Equities & Oil – Different takes on the US Stimulus

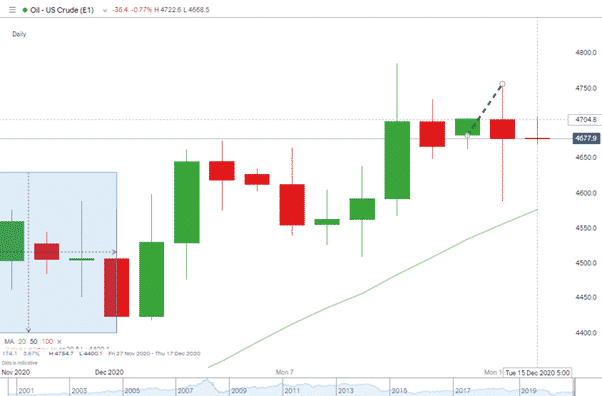

The equity and oil markets headed in different directions on Monday. Stocks fell, despite many in the market expecting further strength. At the same time, US crude has spent time on Monday printing prices above $47 per barrel and Tuesday morning it was up 0.75% from Friday’s close.

Could this divergence be a trigger for a Santa Rally in equities? Oil’s price surge was put down to hopes regarding the US stimulus package and the vaccine rollout. Both of these good news stories should also be interpreted positively by the equity markets.

Source: IG

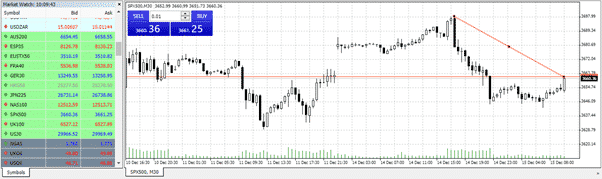

Therefore, the slide in equities caught many by surprise. It doesn’t take much to get the market to buy into the seasonal phenomenon that is the Santa Rally, raising the question, is it a dip to buy?

Statistically speaking, the best returns from the Santa Rally are found following a mid-December dip rather than from the 1st of December.

Source: Tickmill

Reasons the Santa Rally makes sense

To some extent, the Santa Rally is a self-fulfilling prophecy. There is, however, more to it than a general feeling of benevolence to the common man. The financial markets don’t go in for that kind of thing anyway. Instead, it’s self-interest which plays a large part in the seasonal phenomenon.

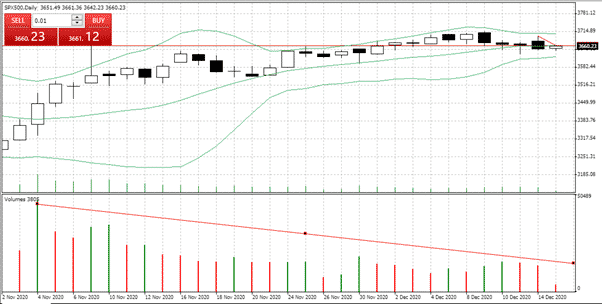

Lower Volumes

As trading volumes drop, so does volatility. Big strategy decisions, for example, shorting the market, tend to happen when trading desks are at full strength. As the holiday season approaches, we’re entering a time when interns will be watching over the trading books. Their role to simply be a ‘safe pair of hands’.

Source: IG

Market Manipulation

It might be kinder to consider this a demonstration of aligned interests rather than outright manipulation. The truth is that the institutional investors, the big players in the equity market, tend to have their bonuses determined by the year-end trading performance of the portfolios they manage.

Throughout the year, there may be an opportunity to finesse the portfolio. That can involve sliding from being over-weight to under-weight and back again in particular sectors and equities themselves. December is instead a time for keeping things steady.

Portfolio Construction

Those portfolios managed by institutional investors are also analysed to a granular detail at year-end. Snap-shots taken on the 31st of December will give a breakdown of portfolio construction and help the investors in the funds establish if the fund manager is in line with the specified investment mandate.

It will also be a time when the investors consider rotating their cash allocation from one fund to another. The name of the game for the investment manager is to keep the portfolio in line to retain current investors and attract new ones.

Upsetting the apple cart by causing an equity shake-down in December is a long way down on the list of priorities. As the emotions of greed and fear are scaled back, speculative reversals and sell-offs become less likely and equity indices tend to benefit.

It doesn’t always work out that way and 2020 is a year like no other. It is, though, definitely a situation worth monitoring.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk