Press reports suggest that positive sentiment is creeping back into the market. Whether that is a case of using any justification to explain price moves is another matter.

Prices across different asset groups are signalling a move into risk-based positions. With US Corporate earnings season being kicked off by Netflix later on Tuesday, the tempo looks set to pick up after a quiet start to the trading week.

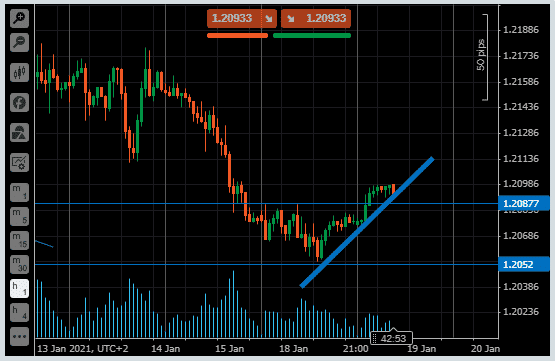

EURUSD

One significant overnight move is the break out to the upside by euro-dollar. The currency pair matched the risk-off move at the end of last week. The Forex Traders’ analysts picked it out in a report on Monday. The tight sideways range while the pair was considering its options formed an interesting pattern for those looking for indicators of which way the markets will go next.

Therefore, the upwards shift is significant and reflects bullish sentiment building in the markets.

EURUSD – 1H

Source: Pepperstone

The move has developed some second thoughts in the hour before European trading day starts but price is still above the 1.20877 support/resistance.

Potential target price to the upside:

T1 – 1.2116

T2 – 1.2130

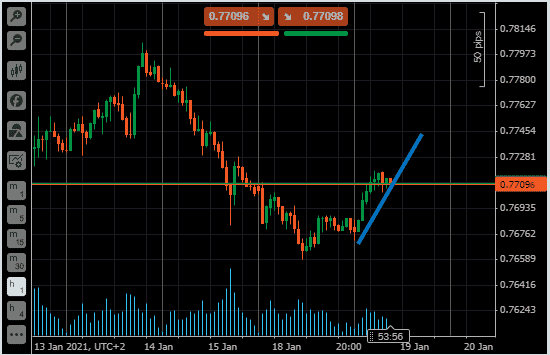

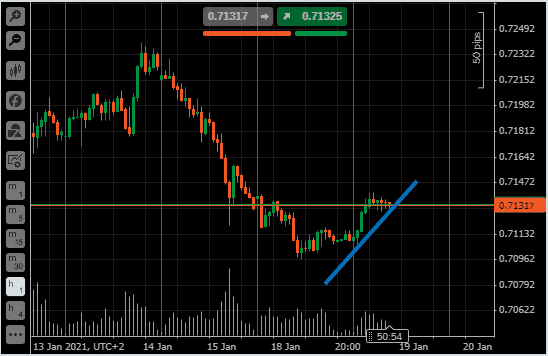

AUDUSD / NZDUSD

Aussie-dollar and Kiwi have during the Asian trading session broken a 3-day downward trend. Trade volumes aren’t necessarily increasing but the price action alone is enough to point towards risk appetite returning.

AUDNZD – 1H

Source: Pepperstone

NZDUSD – 1H

Source: Pepperstone

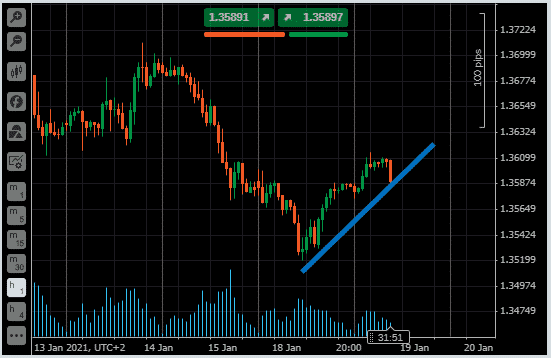

GBPUSD

Cables upward price move started building hours before Aussie and Kiwi. The weekly low – which now represents a support level, is 1.35207, printed at 09.00 Monday.

Source: Pepperstone

Potential target price to the upside:

T1 – 1.3631

T2 – 1.3656

Potential target price to the downside:

T1 – 1.3540

T2 – 1.35207 (weekly low)

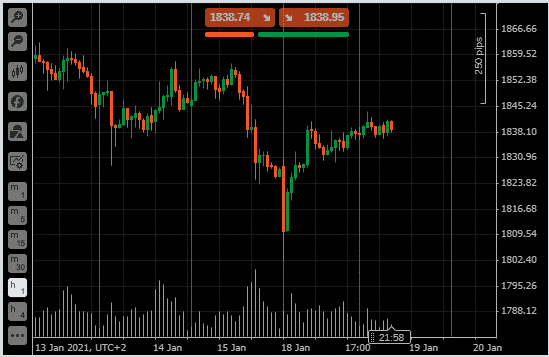

Gold

The interest rate announcements due this week are taking on more significance. The Bank of Canada reports are due on Wednesday and the ECB on Thursday. It’s not only the currency pairs that are anticipating the news; gold is also seeing increased price volatility.

Gold – 1H

Source: Pepperstone

Gold’s move has much more bullish characteristics than the movements in the currencies. There is always a chance of a pull-back but the precious metal looks to be building momentum. Any news from the central banks that suggests inflation could be seeping back into the financial system would support the move in the long term.

Potential target price to the upside:

T1 – 18.45

T2 – 18.50

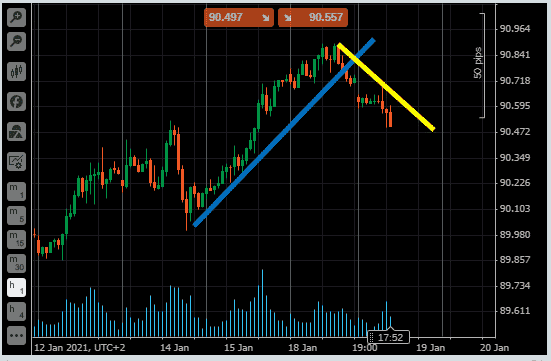

USD Basket

With the US Fed meeting next week, a lot of attention is turning to the global markets’ cornerstone currency, the US dollar.

Positive ‘sentiment’ is hard to quantify, and while the moves in Aussie, Kiwi, Euro and sterling are bullish indicators, there is no sign of the USD Dixie futures capitulating.

USDX – 1H

Source: Pepperstone

The hourly chart has three long red candles marking the open of European markets, but volume is in line with previous days, and the pattern could easily become a textbook Fib retracement.

The dollar looks like the currency to watch not least because it’s easier to measure than ‘sentiment’.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk