One of the most significant consequences of the release of the US Federal Reserve’s minutes of the July meeting is the confirmation to investors of the scale of the central bank’s intervention. On Wednesday, it hit home when a slight realignment of Fed policy predictions, most of them relating to events more than twelve months away, caused asset prices to move quickly.

What we Learned from the Fed Minutes

How can sharing notes on recent musings of Fed’s officers about how interest rates might pan out in November 2022 cause prices to whipsaw in the summer of 2020? It’s easy when the Fed is by far the dominant force and price driver in the markets. The Brookings Institution estimates that between mid-March and early December of 2020, the Fed’s portfolio of securities held outright grew from $3.9 trillion to $6.6 trillion. And that was only the start. The trend has continued through 2021.

QE activity is only part of the story, and the Brookings number doesn’t include the organisation’s other measures, which include, but are by no means limited to:

- Near-zero interest rates – the target base rate slashed by 1.5 percentage points in March 2020 and since then flatlining between 0 – 0.25%

- Forward guidance – a commitment to extending information-sharing regarding future policy

- Bolstering private sector firms – – through the Primary Dealer Credit Facility – low-interest loans to the 24 biggest finance operations

- Backstopping money market mutual funds – through the Money Market Mutual Fund Liquidity Facility

- Repo market support – overnight facilities increased from $100bn to $1trn

- Direct lending to banks – loans discounted by two percentage points

- Tax breaks – particularly on cash held by banks.

This shopping list of items that made money cheap goes on and on. There’s a big bowl of alphabet soup, including PMCCF, ESF, CPFF, MSLP, and MLF.

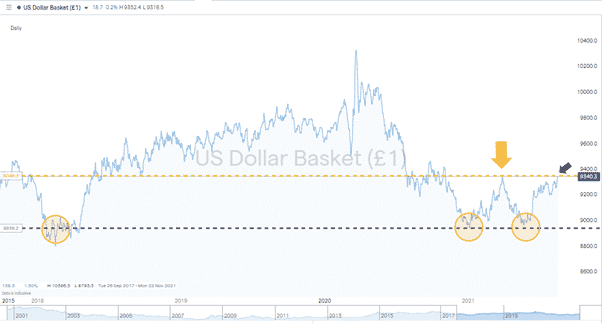

Source: IG

Dollar Surges on Talk of Tapering

Turning off the taps is predicted to result in painful withdrawal symptoms for some asset groups, particularly equities. However, the moves following the release of the meeting minutes were also acutely felt by the currency markets. Yesterday’s events saw the US Dollar Basket index (finally?) clip an important price level, the resistance at 93.46, marking the 2021 year-to-date high.

That price level was reached in the hours before European markets opened on Thursday and given the rate of the recent dash towards holding the greenback, some retracement can be expected. Any price consolidation here keeps the door open to a breakthrough and further upwards movement, which would signify a significant change in market fundamentals.

A rush to the world’s reserve currency would reflect a move away from risk, but given the size of the Fed’s operations, the scaling back of the intervention could be enough of a catalyst to bring that about.

What Next for Forex?

On the one hand, we’re still talking about events that are some way down the track. Futures contracts tied to the Fed’s benchmark interest rate are pricing in a 50% chance that the rate hike will come in November 2022. The possibility of the rate increase coming the following month is currently 69%. In terms of rate rises, it’s not a case of if but when.

The minutes also revealed some members’ concerns about “upside risks to inflation.” In particular, the claim that inflationary pressure, labelled as “transitory”, might last longer than anticipated.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk