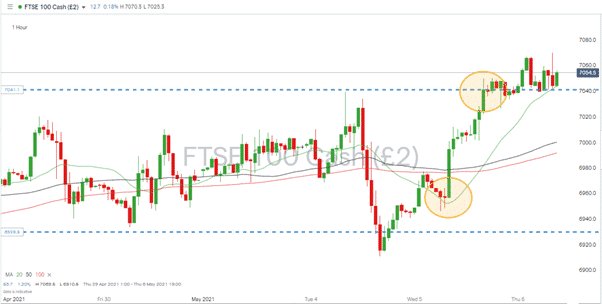

Strong momentum in the FTSE 100 was indicated by this report from the Forex Traders analysts as being something to watch this week. After the extended holiday weekend, the UK benchmark index opened on Tuesday at 6956 and by the close of Wednesday’s session had already touched the upper end of its price range at 7040.

Source: IG

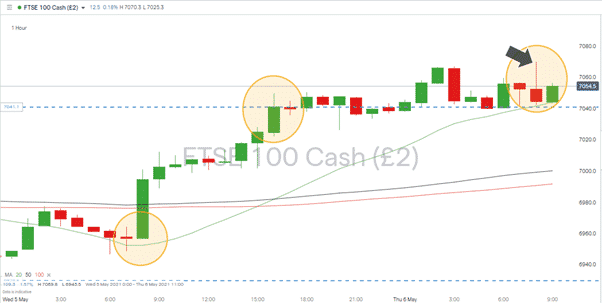

Overnight trading in Asia saw futures in the index consolidate at the 7040 resistance/support level, and in early trading on Thursday, it went on to touch 7070. The long upper-end candle on the 8 am candle is a short-term concern for the bulls, but while 7040 holds, the path of least resistance still looks to be upwards.

Source: IG

Recent FTSE 100 Strength Put into Context

The FTSE 100s upward momentum is driven by its weighting towards oil and banking stocks. These sectors, which were out of favour in 2020, have recently outperformed the tech stocks, which rallied hardest from the March lows. The index of UK benchmarks is yet to return to pre-Covid price levels while the Nasdaq was back posting all-time highs as early as June 2020. While there’s still a lot of headroom for the FTSE 100, its growth looks like a localised story and events elsewhere in the world could be a cause of concern.

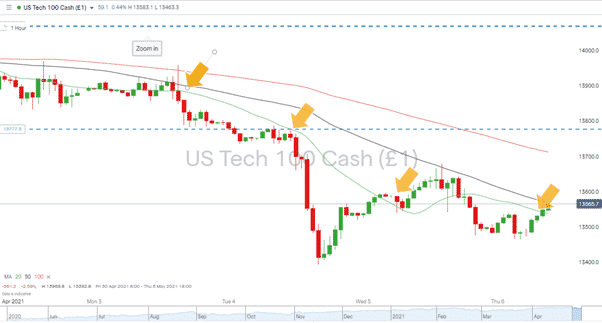

Source: IG

Will Covid in India Crash the Markets?

The Nasdaq 100 index has been heading in the other direction to the FTSE 100. It’s still unable to break the resistance formed by the 20 SMA, and until that starts heading north, price action could remain weak. Neither of the indices has price action, which is out of the ordinary, but the disconnect in terms of direction makes them the markets to watch.

One of the reasons that the sell-off associated with the first wave of Covid-19 was so severe was that it exposed how intertwined is the global economy. As individual links in cross-border supply chains snapped, manufacturers were left scrambling around to find alternatives or faced the risk of their operation closing down.

The 30% price crash in the S&P 500 index occurred over just 15 days. The speed of the price slide was exacerbated by the fact that analysts were struggling to ascertain quite how bad the situation was – getting a clear view on the viability of global supply chains isn’t a necessarily easy or quick task to complete.

The eventual bounce in the markets on the 20th of March came less from investors concluding that economic production could realign effectively and more from hopes of a vaccine being developed. In pathological terms, the Covid-19 version of the coronavirus is much more in line with existing influenza diseases already controlled by jabs. The realisation that it wouldn’t be a multi-year project, such as the search for treatments of HIV, meant buying pressure began to build.

The current financial situation in India is hard to get to the bottom of and might explain the price divergence between two of the major equity indices. The variables in play could impact tech supply chains specifically, and new variants threaten any recovery of the broader global economy.

If you want to know more about this topic, please contact us at editorial@forextraders.com

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk