s obviously well thought out as this week’s report shows.

Keeping Up to Date with the Markets

The FP Week Ahead report doesn’t point in which way the market is heading but does highlight the potential for the week being full of surprises. The Fed’s announcement is diarised, but Yellen’s policy ideas may well drip into the markets on an as-and-when basis.

Monday’s price slide in equities is a signal of risk being taken off the books, but at least price action was consistent. Wednesday’s markets could possibly see price action whip-sawing and triggering stops.

Keeping on top of events could be the difference between a loss and a profit. It’s also worth remembering the adage of “No new gear on race day”. FP Markets have new features on their mobile App which will ultimately pay dividends for its clients. However, it might be worth checking before Wednesday that all the upgrades have bedded down successfully.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk