If anyone should know about the market ‘always being right’ it’s the professional stockbrokers on Wall Street. The guys who get paid millions, or is that billions, to invest in shares for a living. The stock markets can be brutal, but by leveraging their personal address books and research teams, institutional investors usually end up on the right side of a trade.

Wednesday was different. Expense account lunches with contacts in the know counted for nothing. Instead, retail investors armed with little more than internet chat rooms stormed the US stock markets and took out Wall Street.

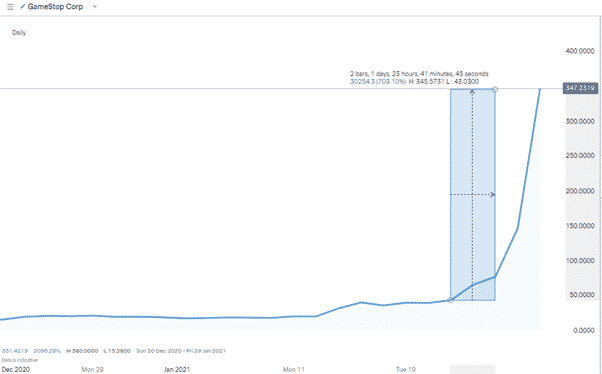

The US-listed stock GameStop (Nasdaq: GME) had a price of $19 at the start of January and during the Wednesday trading session of the Nasdaq exchange it was printing at $330.

Source: Reddit / Wallstreetbets

Individual investors and day traders have fuelled the meteoric price rise. The labyrinthine network of online chat rooms has been packed with retail traders sharing views and good news stories of profits being made in GameStop. The Reddit thread “wallstreetbets” being noted as a source of much of the enthusiasm for backing the eye-watering price rise.

On Wednesday the scene was set for a face-off between the millions of retail share traders with small accounts and the hedge-fund ‘masters of the universe’ who are fewer in number but possess far bigger cash piles.

GameStop – FOMO vs Logic

The doubling of the GameStop share price in one trading session confirmed it was the little guys who won the day.

The hedge fund managers’ problem was that they had been betting against GameStop for some time. Being able to short-sell stocks allowed them to build positions against the price rise.

In-house analysis based on balance sheets and growth forecasts pointed to the price being unsustainable. At some point in the future, the hedge fund manager would repurchase the stock at a lower price, cover the short position and bank a handsome profit.

GameStop – The Short-Squeeze

Unfortunately for some big hedge funds, the GameStop price correction didn’t come soon enough. Instead, the losses on the short positions built through the day. The final humiliation of any short-squeeze is the moment the short-seller has to bail out of its position.

It’s a cruel irony that this converts to even more buying pressure as they scramble to buy a stock that is already going higher. As one manager breaks ranks and becomes a buyer, the pressure escalates on those trying to hold their position. It’s less a question of whether to panic, more of when!

Source: Reddit / Wallstreetbets

One of the short-sellers, Melvin Capital, called on its backers Citadel and Point72 to pump almost $3bn into the fund to keep it afloat to hold onto the downward bet. By Tuesday evening, Gabe Plotkin, boss of Melvin, let CNBC know he’d thrown in the towel and closed his short position.

Data analytics company S3 estimates hedge funds and others that bet against GameStop have collectively lost more than $5bn. As the markets are a zero-sum game, the little guys are between them $5bn richer; no wonder the trading platform that supported a lot of the retail activity is called Robin Hood.

GameStop – Lessons to be Learnt

Depending on your viewpoint, the little guy socked it to the man or the lunatics took over the asylum.

Either way, it was a painful lesson for many high-profile hedge fund managers. Some were carried out in career-ending carnage. For hedge fund managers like Steve Cohen, owner of the New York Mets baseball team, much of the daily routine is less about money than it is about prestige.

It’s a game, a chance to demonstrate superiority over a rival. Even after the losses made by hedge funds yesterday, the big guys will still holiday in their second home in the Hamptons. They have enough cash banked after years of getting the big calls right.

It’s just that the pool-side drinks won’t go down so easily knowing that they were severely beaten by cab-drivers, stay-at-home-moms and other part-time Robin Hood traders.

Source: IG

GameStop stock rose in value by 703% between the 21st and the 28th of January. The story will go down as a market legend.

It also signals a new dawn for retail investing. The genie is out of the bottle and individual share traders are looking for ways to join the party.

A surge of new members forced the WallStreetBets forum to stop admitting new users for a time. Communications platform Discord banned the group entirely. That doesn’t appear to be a case of sour grapes but was due to the influx of users being so large the comments could not be moderated.

Putting GameStop into Perspective

This isn’t a new phenomenon. War-time economist John Maynard Keynes famously explained, “the markets can remain irrational longer than you can remain solvent.”

In the 1990’s Long Term Capital, which had been the flagship of hedge fund invincibility, famously collapsed after betting against the markets being ‘irrational.’

When you lose big against the markets, even high-profile managers’ reputations count for nothing. As the old trading room adage goes, “even the pretty girls get hurt when the bus crashes.”

But Wednesday was different. The hedge funds that usually win didn’t. Everyday folks might question the ethics of short selling but the funds play by the rules set by the exchanges and have the oceans of cash. It has the feeling of being an exclusive club, but as pot-leader, the funds gradually clean up each little guy one by one.

Today, the euphoria present in the retail chat rooms is partly explained by the incredible profits that are being made. It’s also a reflection of the delight at the hedge funds being taken down by their own rules.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk