Like it or not, we have raised our central bank chairmen to celebrity status. Financial markets move to the beat of their every word. Their status, however, is in jeopardy. The reality of the present global economy and their supposed temporary policies that have lasted a decade are quickly converging upon a tipping point of sorts, where constrained market forces may soon be unleashed with immeasurable consequences. What is the response? These scions of society are gradually shedding their independence, yielding to political pressure, and kicking the can down the road, like all good politicians do.

The exalted actors in this five-act play have been Jerome Powell, the chairman of the Fed, and Mario Draghi, the talented impresario of ECB fame. Draghi, however, has decided to depart the spotlight, after claiming that he would do whatever was necessary to keep the European economy on stable ground, having made this commitment not once but twice. His replacement will be Christine Lagarde, the current head of the IMF, who is known to be both an economist and a politician of the first rank. She will undoubtedly change the complexion of the ECB, for better or for worse.

In the meantime, Mr. Powell and his merry band of bankers stateside are coming under increasing pressure from the Tweeter in Chief, President Donald Trump, who, in his inimitable and degrading style has insulted the Fed for not following his politicized agenda. After ill-advised tax cuts and expanding deficits, Trump has done his level best to delay recessionary forces in the U.S. economy that could spell doom for his re-election campaign efforts in 2020. He is demanding that the Fed, after calling them fools, cut interest rates to keep his economic boat afloat for just a while longer.

Like it or not, Jerome Powell now finds himself caught between a rock and the proverbial hard place, as he waits for his semi-annual hearing before Congress. The Fed is scheduled to meet soon thereafter, and the market has priced into futures a 25 basis point rate reduction. It had been 50 basis points, but even the market and investors knew that size of a cut was a stretch, especially after the latest Non-Farm Payroll Report. Net job additions came in well above forecast, and the figures failed to support any rational case for reducing interest rates. But we live in strange times. Facts have lost their meaning.

What were the details of the jobs data in the U.S. for the month of June?

June figures were substantially better than May: “The headline numbers that accompanied the jobs report greatly surpassed expectations. According to the report, the U.S. economy added 224,000 jobs in June, whereas economists had only expected about 160,000. However, all was certainly not perfect with the headline numbers as the Bureau of Labor Statistics was forced to revise the numbers for both April and May downward. The April number was revised downward from 224,000 to 216,000 and the May job creation number was revised downward from 75,000 to 72,000.”

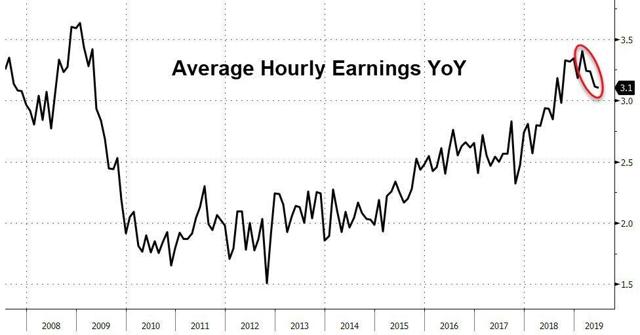

Regardless of over-performing headline data, the report did contain a few disappointments. Annual hourly earnings are closely watched, since they have a bearing on consumer spending going forward: “According to the latest jobs report, average hourly earnings went up by 0.2% as opposed to the 0.3% that economists expected. The average wage increase also missed expectations on an annual basis, rising just 3.1% year-over-year as opposed to the 3.2% that economists expected”. The chart below evokes concern:

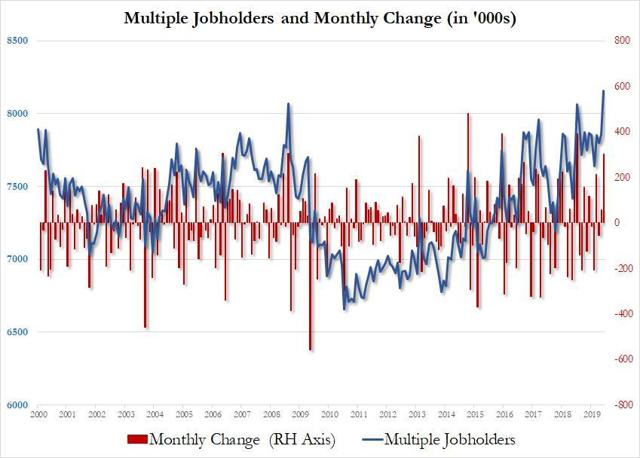

Analysts will typically dive deep into this report to discover trends that do not easily rise to the surface of the accompanying narrative. The surprising “find” this time around is revealed in the following portrayal of historical data on multiple jobholders:

“In the week ahead, Jerome Powell faces a trial by fire on Capitol Hill.”

The “revelation” is that historical net-job creation, although it has been an unbroken positive string of gains since 2010, may not be what it has been cracked up to be. Individuals have to work multiple jobs in order to make ends meet. Net-job additions may not portray an overheated economy, but one where labor resources are spread over multiple part-time working arrangements. The simple truth for June is that the net gain of 244,000 jobs is less than the 301,000 temporary jobs taken on by multiple jobholders. As one analyst remarked: “We can conclude that the new jobs that the economy is creating are not particularly good ones. This is certainly not indicative of a strong economy and it is certainly not conducive to a strong consumer sector.”

And that brings us full circle to Jerome Powell and his impending appearance before hearings on Capitol Hill. The above quote was offered up in one article that reviewed the strange situation that Powell must confront in the week ahead. The author of this quote also noted: “His plight underscores the difficulty in conducting monetary policy in an environment where the tail often wags the dog and political pressure is unrelenting.”

The following chart has been bandied about investment house for months, suggesting that something has got to give. Bond yields have fallen, while stocks have soared. While bond yields profess that an economic slowing is occurring and that a recession is coming, stocks seem to be ignoring the message altogether, as depicted below:

The counter argument is that the simple truth is that the Fed backed away from its normalization program and hinted that, “It would do whatever it took to continue the economic expansion.” Translation: Keep interest rates low, even cut them, but forget about building an interest rate “cushion” for the impending recession. The goal is to avert the recession, i.e., kick the can down the road.

Stocks responded appropriately: “Because a renewed commitment to accommodative monetary policy means abundant liquidity, an end to quantitative tightening in the US, a possible return to monthly asset purchases in the EU, the postponing of any push towards normalization in Japan and rate cuts across multiple locales, bonds, stocks and credit are all bid, and so is gold on the assumption that easing amounts to currency debasement.”

The conundrum that Powell faces is that equities have priced in an interest rate cut, but the jobs report precludes the need for such a policy change. Does he act like an independent central banker or does he bow to incessant political pressure that demands a cut, regardless of the economic need for one. Powell could announce a cut after his July meeting, claim it was part of his new “wait-and-see” mentality, but the press and the world would consider it a political move, plain and simple.

A few observers prefer that Powell justify his future rate decrease by using what has been called the “insurance” argument. He and his committee found it necessary to cut rates to spur inflation to greater heights. Equity markets would not go into a tailspin, but there would be some correction, since the “insurance” language implies that there will not be more cuts to come.

The folks at Bank of America see the “insurance” gambit as short lived: “But this would be yet another shift in the dialogue for Powell, further complicating their reaction function. Moreover, only a handful of Fed officials seem to be on board with this narrative. That said, if the Fed does take this path and cuts in July because of insurance reasons, it would likely imply only a few cuts rather than the start of a true easing cycle. As such, it would still disappoint markets.”

In any event, Powell will undoubtedly be questioned by Democrats in Congress about any plans to cut rates and if those plans were due to political pressure from the White House. According to PIMCO’s Joachim Fels, the “heyday of central bank independence” has ended. He senses that central bankers across the globe will gradually become more beholding to the political powers that be. Near-zero interest rates and Quantitative Easing may be with us into “perpetuity” – “policy normalization is on the verge of being effectively banned from on high.”

And so, market forces will continue to be chained to political decisions from on high. Central bank balance sheets will continue to be stuffed with all manner of illiquid assets with unfathomably long duration periods. Economically unjustified projects will continue to get funding from an oversupply of cheap credit, and imprudent resource allocations will continue unabated. Eventually, real interest rates will rise, and when they do, there will be consequences.

Concluding Remarks

Jerome Powell, whether he likes it or not, has inherited an untenable situation. Will he and his Fed members act like independent bankers and take the actions they deem necessary or will the Fed bow to political pressure, choose the path of least resistance, and put off today’s problem for someone else to solve in the future?

One pundit’s take of the current situation is apt: “Between politics and market risks, there doesn’t seem to be a way to crawl back out of the accommodation rabbit hole. Market laws had to be suspended to restore normal functioning of the markets.”

Unfortunately, what was supposed to be temporary has now become quasi-permanent, at least and until market forces find their own way to unravel. Hopefully, the reckoning to come will be foreseen and be manageable.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk