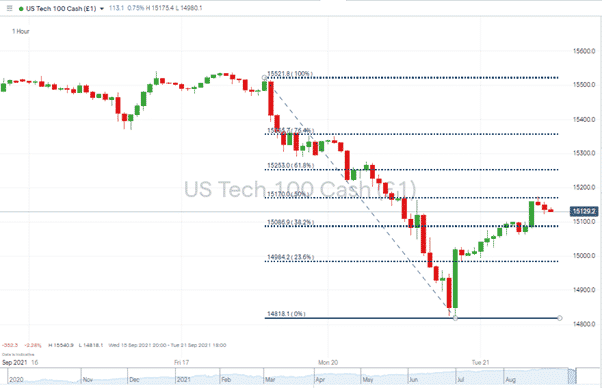

Monday’s sell-off was unsurprisingly followed by a rebound overnight in Asia, which has continued through the early hours of European markets. The recovery has seen prices in the Nasdaq 100 print at the 50% Fibonacci retracement level, but a dead-cat bounce can’t be ruled out. Not least because of the critical news announcements due to hit the markets in the coming days and the time intervals between them. The drip-feeding of key indicators will allow time for investors to consider reigning in their risk profiles or buy the dips, so volatility could be expected to pick up.

Nasdaq 100 index – 1Hr Price Chart with Bounce to 50% Fib

Source: IG

What to Look Out For in the Coming Week

Three significant news events now look likely to set the tone for the trading week.

1. US Federal Reserve FOMC Committee Meeting – Wednesday the 22nd of September

At 7 pm UK time on Wednesday, the US Fed will announce to the markets whether the Fed Fund’s base interest rate will be changing. Markets are currently pricing in ‘no change’, but after that straightforward data update, the Chair of the Fed, Jerome Powell, will release a statement adding more colour to the FOMC’s views. Any suggestion that those notes lean towards a tightened monetary policy and the colour will likely be ‘red’. The US Central Bank has been the main prop of asset price growth since Spring 2020.

2. Evergrande – Thursday the 23rd of September

Chinese property giant Evergrande has been blamed for the pessimistic mood in the markets. Owned by one of China’s richest men, the firm has fallen foul of the principle that money can be easy to borrow but hard to pay back. What looks like a classic property bubble about to burst could have repercussions for the global financial markets?

To some extent, the Evergrande situation is ‘firewalled’. The restrictions imposed by Beijing on foreign banks saw non-Chinese lenders miss out on the multi-year growth opportunities, but that also means they won’t be exposed to much of the fall-out. Recent developments point towards geopolitical risk being more of a worry than the strength of the Western banking system. Reports that investors may receive protection based on whether they are Chinese or not could take US-Sino relations to depths not seen for several years. And the two economic superpowers going head-to-head is not part of anyone’s roadmap out of Covid and lockdowns.

Evergrande is due to make an interest payment of $83m on Thursday. Markets are pricing in a default on this instalment.

3. Evergrande – Wednesday the 29th of September

The second tranche of Evergrande debt needs financing next Wednesday. The Evergrande interest payments can be missed without the firm going bust, but they have only 30 days to make (late) payments. The ‘will they, won’t they’ credit problem is likely to add to market volatility and, potentially, for once, will overshadow the news from the US relating to interest rates.

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk