Confirmation from the US Federal Reserve that loose monetary policy is here to stay has boosted equity markets, the Euro and the Yen. Gold and silver have also found strength, and Bitcoin’s second-wind in the $57,000 price region is beginning to look like price consolidation below the $60,000 price level.

Minutes from last week’s FOMC meeting were released on Wednesday and confirmed the behind-the-scenes discussions tallied with the comments made during the post-meeting press conference.

“Participants noted that it would likely be some time until substantial further progress toward the Committee’s maximum-employment and price-stability goals would be realized and that, consistent with the Committee’s outcome-based guidance, asset purchases would continue at least at the current pace until then.”

Source: CNBC

The next Fed meeting is five weeks away, and there appears little reason to think that the $120bn per month bond purchases will be derailed any time soon.

There were some laggards in the overnight trading session. Sterling has not joined the party, and GBPUSD is actually down on the week, and AUDUSD is flatlining. Both of those currencies reflect uncertainty caused by specific domestic issues that have outweighed a global move out of USD.

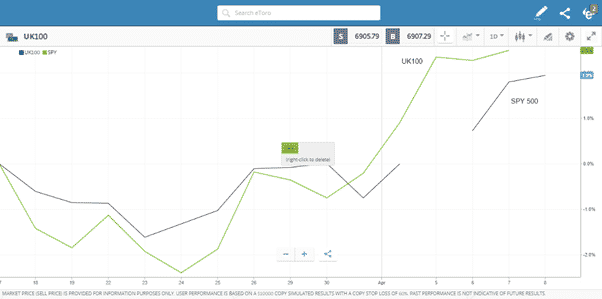

FTSE 100 – The Long-Term Play

Since the 17th of March, the UK100 index has outperformed the alternative US 500 (SPY). The UK index is up 2.5% compared to 2.0% for the American alternative.

UK 100 vs SPY 500

Source: eToro

The relative weakness of sterling partly supports this interesting development. Many constituent members of the FTSE100 generate profits abroad to get a currency conversion uplift when GBPUSD slides.

It could reflect investor appetite for the UK benchmark index picking up in the belief it’s undervalued. Whereas all the major US equity indices have recovered from the crash of March 2020, the UK100 is still trading below 7,000. The high in January 2020 was 7,690.

The long FTSE trade is a slow-burner. It is touted by those looking for an uptick in interest in cyclical and defensive rather than growth stocks. The recent strength, in absolute and relative terms, could see more take positions in that trade.

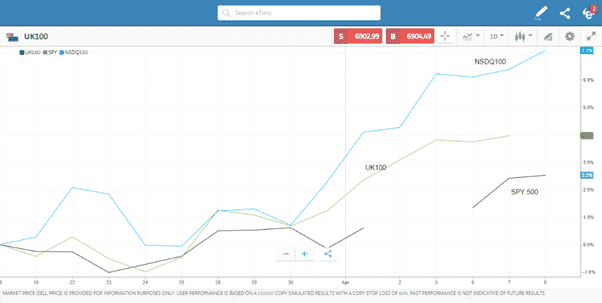

Nasdaq 100 – The Comeback Kid

Stories of the demise of the Nasdaq 100 appear overplayed. Successful global vaccine rollouts and a return to ‘normality’ dampened enthusiasm for stay-at-home and home-delivery stocks. However, as is often the case, a dip in that index price only acted as a buy signal for many investors.

UK 100 vs SPY 500 vs Nasdaq 100

Source: eToro

Since mid-March, the Nasdaq100 has put on more than 7% and outperformed the more ‘traditional’ indices. The dip-buying could be a Pavlovian reaction, built up over months and years, and could one day come back to haunt fans of the tech index. For now, it still looks like a tried and tested method of getting on board the index that is offering the most potential.

A short-term pullback can’t be discounted, but with the Fed showing little sign of changing its long-term approach, the path of least resistance for equities currently appears to be upwards.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk