Pressure continues to build on the euro, with the consensus being the question not which way the price will head but how far the euro might fall. A perfect and painful storm has hit the world’s most traded currency pair.

Weaker Euro

Covid case rates in eurozone countries have sky-rocketed, and lockdowns have come into place in the Netherlands and Austria; however, there is a different feel to the enforced closures this time. Demonstrations and riots against the lockdown have taken place over the weekend. That leaves policymakers facing a lose-lose situation when economic activity grinds to a halt, but the infection rate doesn’t slow down.

Stronger Dollar

Concerns about the US economy, in contrast, relate to the risk of the economy overheating. Employment and inflation data released over the last few weeks point to growth continuing to build momentum. Tapering of the Fed’s bond-buying program has been confirmed, and all eyes are on interest rate rises coming into play. With investor appetite switching to US markets and the likelihood of savings account interest rates picking themselves up from near zero, demand for the greenback looks set to continue to climb.

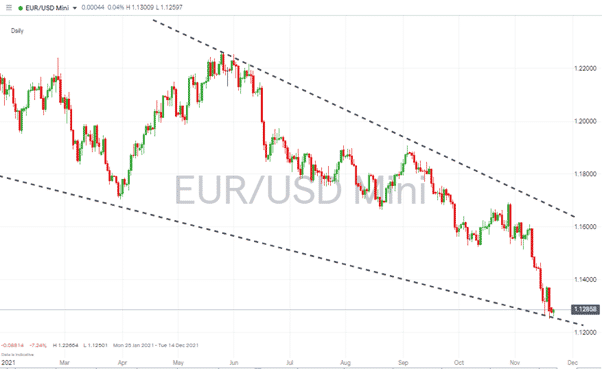

EURUSD – Daily Price Chart – 2021 – Downward Channel

Source: IG

Euro weakness and dollar strength could be long-term trends. The 3.15% change in the market from the 25th of October reflects that early adopters have already been getting into positions based on a long winter flu season taking its toll on eurozone production levels.

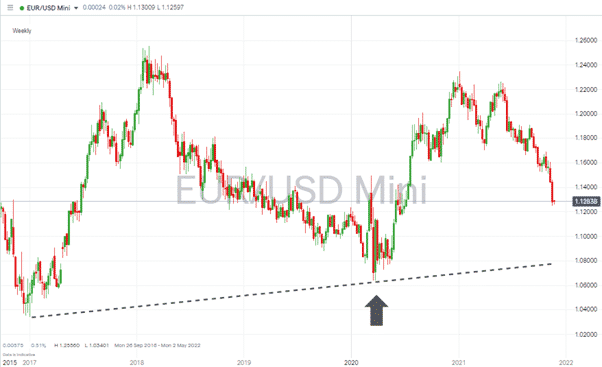

EURUSD – Weekly Price Chart – 2015 – 2021 – Support Levels

Source: IG

On a short-term basis, there is a chance for a pull-back with 1.13 forming the pivot for market direction. Immediate price targets for short euro positions are 1.125 and 1.123. Longer-term goals include the supporting trendline in the region of 1.08 and then the March 2020 multi-year low of 1.06359.

The extended target at 1.06 would have appeared out of range as recently as June of this year when EURUSD was trading above 1.22.

How to Trade EURUSD

For traders, there is an opportunity to take on positions in one of the most liquid currency markets. The volume of trades transacted means that bid-offer spreads at brokers are as tight as they come, with some brokers offering spreads as low as zero pips. Pepperstone and FP Markets have a strong reputation in forex markets, are regulated by Tier-1 authorities, and have the operational capacity to cope with the increased interest in EURUSD.

There is no guarantee that prices will continue to fall from here, but technical and fundamental indicators point to the path of least resistance being downwards. Those considering taking a position may want to watch out for the data releases due out this week:

Monday the 22nd of November

- Eurozone Consumer Confidence

- US Existing Home Sales

Tuesday the 23rd of November

- US & Eurozone Markit Manufacturing & Services PMI Flash

Wednesday the 24th of November

- Germany ifo Business Climate

- US Initial Jobs Claims & Minutes of FOMC Meeting

Thursday the 25th of November

- Germany GFK Consumer Confidence

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk