Wednesday’s direct listing of Coinbase on the stock market now offers an indirect way to trade the crypto boom (and bust?) without the need of using a special wallet or unregulated exchange.

During a gold rush, sell shovels

The listing of Coinbase fits neatly into this adage about how to play a boom market. By providing a service to the many crypto speculators, Coinbase has developed a business that at launch was valued at $75.9bn.

The firm, which has been operating since 2012, supports trading in cryptos that have only been in existence since 2008. Even so, its market capitalisation started the day higher than that of the $67bn price tag on ICE. ICE is the company that owns the Nasdaq Exchange that Coinbase is listed on and is a constituent part of the S&P 500 equity index.

It was a day for backers of the innovative crypto trading platform to count their winnings.

- Venture Capital firm Union Square first bought into Coinbase in 2013, and at the close of trading on Wednesday, it had a holding worth $4.6bn. Not a bad return on a $200m outlay.

- Proving that you don’t have to be first to the party to have a good time, DFJ Growth invested in later rounds of fundraising but has made a 120-fold return on the capital. The story goes that Barry Schuler of DFJ went to buy his first Bitcoin in 2014 and conducted the trade using a bundle of cash behind a convenience store. In doing so, he realised there must be a better way of trading cryptos.

- Brian Armstrong sits at the top of the Coinbase rich list. The firm’s CEO holds 21.7% of the equity, which after the listing is valued in the region of $20bn.

How Can I Buy Shares in Coinbase?

For those who have been waiting for the firm to come to the market before investing, the good news is that online retail brokers are now offering markets in the stock with the ticker COIN.

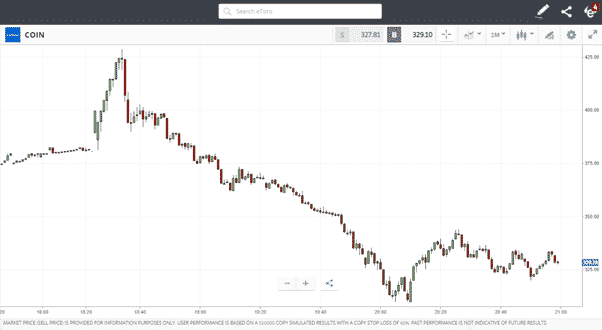

With only one trading session under its belt, there’s not much price history to draw on, but eToro has already started offering a market.

Source: eToro

Fans of technical analysis don’t have much to go on yet; however, the social trading forums at eToro are proving an excellent way to source information from others who are following the market.

Another well-regulated broker, AvaTrade, is offering markets in COIN and is one of the first to offer it on MetaTrader’s MT5 platform.

Is Coinbase Overvalued?

Both brokers offer the chance to Buy or Sell COIN depending on whether you think the exchange is over or under-valued.

There’s been a lot of hype about the launch, and while the price did fall away soon after it launched, it has stabilised. Trading activity in Bitcoin and Ethereum, Coinbase’s two major markets, has ballooned in 2021.

A New and Safer Way to Trade the Crypto Boom

The price of COIN looks set to be correlated to the price of the crypto assets it supports. A crash in the price of Bitcoin is likely to lead to lower trading volumes and lower revenues for the platform provider.

As the BTC and ETH prices have sky-rocketed, so too has retail interest. Trading the shares in COIN is now a way to indirectly play the crypto markets using a regulated broker and a regulated equity instrument.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk