Financial markets, especially the major pairings in the foreign exchange market, are in the summer doldrums once again, with prices confined to tight ranges and opportunities for quick gains few and far between. Are we experiencing the typical swoon attributed to investors going away in May to return another day? Brexit brought with it a newfound uncertainty in market direction, but even this jerk in the chain seems to have dissipated over the month of July. A calmness has set in, but analysts tend to worry at the least of provocations, and their latest concern is the fall in oil prices and potential consequences.

What happened to the major fundamental drivers for 2016? Election hysteria in the U.S. has yet to send the markets roiling into panic mode. The Fed, caught like a deer that has frozen in the headlights of a slackening global economy, has backed off hiking interest rates, at least for now. China is still China, no great fall or disruption in those parts, except for ongoing adjustments to low demand demographics. Europe is taking a hit due to terrorist activity scaring away tourists, and commodities have surged, if you ignore oil prices. Yes, the oil rollercoaster is in the news again, and investors are worried.

Is it time for a mid-course correction for 2016? How will each fundamental driver in the marketplace behave over the remainder of the year? What are the prospects for recession going forward? Will volatility pick up steam once the analyst community gets back to their desks in September, as in prior periods? Questions, questions, always questions, but very little in the way of accurate answers to guide our near-term thinking. These are the times when judgment and experience are supposed to prevail. A current snapshot of global considerations may be the best place to start.

A quick review of current global fundamentals

In no particular order, here is a brief rundown of the “Big Four” fundamental forces at play in today’s financial markets:

1) Fed Rate Hikes: When 2016 commenced, the Fed was prepared to make four rate hikes over the ensuing year in order to initiate its interest rate normalization process, which it had been telegraphing to markets for months. China, commodity process, and dismal economic developments on the global front soon caused the central bank to back off its aggressive plan. At its last meeting, it failed to raise rates again, but the prospects for a rate hike this year continue to be on its lips, especially when Fed governors choose to speak publicly about the topic. Charles Evans, President of the Chicago Federal Reserve, said yesterday that the U.S. economy is doing “quite well”, especially given the uncertainties overseas, and that, “I will give you the punch line which is what you’re looking for which is I do think that perhaps one rate increase could be appropriate this year.” The spotlight now shifts to September. The USD index had slipped nearly 10% into May, but it has regained its strength, settling in around 95, down from its 101 peak. As the September meeting nears, look for further appreciation.

2) China: One phrase seems to sum up best the current situation in China: “There are both winners and losers in China’s diverging fortunes.” In other words, it is a mixed bag across the Middle Kingdom. One positive fact is that 15 of 31 provinces displayed improvement over first quarter results in the quarter just ended in June. On the downside, one reporter noted, “The northeastern province, ground zero in China’s multi-year slowdown, saw its economy contract 1 percent in the first half of 2016 as factories splutter and the coal industry groans under the weight of overcapacity.” This recessionary trend, however, appears to be localized. Three provinces did manage to perform at double-digit rates, reminiscent of the Golden Age some years back. China is achieving a soft landing via a combination of both soft and hard ones in some cases, but the Peoples Bank of China continues to add stimulus to the lagging economy by funding infrastructure spending and easing loan policy constraints. The transition to a service-based economy is progressing, but more monetary easing may be necessary. The Yuan should weaken over time, despite attempts to bolster the national currency.

3) Commodity Prices: So goes China, so goes commodity prices, or so it went for the past several years, but 2016 has been a different story. If you review selected equity gains, stocks in the metal and mining sector appreciated 34% over the first six months of this year, while energy stocks rose 14%. Investors that jumped onboard for the rally have profited mightily, but the question is whether the good news is over for the time being. Analysts believe that the positive trend in energy stocks is sustainable, if you separate oil interests from the portfolio. More on oil will follow below. As for metals, sustainability varies across the map. There will be volatility, but supply and demand issues will still require re-balancing. Iron, the primary component in steel, remains in over supply, due to moderating demand in China. Zinc and copper are in favorable positions, but iron ore, coal and uranium will take much longer periods to reach equilibrium.

4) Europe and Brexit: The impacts of the Brexit referendum continue to reverberate across the UK and the EU, but recent terrorist attacks have had more debilitating effects on the region’s economy. Weaker currency values were supposed to ensure a heavy tourist season, something everyone had been patiently waiting for years to occur, but tourists have stayed away in droves. After each shock of terror, cancellations have increased by double-digits. As one tourism consultant opined, “We are experiencing a structural change, a phenomenon of war on our doorstep that didn’t exist before. If it’s not resolved, the problem will continue.” The ECB has not modified its present stance, but the Bank of England acted this Thursday to lower interest rates and to expand the money supply. Pound Sterling fell 200 pips, as a result. Lower housing prices, diminished trade results, and reduced confidence in the business sector have been the immediate ramifications of the Brexit vote to leave the EU, but officials remain determined to follow through with the vote. Scotland and Northern Ireland may have other ideas.

Are recession storm clouds forming on the near-term horizon?

The U.S. economy has been hobbling along over the past three quarters, averaging roughly 1% GDP growth on an annualized basis. Expectations had been for 2.6% growth for the last quarter, but Commerce Department noted that inventory adjustments had been the factor that pulled growth down. According to one economist, Harm Bandholz, “The U.S. economy just went through a meaningful inventory correction cycle. In the past, those developments have even led to recessions, but given that potential growth is slower these days and that other headwinds occurred at the same time, one may actually be tempted to highlight the economy’s resilience.”

GDP growth for 2016 may be a bit shy of 2%, as forecasted, but no one is beating the recession drums for 2016 yet, except for a few outliers. 2017, however, is another matter. Recessions typically follow presidential election years. In the UK, Brexit is being blamed for more recession news. The National Institute of Economic and Social Research in the UK grimly assessed in a recent report that, “We expect the UK to experience a marked economic slowdown in the second half of this year and throughout 2017. There is an even chance of a technical recession in the next 18 months while there is an elevated risk of further deterioration in the near term.”

What is happening with oil prices and where might they head?

Investors were celebrating when oil prices recently topped $50 a barrel, but cheers soon turned to jeers when crude revisited $40. Falling prices have renewed fears that companies and countries that depend on oil for their livelihoods will have to endure more financial stress, i.e., bad debts and bond defaults. There still exists a supply glut, but production in the U.S. and in non-OPEC countries has declined, while Saudi Arabia and Iran keep pumping away. Demand is increasing gradually. Low gasoline prices equate to more car trips on a global basis, but terrorist attacks in Europe have dealt a terrible blow to the tourism industry. As a result, demand for jet fuel has been on decline.

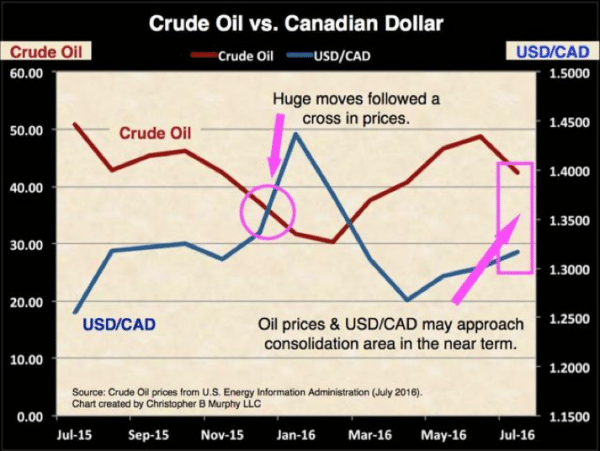

Analysts had been projecting $75 oil by yearend, but those forecasters are now hiding in the shadows, hoping the fickle finger of accountability passes them by. Volatility in the oil markets can be a very good thing for currency traders that focus on commodity driven forex pairs. Traders are now refining their strategies for the Canadian Dollar and the Norwegian Krone, based on where oil prices might head over the next few months. The movements in the Loonie have correlated rather well with fluctuating oil prices:

No one is predicting that OPEC will cut back production. Recent EIA data shows that inventories are on the rise again, putting more pressure on oil processors in the near term and raising the possibility of $30 oil once again. If the Fed keeps broadcasting a rate hike in September, then the USD should continue to improve until another “cross” in Oil versus the “USD/CAD” occurs. After this run up, then be prepared to short the greenback. The prevailing consensus suggests that demand will re-balance with supply over the next year. $75 oil will eventually happen, but not until 2017 or beyond.

Concluding Remarks

Brexit is behind us, but now attention must shift back to the real economic issues at hand. Of the “Big Four” fundamentals, oil prices appear to be the most demonstrative over the near term. Presidential election politics and terrorist activities will continue to cause uncertainty, but for the time being, the current bearish posture of oil prices will continue up to a point. Neither the Saudis, not the Iraqis have any attention of cutting back production, while oilrigs and shale producers in the U.S. market take a breather.

Where will oil prices go in the near term? As one expert, Andrew Hecht, commented, “The current oil weakness is not a surprise.” He believes the oil market over reacted in February when it hit $26, providing a trampoline effect going forward past $52 on June 9th. There was nowhere to go but down. For now, expect further boundary testing, possibly at the $38.50 level. There is upside potential, however, since demand could overtake supply. In the meantime, have fun trading your friend, the Loonie.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk