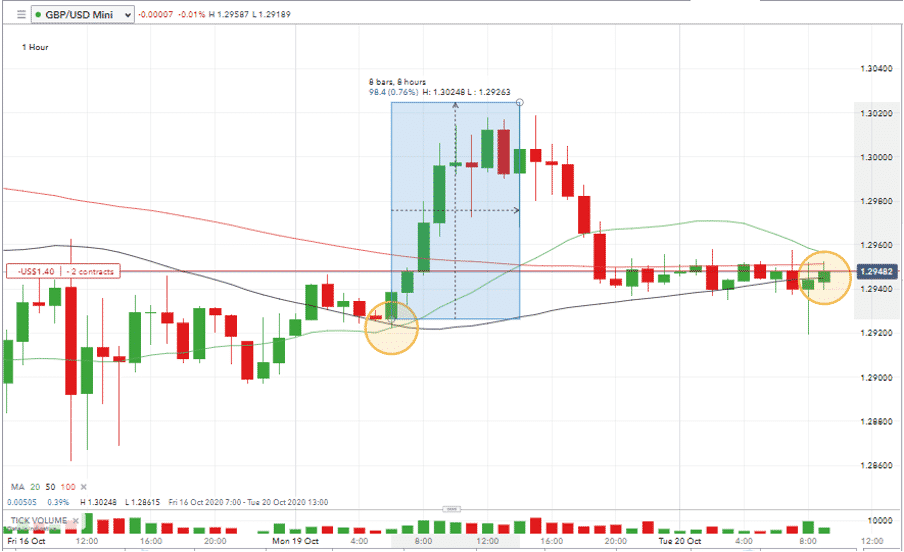

Day 2 of the trading week and some of the trends we identified yesterday are coming into play. The research note “Head to Cable if You Want Volatility” identified GBPUSD as the market to head to for price volatility and intraday price moves panned out as expected.

Source: IG

The 0.75% price spike and fall back over 24 hours would have been profitable for many.

Spotting the potential for this wasn’t rocket science. Political manoeuvring is increasingly turning into political posturing. A lot of factors still suggest a Brexit deal will ultimately be done but no-one is predicting it will be a smooth process.

The Forex Traders analytics team are pleased that they spotted the counter-intuitive rise in the value of GBPUSD. Not quite a short-squeeze, more a consequence of the support at 1.29 and inability of price to resist kissing the 1.30 level.

One question now being asked is whether Monday’s brief encounter with 1.30 is the last for some time?

It’s likely that short interest grew in size at the 1.30 price which is a psychologically important level. Many will be in positions that, given the situation between London and Brussels, they may be willing to hold for some time.

It is impossible to discount the risk of positive news regarding Brexit talks so it could be worth remembering that it’s never a bad thing to take a profit.

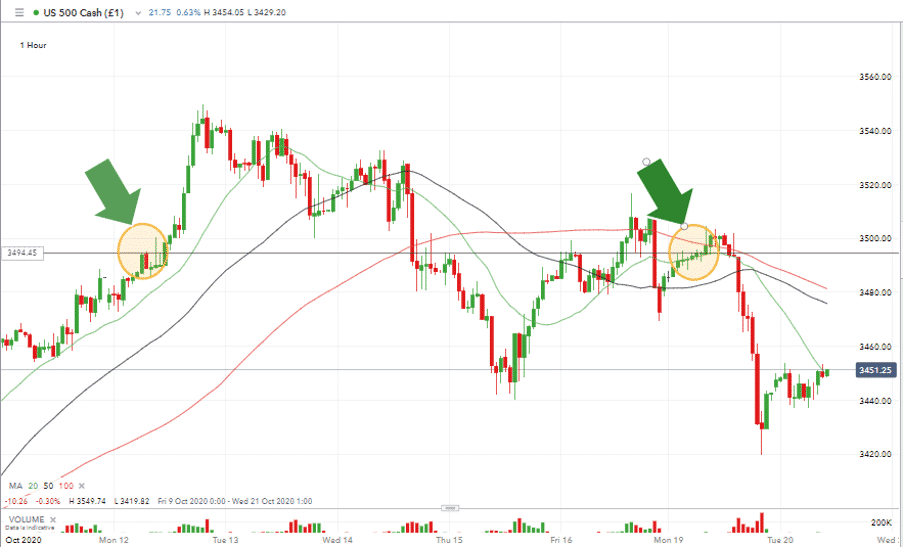

Equity Markets – Pointing the Way?

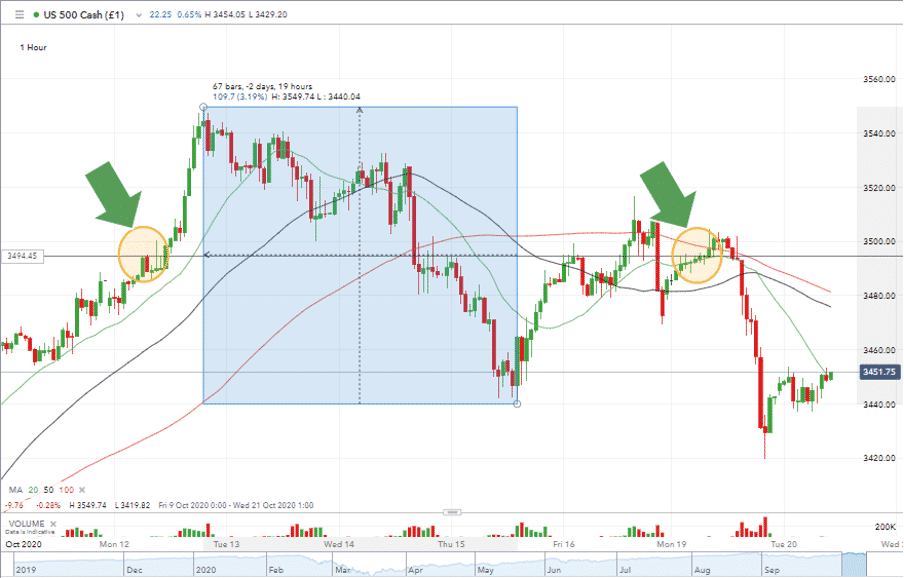

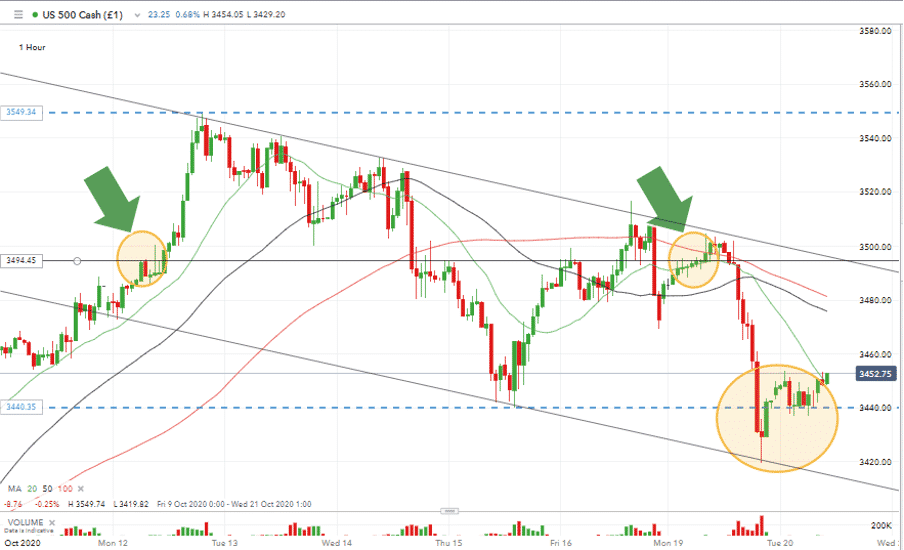

The S&P 500 equity index threw up some interesting numbers yesterday. During the week beginning the 12th of October, the index took range-bound trading to the extreme.

Marking the price at the start of the week on the 12th and 19th day of the month, the S&P price was only one point different over seven days of trading.

Source: IG

The range of price movement over the week was not insignificant. The range from peak to trough was greater than 3% but, as we predicted, the world’s flagship equity index was showing signs of being non-committal.

Source: IG

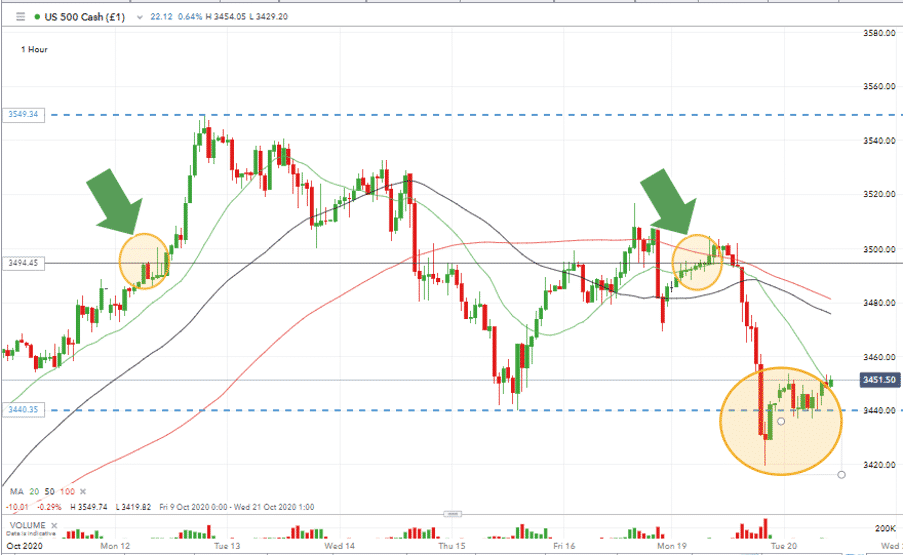

The price move during the close of Monday’s US markets is notable for its break of the previous week’s low.

Source: IG

Price has recovered through Tuesday’s early European trading and is back above the 3,440 level, however, price action is far from bullish. With a noticeable downward channel forming in the Hourly chart.

Source: IG

Bottom Line

Forex and ‘cable’ in particular will be happy hunting grounds for many. Short-term holding periods might be the order of the day, as while not ‘whip-sawing’ price is certainly flip-flopping.

Those who are looking for longer-term trends may want to consider the equity indices. The bulls have not lost their ability to read between the lines of economic data reports and find positives. The recent releases out of China have been used to explain Tuesday’s pick up in equity prices.

The test of support lines based on last week’s lows meaning that equities may instead be one to watch with the potential to offer a trade with more significant momentum.

Our analysis is based on a comprehensive summary of market data. We use a range of metrics with weighting given to simple and exponential moving averages and key technical indicators. Any information contained on this Website is provided as general market information for educational and entertainment purposes only, and does not constitute investment advice. The Website should not be relied upon as a substitute for extensive independent market research before making your actual trading decisions. Opinions, market data, recommendations or any other content is subject to change at any time without notice. ForexTraders will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk