Earlier this week, Elon Musk, founder and CEO of the world’s flagship EV, pulled the trigger on a sale of $1.1bn worth of Tesla stock. The extent to which this baling out of the firm he created was a direct response to the Twitter poll he cast at the weekend is up for debate.

Is Now the Time to Buy Tesla?

For the day-trading community, a more pressing question is what might happen to the Tesla price in the next few sessions? If the suggestion of the sale had already been priced in, then will the confirmation of it result in a bounce in the share price as short sellers’ close positions and drive price higher? ‘Buy the rumour, sell the fact’ is an old adage used to explain the reversal in fortunes when bullish conjecture precedes an official news announcement. Thursday’s price move in Tesla suggests that it could be working equally well in reverse.

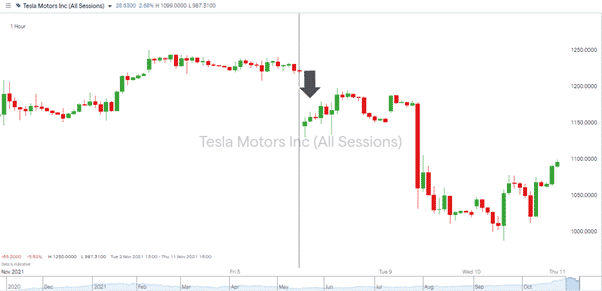

Tesla Share Price – 4th-11th November

Source: IG

Just before the opening of the US exchanges on Wednesday, Tesla stock was trading 19.18% lower than where it closed the previous Friday. Firms with trillion-dollar market caps aren’t traditionally expected to see a fifth of their value shaved off on the back of social media posts. However, this is Tesla, which is also part of why the stock is the target of traders using short-term strategies.

Since Wednesday’s low point of $987.31, the stock has rebounded by +10% and now sits above the psychologically important support level of $1,000. It’s a high-risk-return market, but there are profits to be made.

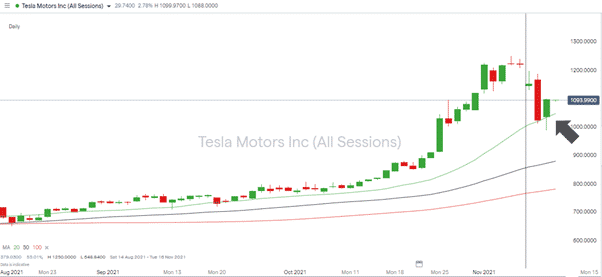

The daily price chart shows that the stock failed to close below the 20-day SMA. In fact, its brush with that key support level, and the failure to break it, will be one of the indicators being used to justify long positions. The bottoms of the last red and green candles are sitting so closely to the 20-day SMAs that they could be used in a textbook on trading using technical analysis.

Tesla Share Price – Daily Candles – SMAs

Source: IG

In terms of ‘rumours’ and ‘facts’, there is a sense that all the news relating to this is out in the open. Musk’s poll and sale have flushed out a series of stories that might not be particularly palatable to investors who lost out from the Tesla stock price crash, but for those looking to get in at current levels, it does at least look like most of the cards have been played. Most notably, there has been confirmation that Musk was already lining up to offload some of his position even before he opened the polling on Twitter on Saturday.

Musk and Tax

First off, it does look like Musk’s Twitter poll and the sale came down to his need to finance an upcoming tax bill. Musk has recently offloaded about $5bn worth, or 3%, of his stake in Tesla stock.

Disclosures relating to the sale do throw up some interesting details. Approximately $4bn worth of the sale (3.6 million shares) hit the market on Tuesday and Wednesday and could be considered as counting towards the 10% pledge he made on Twitter. However, around $1.1bn worth (934,000 shares) was sold in line with an insider dealing arrangement that was already in place before the poll. Traders can make of that what they will, but those going long are taking comfort from the fact that at least details on the sales are now fact rather than a rumour.

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk