Monday’s impressive market rally has thrown up some bull-friendly headlines but there are signs it was a regulation-style price adjustment rather than the start of a new trend.

In the equity markets, the Dow Jones Industrial Average posted its most impressive daily gain since March and the Russell 2000 index was up 2.16% on the day. Overnight, the Nikkei 225 jumped more than 3% to make up for Monday’s price slide when Asian markets were spoofed by US end of week jitters.

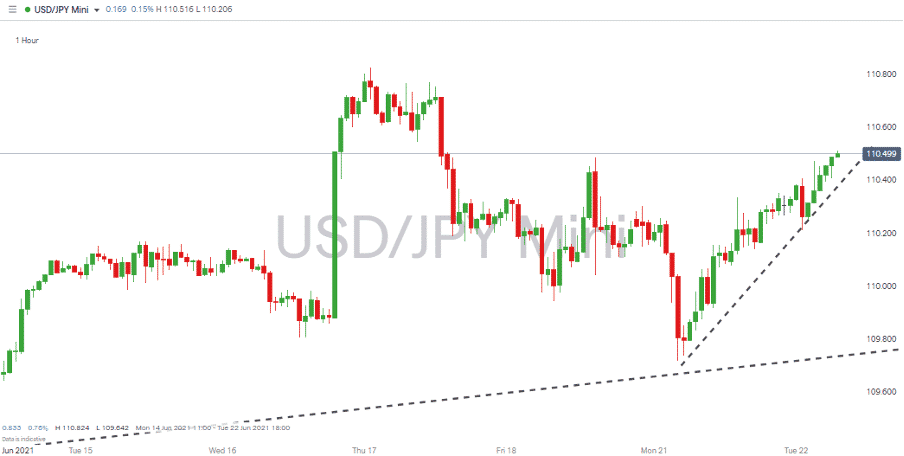

USDJPY

Those trading short-term strategies would have welcomed a significant uptick in volatility in the forex markets. USDJPY recorded intraday price moves above 0.50% and a steady price climb.

USDJPY – Monday’s Price Climb

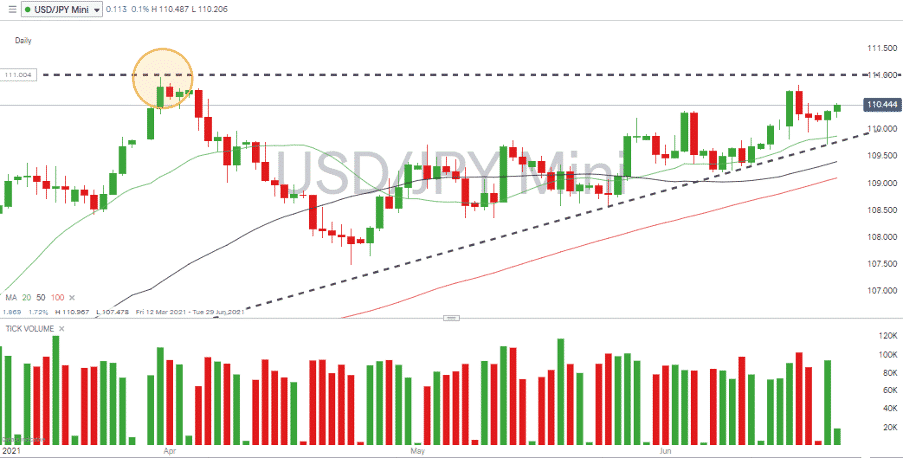

USDJPY – Daily Chart Rising Wedge & Volumes

Source: IG

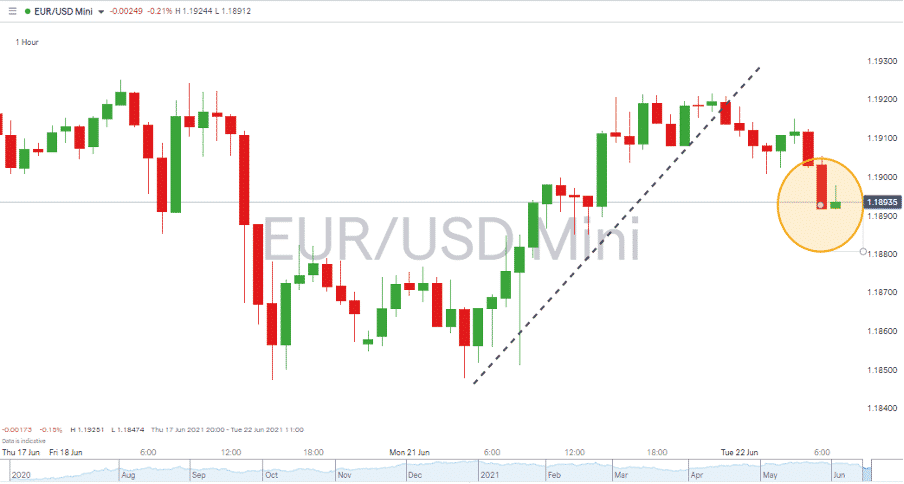

EURUSD

The price chart on EURUSD mirrors the other markets but the draining away of upward momentum could be a warning to those piling into risk.

Source: IG

Also, note on the USDJPY Daily chart that Monday’s trading volumes were less than those of Thursday when the move away from risk started. In short, Monday’s move was not as broadly supported as some bulls would have liked. It also looks very much like a bounce off the long-term supporting trend-line rather than a breakout to the upside. Even after the surge, the USDJPY price is sitting in the middle of the range of a rising wedge pattern which is still offering few clues as to how it will end.

Is Now a Good Time to Buy the Dips?

Nothing can be guaranteed, and Monday’s move might not be the new dawn bulls were hoping for. Technicals point to low volume markets bouncing off multi-month price support levels. By the European open on Tuesday, some markets such as EURUSD had already lost upward momentum.

It’s worth remembering the catalyst of last week’s sell-off was news that the US Federal Reserve declared it was talking about talking about interest rate rises. Fed Chair Jerome Powell spoke last Wednesday when he made it quite clear that interest rate rises would be brought forward. Hikes pencilled in for 2024 would now more likely be seen in 2023; any forecast for 2023 may now appear in 2022. The slow-paced sell-off that followed suggested that investors and analysts were nervously working through calendars two and three years ahead, but by Monday morning had concluded that it was foolish to worry about events so far in the future. The years 2022, 2023 and 2024 had all been mentioned but there was nothing in the Fed’s statement about 2021.

This might represent over-confidence. The real threat to the impressive multi-month bull run is not interest rate policy but the tapering of quantitative easing. The $700bn package announced in March 2020 flooded the markets with cash which had to find a home somewhere. This inflated asset prices, but the Fed is now sitting on $2trn of assets. There will come a point when the Fed starts, talking about, talking about, tapering and even the suggestion that conversation is about to begin is a far greater risk to prices.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk