After a tumultuous 12 months, the forex markets are finally showing some consistency as they head towards the finishing line. There is little chance of this being a sign that 2021 will be significantly less volatile and is more to do with trading volumes draining out of the holiday market. Either way, the calmer environment is managing to throw up some interesting trade entry points.

EURUSD – Continues to Show Strength

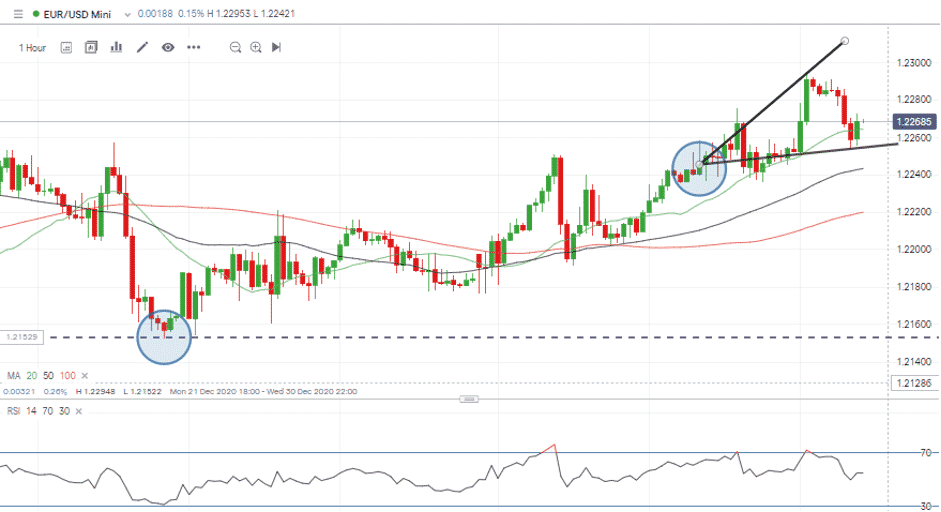

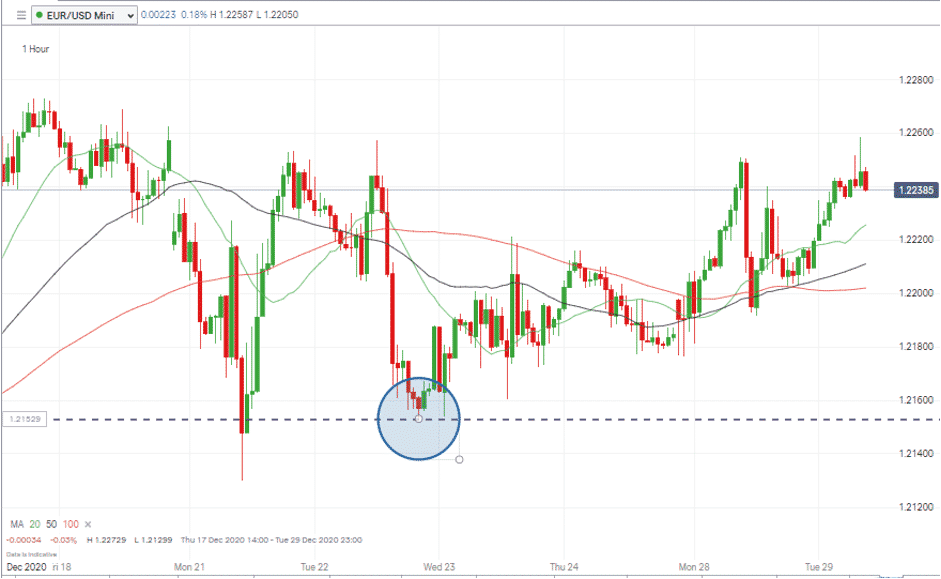

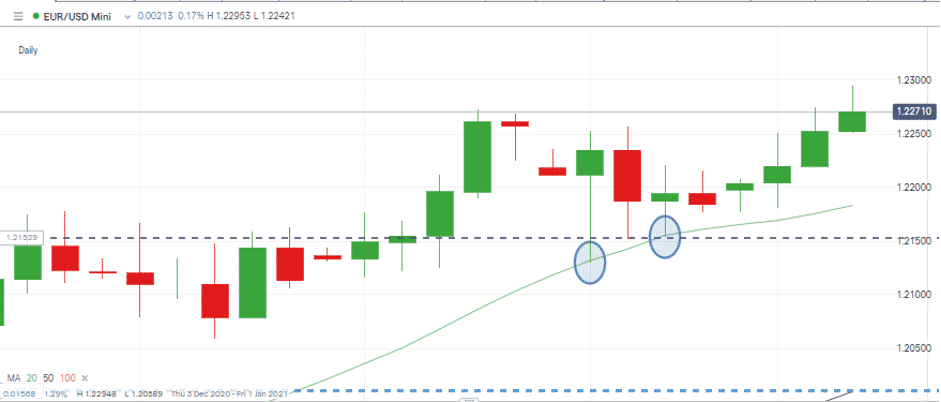

On Tuesday, the Forex Traders analysts in this piece of research picked EURUSD as a market to watch. This was based more on the clarity of the signals than the size of the potential gains. Not only did the predicted move occur but it did so on a surprising scale.

Source: IG

- First target of 1.2250 hit @ 11.00 UTC

- Second target of 1.2270 hit @ 13.00 UTC

The above pattern had the big drawback of requiring a long-way-off stop loss but the pattern held and first and second-price targets were met in the space of hours.

Taking profits would have opened the door to re-enter the trade at the close of European markets. Holding that long position through that pull-back would have also paid off and those riding the upward trend overnight into Wednesday saw EURUSD print prices as high as 1.22948

There are reasons to hold onto the long position.

- Hourly RSI is still supporting the bullish prognosis

- The Daily 20 SMA has twice provided support to the uptrend and currently sits at 1.21833 but is to some extent keeping up with the recent price move

- Higher highs, and higher lows. In quiet markets, the simplest signals can prove the most reliable.

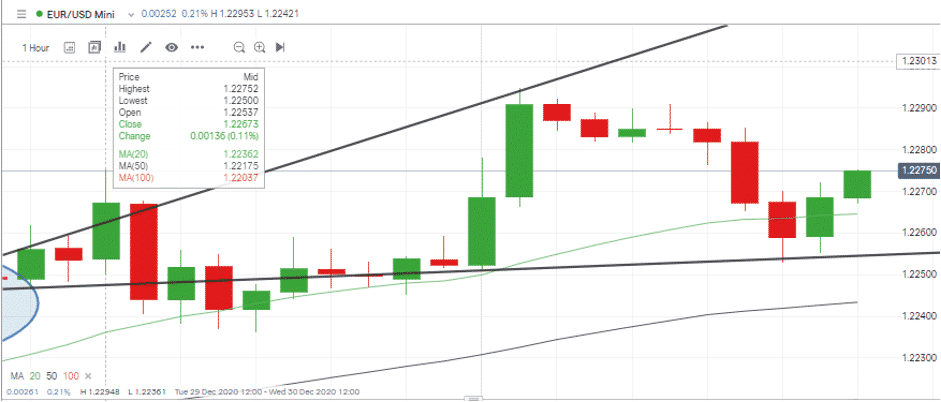

Source: IG

On the other hand, Thursday is the final trading session of the year and is followed by an extended weekend break. The charts seen this week have formed a perfect example of quiet Christmas markets that are guaranteed to change when bourses open on Monday the 4th of January.

Bringing stop losses up to above break-even would be a conservative approach. Setting stops just below the 1.22528 low of Wednesday morning would ensure some profit is locked in and avoid any disappointment that comes with a profitable trade going bad.

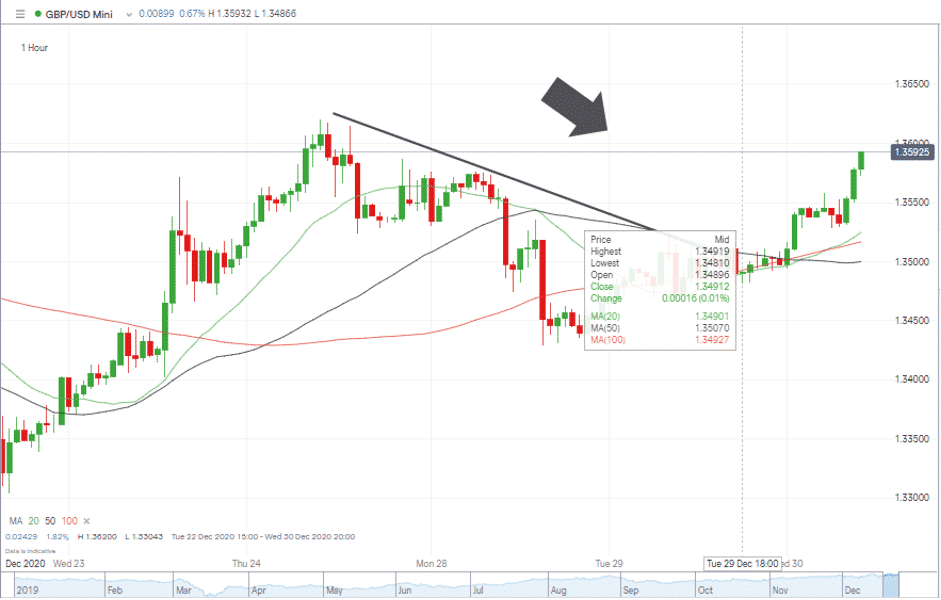

GBPUSD – Breakout to the Upside

As with EURUSD, the price moves in GBPUSD have been as predicted by the Forex Traders analysts. The difference with cable was that GBPUSD didn’t overshoot moderately; instead, it made a major price break-out.

The price move looks to be largely based on the EU and UK reaching the final stages of the Brexit process.

After years of uncertainty events of Wednesday have a ceremonial feel. A hard copy of the agreement which has been signed by all 27 members of the EU will be transported to London under the guard of UK and EU officials. There it will be signed by UK Prime Minister Boris Johnson.

The high of 1.362 in GBPUSD, which was posted on the 24th of December looks likely to be tested. Momentum is with the GBPUSD bulls and the question now is at what levels they take a breath.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk