Are you experiencing complex trading strategy overload? Every forex tutorial known to man states that you must have a strategy and exercise “stick to” discipline in order to record consistent gains over time. Sounds simple enough, but there are thousands of strategy gurus on the web promoting their pet strategies. Which one is best? None of these strategies will deliver at all times. Market odds do not work that way, but each guru attempts to increase the power of his tool by adding layers of complexity that can boggle the mind in an instant. If you are totally frustrated, then it’s time go back to the basics.

Trading currencies is not unlike many other of life’s activities – keep it simple, and you will enjoy it more. Complex trading strategies create a level of clutter that keeps your mind second-guessing every move that you make. This situation is similar to having too many indicators on a chart at one time, never a good thing. Your mind needs to focus to be effective, not be distracted chasing rabbits all over the screen. A good strategy is one that is simple to follow and that gives you a signal, which can be confirmed by pattern recognition or another selected indicator. The basic objective is to tilt the odds in your favor, thereby giving you a small edge to leverage over time.

Tilting the odds in your favor is all about assessing the probabilities

The rule of thumb in trading is that you need to have a winning ratio of “55%/45%” in net dollar terms, “net” meaning net of commissions. Assuming that markets are random, a “50/50” ratio would be a normal breakeven, but the 5% ends up covering the commissions and spreads incurred, all enhanced by leverage. It then logically follows that, if you are to have consistent gains over time, your goal would be to achieve a “60/40” ratio. This ratio has to be in dollar terms, too, since average dollar losses will typically exceed average dollar gains until you become a more proficient trader.

Is a “60/40” ratio achievable in a random market? The truth of the matter is that markets are not totally random at all times. In fact, the entire basis for technical analysis and any strategy that you may develop using TA rests on the un-randomness of the market. Prices are a product of human psychology and herd mentality. For the most part, “black box” trading robots control much of the trading space, but the software that drives their decision making processes are the same technical tools that are in the market today. The only difference is that high-speed computers are capable of reviewing a mountain of data, including indicators, pattern recognizers, Fibonacci ratios, pivot points, and prevailing support and resistance levels, to make multiple decisions in seconds.

Occasionally, a pattern emerges that suggests an outcome that will prevail in the near term with a high degree of certainty, more than the “60/40” split that we are after. If we are patient and wait for these moments, we are tilting the odds in our favor. Yes, we might be wrong, but, hopefully, a tight stop-loss order will protect our downside. When we do hit a strong trend, that is the time to score and to score big time, wiping out any of the losses that may have been triggered by protective orders.

How can we see probabilities in action?

The easiest way to see the odds play out before you is to use Bollinger Bands. This unique and helpful technical tool has its basis in statistics, that topic that we all learned to hate in school, even if we liked math in the first place. Statistics is the study of probabilities and how they play out in a sample population of selected data points. If a pattern is determined to be valid, then inferences can be made as to various properties and tendencies of the sample system model.

What are Bollinger Bands (BB)? None other than John Bollinger developed this clever tool in the 1980s and has been enhancing his invention ever since with additional indicators and helpful analysis. It has become commonplace in the analysis of financial markets the world over, and it is rare when it does not appear on a representative chart of a security’s price action. The tool combines a moving average, typically set to be a 20-period EMA, with a set of “bands” that depict the instrument’s volatility. Based on a sampling of 20 data points, the bands are usually placed two standard deviations about the median average.

If the data resembles a normal distribution, then the inference is that 95% of the pricing activity will occur within the upper and lower bands. When a price moves beyond a band, it is a rare event, one chance out of twenty, so to speak. From a statistical perspective, pressure mounts to force the price action back towards the mean over time. These specific inferences then provide a logical basis for a popular trading strategy called “Bouncing the Bollies”. When a price candlestick closes outside of a band, it is a clear Buy or Sell signal, but you will also need more confirmation from another indicator to obtain the consistency that you will desire. Let’s look at a chart:

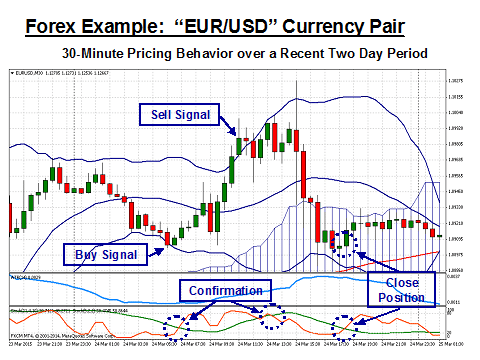

A recent 30-Minute chart of the “EUR/USD” currency pair is portrayed in the above diagram. This trading strategy works best for time periods below an hour and when markets are displaying ranging behavior. Markets do tend to range the majority of the time, and this strategy is in some regards a scalping approach. You will have several trades in quick succession, and you will need to set tight stop-loss orders and move them accordingly as your trade progresses.

In the chart above, the Euro closed first below the lower band, and then later, above the upper band, yielding the anticipated Buy and Sell signals. You would normally also want the next candlestick to be the opposite in nature, as occurs in both cases, but the Bollies can often give false signals, as with any other single indicator in play. The trick, if there is one, is to select another method that provides confirmation at a better than “60/40” average of when to react and take a position.

The indicator chosen for confirmation purposes above is a combination of a slow and fast Stochastic (the settings are ’21,10,4’ for the Slow and ‘5,2,2’ for the Fast without Signal Lines showing). The crossovers of the two individual Stochastic lines than act as the desired “trigger” for each trade. As for stop-losses, initially set them at 10-15 pips outside the band above the previous close price, and then move them to the band after the “bounce” occurs. The first trade worked like a charm, but the second one might have tripped your stop-loss. In that case, you would follow the action more closely at 15-minute intervals to catch the “bounce” that eventually took place.

What are a few caveats to this simple Bollinger Band strategy?

As was mentioned above, this strategy works best when markets are ranging. If there is a new trending breakout, there may be many successive candlesticks that “hug” or extend beyond the borders of the bands. In that case, you would adapt to another strategy designed to profit when a strong trend takes over the market. To protect your self, a tight stop-loss is needed. The ATR indicator also helps to highlight when volatility is rising. A spike in volatility always precedes a strong move in a given direction, as can be observed in the second potential trade. Sellers reacted strongly to drive the price back down to the previous support level, but only after testing higher levels.

A second caveat deals with the nature of Bollinger Bands and its statistical foundation. The inferences that can be drawn relate to what is known as a Normal Distribution. A common definition for this term is that it is a probability distribution that plots all of its values in a symmetrical fashion, such that the distribution of many random variables resembles a symmetrical bell-shaped graph. At two standard deviations, the “tails” of the Bell Curve are supposed to comprise 5% of the action, but forex pairs, stocks, options, and commodities are known to have notoriously “fat tails” on one side or the other. The distributions are anything but normal, and the results are skewed even more by the small sample size required to make the Bollinger Bands workable in the first place.

Concluding Remarks

Bollinger Bands are one of the most useful tools ever invented. They are simple to read and provide an immediate snapshot on how forces and odds are playing out in the market. Many veteran traders rely heavily on this tool and develop a number of useful trading strategies with it as the sole basis for attacking the market. “Keep it simple” is their motto. It also helps to have a basic understanding of Japanese Candlesticks, as these patterns go hand-in-glove with nearly every Bollinger application. You may also want to research other BB strategies and test them out, as well. No strategy works well in every market. Your goal each day is to adjust to market conditions and adapt your strategy for the prevailing conditions. Never fight the tape, as veterans say.

Lastly, always remember that no strategy is perfect, nor is any technical tool, alert system, trading program, or pattern recognition service. All of these tools depend on a market that does not act on a random basis, but markets have a way of switching back and forth. A trader must therefore be patient enough to look for those occasions when the odds are tilting in your favor. The Bollinger Bands offer a simple way to spot those opportunities and then react when there is confirmation from another source. Be sure to invest practice hours on your demo system to become familiar and comfortable with “Bouncing the Bollies”, and, above all, enjoy the process and keep it simple!

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk