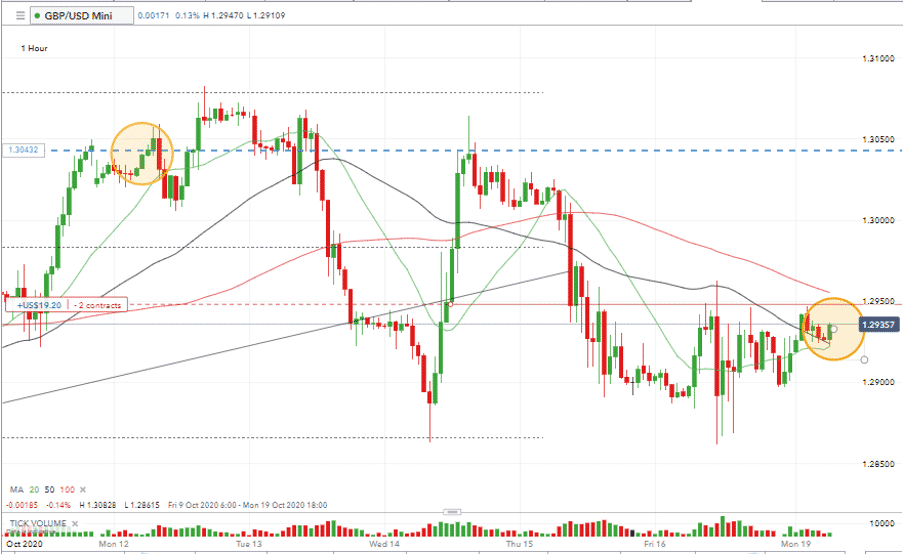

Our market update of last week pointed to sterling weakness. Since then, GBPUSD has traded as low as 1.28615. That support level was tested on both Wednesday and Friday.

Cables inability to print at even lower prices is partly explained by the Weekly 100 SMA which is currently offering support in the region of 1.28972.

The GBP sell of last week might not have been conclusive, but it was dramatic. The short-term price volatility caused by Brexit news snippets reaching the markets would have been a treat for scalpers.

Source: IG

With the opening of the European markets on the 19th of October, it is another SMA, the Daily 20 (1.29315) that the price of GBPUSD is drawn to. A break of that resistance level would offer room for further GBP gains. Some kind of a relief rally can’t be dismissed and price action is currently pointing towards an upward move.

The 50 SMA is the next Daily moving average to stand in the way of any cable bullishness, and that is currently as high as 1.29968. If price is going to get that close to the magical 1.30 number, then it would be highly likely that it might at least touch that psychologically important pressure point.

Something for the bears?

Traders looking to the downside might be sitting on their hands. Price action did spend a good part of last week testing the 1.29 level but that level has held so far.

If the Brexit talks and the Bank of England throw up negative news updates, there is a lot of room to the downside for sterling. Remember that as recently as March the pair was trading at 1.141. Racing to put shorts on just above 1.29 could lead to fingers getting burned. It is complicated – but getting the right side of news events could be profitable.

There is still a sense that Brexit negotiations could get worse before they get better. UK and EU representatives are back at the stage of having talks about talks. The first part of the week will shed light on whether EU delegates travel to London or stay in Brussels.

The Bank of England is making louder noises in terms of UK interest rates going negative.

Macro events – USD

All forex pairs, of course, involve two currencies and state-side geopolitical uncertainty put considerable pressure on the US dollar itself. With the countdown to the presidential election well and truly underway, the dollar weakness continues to put off any capitulation of GBPUSD.

China’s announcement of GDP figures on Monday saw Q3 growth reported as being 4.9%, however, there is always some scepticism about economic data released by the National Bureau of Statistics. The numbers have a reputation for being ‘enhanced’. If there was a time to over-estimate, then it is now.

It’s interesting that the 4.9% figure came in below the analyst estimates. Surveys of Chinese economists had predicted a quarterly growth of 5.2%. Even so, the confirmation of some kind of recovery has allowed the bullish participants to look to put risk-on.

The bears may not be done, but they do look to be stepping out of the way of bullish GBP price action. It could be a tumultuous week for cable.

Our analysis is based on a comprehensive summary of market data. We use a range of metrics with weighting given to simple and exponential moving averages and key technical indicators.

Any information contained on this Website is provided as general market information for educational and entertainment purposes only, and does not constitute investment advice. The Website should not be relied upon as a substitute for extensive independent market research before making your actual trading decisions. Opinions, market data, recommendations or any other content is subject to change at any time without notice. ForexTraders will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from use of or reliance on such information. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk