European stock indices were mostly higher on Thursday morning on the back of good news from the US. The $1.9 trillion Covid relief bill passed the final hurdle when approved by the House of Representatives before being sent to President Joe Biden to sign into law.

The recently beleaguered Nasdaq index finished Wednesday strongly (up 1.5%), which in turn acted as a catalyst for Asian and European markets.

With the ECB due to make an announcement on rates at 12.45 pm London time and sharing a more detailed report at 2.30 pm, it looks like markets are positioning themselves for good news from the ECB’s President, Christine Lagarde.

That is an interesting jumping of the gun as it goes against a longer-term price slide. The ECB has been thought to be considering both hawkish and dovish next steps.

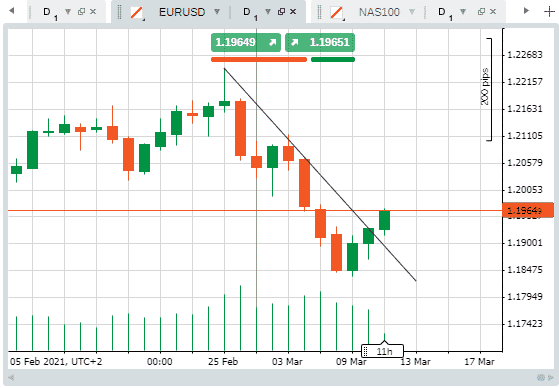

EURUSD – Showing Strength Ahead of ECB

Following its retreat from February’s highs of 1.224 EURUSD looks like it may have turned a corner. The ‘big number’ resistance at 1.20 may soon come into play, but it has built considerable momentum since Monday’s close at 1.18474.

EURUSD – Daily Price Chart – break of downward trend-line

Source: Pepperstone

The RSI is overbought on an hourly basis, but if this is indeed a longer-term rally, it might be dismissed by the bulls who can point to the Daily RSI still languishing nearer to oversold territory at 42. The path of least resistance looks likely to be upwards with the potential for short-term shake-downs, particularly around the time of ECB announcements.

Bullish Scenario: long positions above the 1.19 pivot point.

Target 1 – 1.1966

Target 2 – 1.2000

Bearish Scenario: short positions below the 1.19 pivot point

Target 1 – 1.1886

Target 2 – 1.1871

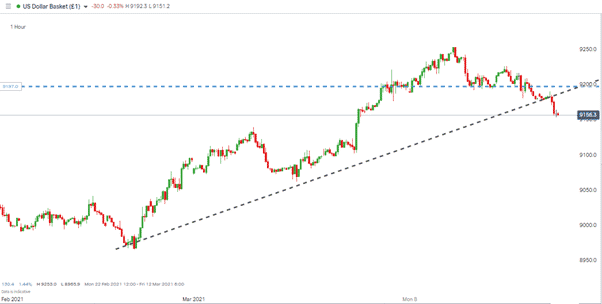

EURUSD – Benefitting from USD weakness

Other risk-on currencies have also matched the EURUSD move. It appears that USD weakness has overridden any concerns traders have about the ECB’s potential for surprises.

USD Basket Index – 1H chart – Break of key support at 92.00

Source: IG

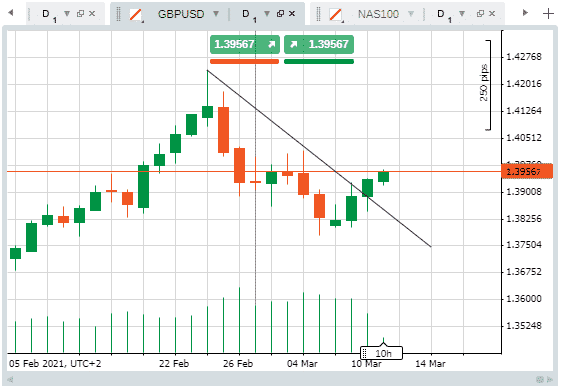

GBPUSD – RSI pointing to further price rises

Bullish Scenario: long positions above the 1.39 pivot point.

Target 1 – 1.3976

Target 2 – 1.4000

Bearish Scenario: short positions below the 1.39 pivot point

Target 1 – 1.3881

Target 2 – 1.3856

GBPUSD – 1D chart – Break of downward trend-line

Source: Pepperstone

The timing of the move in EURUSD has caught some on the hop. Earlier in the week, the consensus was that the ECB policy could swing either way regarding their upcoming policy announcement.

Bond yields have been rising in the US, which is bad news for everybody in terms of a threat of inflation.

For some time, central bank officers have been able to nudge markets using comments alone. The famous “whatever it takes” announcement by the then ECB head Mario Draghi snuffed out a run on the Euro in 2012.

This time, it looks different, and central bank buying of bonds looks the most likely policy measure to control the spike in yields. Does the ECB have the will or the firepower to continue doing that? That is the question, and the early price move suggests some may have already made up their mind that the announcement on Thursday to that question will be yes.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk