The FCA, the UK regulator, is bringing in stringent new trading rules next month. The ban on cryptocurrencies being traded by UK retail clients using CFD instruments could potentially reduce liquidity and demand. As basic economics points out, when demand falls so does price. Will that be the case?

The FCA rules don’t come into effect until the 6th of January but some brokers are keeping ahead of the game by updating their clients in terms of cut-off times for last trades. The date of the change is fixed, however, there are still a lot of variables which will likely impact the prices of Bitcoin, Ethereum, XRP, Litecoin and others.

Why Might the Price of Bitcoin Not Fall?

The FCA isn’t banning the trading of cryptos entirely

The ban only applies to UK retail clients that use CFD instruments. The move by the FCA is a significant hurdle but there are, of course, still routes for individuals to gain access to the crypto market.

The law of unintended consequences might come into play. It waits to be seen if those who are committed to trading cryptos now turn to unregulated exchanges or fall foul of other scammers.

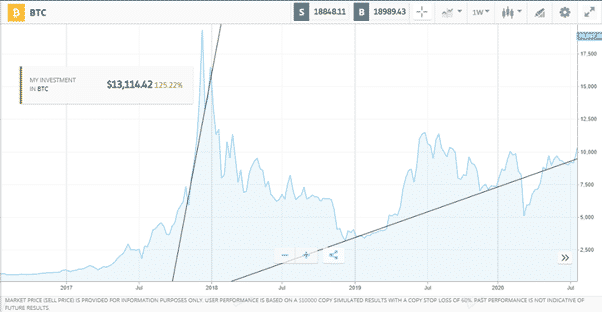

Source: eToro

Santa’s crypto rally

Bitcoin has traditionally performed well in December. With the Christmas holiday at the end of the month, there is a theory that Bitcoin is used to buy some presents that fiat currencies just can’t buy.

The general market euphoria known as the ‘Santa Rally’ extends to a wide range of asset groups. The rules and regulations mean there could well be a time to sell BTC, but is it now?

Source: eToro

Size matters

Crypto markets such as Bitcoin are global in nature. The percentage of the market made up by UK retail clients trading CFDs is not known but it may not be as large as first thought.

Approximately 4% of the adult UK population own cryptocurrencies. Of those accounts, 75% are of a size of £1,000 or less. That would suggest the account owners would be categorised as ‘retail’ but the total net sum is small in terms of total crypto market cap.

It’s also the case that the new regulations prohibit putting on new positions. Those already holding cryptos in CFD format will be able to wait and sell at a time that suits them.

Why the Price of Bitcoin Might Fall?

The tightening of regulatory guidelines will take buying pressure out of the market. Of equal importance is the signal from regulators that acceptance of crypto is a long way off and is looking less not more likely.

Other markets

The trick to successful trading is keeping one step ahead of the herd. While many are weighing up the pros and cons in terms of crypto prices, there is another question to ask.

With capital likely to drain out of at least part of the Crypto market where is it likely to go?

Given the volatility of the Bitcoin and Altcoin markets funds used to trade, those would have to be categorised as being speculatory. That would likely translate as crypto funds being used for trading other asset classes at the same broker. Traders will still be able to access commodity, forex and equity markets using their existing accounts.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk