The annual United Nations Climate Change Conference COP26 in Glasgow has now ended. Those following the events may have been surprised by the contradictions thrown up as much as the policy resolutions that were passed. Claims that the event represents ‘greenwashing’, the insincere pretence that something is being done about climate change policy, have a case. Top brass attendees flew into Glasgow on private jets, while the conscience of the movement, Greta Thunberg, was left to protest outside the conference centre. She was not invited into the meeting to contribute to policy.

It’s not just politicians who try to demonstrate green credentials to appease public opinion; it’s also a major issue for big corporations. One of the buzzwords of the moment is ESG, Environmental, Social and Governance policy. There are no standardised definitions of what an ESG should contain, what metrics should be used to monitor progress, or, indeed, what would be considered a success. They are built on a case-by-case basis, which means these costly, important and high-profile reports are causing as many problems as they are solving.

Part of the problem is that without direct legislation from governments, much of the onus is on prominent asset managers to allocate investments more ethically. The problem that ‘big money’ faces is that it’s notoriously hard to establish what a firm’s ESG exactly is, let alone measure its effectiveness. Factor in that most of the ESG targets are years away; sometimes decades, it can be difficult for those who want to invest ethically to establish where their money should go.

Ethical Investing – Tips From Inside The Industry

Tariq Fancy, who held hold the Head of Sustainable Investment position at BlackRock, spoke with the press after the COP26 shutters came down. Sharing ideas from his years in charge of the eco-investing arm of the world’s largest investment manager, he cut through some of the confusion and outlined the pitfalls to avoid:

“The financial markets don’t think about ethics. There are people who have financial incentives to maximise return, which is measured in dollar values, not social values. There are legal obligations … they are investing money that is not their own, so they have to focus on maximising return.”

This would suggest that firms’ ESG policies are therefore window dressing and do little to solve the problem, which Fancy describes as a “misalignment of short-term incentives and long-term public interest”.

How do you square the circle that a firm which is obviously bad news for climate change, for example, and an oil exploration firm may have the most polished ESG policy in the market? Fancy said:

“Having spent years digging through ESG data and trying to understand and disaggregate it I would actually say that sometimes the level of work going into it is almost counter-productive. It tries to put precision onto things which are quite hard to measure.”

Fancy’s approach is to cut through the greenwash and approach the situation from a higher level. After years of running a team of investment professionals, he recommends the below approach, which would work as well for retail investors as institutional ones.

“The simplest thing is to run a test that if this company doubles in size, is it good or bad for the world? Well, if it’s an electric vehicle maker it’s probably good for the world … and if Exxon Mobile doubles in size, it’s probably not good for the world.”

Ethical investors who use the simple litmus test to find a home for any spare cash can avoid spending time analysing unavoidably opaque ESG policies. Doing the right thing doesn’t necessarily involve hours of extensive research. That’s a win-win for ethical investors and also good news for ethical firms.

Is it ‘good’ is a question that remains? The modern financial system is not necessarily one which most ethical investors consider being a comfortable bedfellow. But removing any obstacles to capital flows to more socially conscious firms is, at a minimum, the least bad option.

Source: IG

While COP26 may have been short on headline-grabbing new initiatives, there is some good news for ethical investors. Brokers have been meeting the deep-seated demand for greener products.

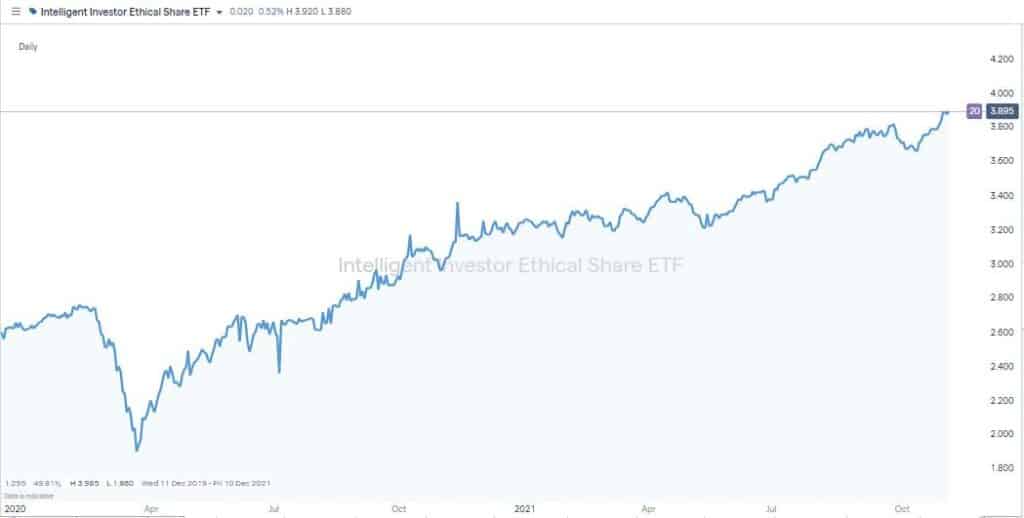

Those looking to invest in single stocks can pick up on growth sectors such as renewable energy firms, listed here. More traditional investing strategies are also catered for. Exchange-Traded Funds (ETFs) allow investors to buy a basket of stocks with just one trade. This diversifies the risk that one single stock goes bad.

ETFs have sprung up with ethical investing in mind. There are now so many that it’s possible to build a healthy-sized list of candidates for investment, such as this one of sustainable ETFs.

Final Thoughts

Climate change and other ethical concerns are attracting new people into investing. There is a chance that spare cash can be used to bring about societal change and a potential investment return.

While many eco-investors may give more weight to the feel-good factor than the financial returns, it is vital to steer clear of fraudulent brokers. If you lose your cash to a scam, then there is no chance of re-investing in another equally deserving project in the future.

Step-1 for those who are new to investing is to ensure they use a regulated broker. This list of trusted brokers the Forex Traders team have reviewed is an excellent place to start.

Further Reading:

- Learn more about ESG

- Head here to compare the CSR policies of big-name stocks

- The best renewable energy shares to buy now

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk