The GBPUSD currency pair faced another wave of selling pressure as the Bank of England (BoE) hinted at an easing cycle on the horizon, exacerbating the British pound’s weakening trend. The monetary authority, which held interest rates steady on Thursday, took markets by a surprise by signalling the advent of rate cuts in the near future.

In a pivotal shift from its prior hawkish stance, the Bank indicated that looser monetary policy might soon be warranted, given the decrease in Britain’s inflation rate, which cooled from 4.0% in January to a more temperate 3.4% in February. This move towards a neutral or even dovish position comes in stark contrast to the aggressive rate hikes of the past year, aimed at curbing spiraling inflation.

The much-anticipated meeting concluded with an 8-1 vote in favour of the current policy stance, which came off as more dovish than the market’s expected 7-1-1 split. This dovish tilt did not bode well for boosting the Pound’s value in the immediate aftermath.

Market participants are recalibrating their expectations in the wake of the BoE’s recent policy meeting, now assigning a 75% probability of rate cuts by June, up markedly from the 65% assessed prior to this latest convening. This reassessment is in line with a broader global pattern of central banks easing their foot off the rate-hiking accelerator.

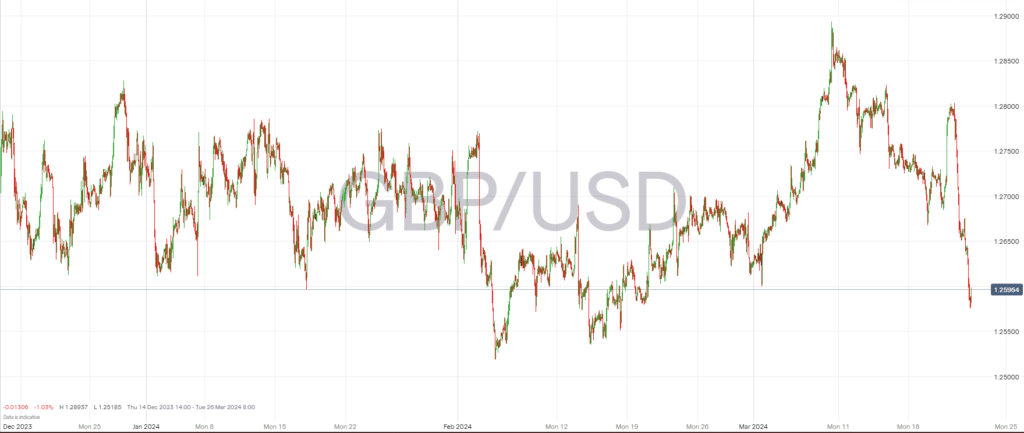

Aided by similar tones from the U.S. Federal Reserve, which maintained its outlook for rate reductions beginning in June and forecasting a total of three rate cuts in 2024, the GBPUSD pair found itself on a downward trajectory. Notably, the pair has descended past a significant support trendline and crucially dipped below the 1.2650 support level as well as the 30-day Simple Moving Average (SMA). Technical indicators, including the Relative Strength Index (RSI), further confirm the strong bearish momentum gripping the pound.

Observing the currency’s technical posture, bears appear to be gaining the upper hand. The GBP/USD chart exhibited a lower high formation near the 1.2800 resistance zone, followed by a breach below the previous low, pointing towards an impending retest of the 1.2550 support threshold – a level that could now be within reach should the bearish trend persist.

GBP’s lacklustre performance was also exacerbated by a rally earlier in the year, largely fuelled by corrected interest rate expectations and data that exceeded market forecasts. Nevertheless, Sterling’s impressive gains earlier in the year have left it exposed to shifts in market sentiment, which is increasingly becoming a stronghold for potential volatility.

Traders will continue to monitor the unfolding situation, with the pound’s prospects closely tied to the BoE’s forthcoming policy moves and the broader narrative of international monetary policy realignment.

Don’t Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading.

These tips could help make you a better trader – and we’re giving them away for free!

Related Articles

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk