Strategy development is an essential ingredient for achieving success in the trading arena. If a trader is ever to generate net gains on a consistent basis over time, he must have a step-by-step plan to guide his efforts, primarily to block his mind and emotions from undoing his decision-making process. It is an art form, and like fine art, it often takes two people to create it. One is the artist, who is never satisfied and would keep tinkering with his canvas forever and a day, if it were not for the second individual, the one that makes the artist stop.

In forex trading, a mentor usually performs that secondary role. In the absence of a guiding hand, it is far too easy to be forever unsatisfied and to tinker with your plan until you are left with a disgusting mess. As we noted in the first article in this two-part series, getting burned out on strategy is common, and the best antidote is to back away and go back to the basics, the simpler, the better. The first article dealt with ranging markets and suggested that “Bouncing the Bollies” was a simple way to get back into the game of taming your favorite currency pair and squeezing out admirable profits.

What do you do in a trending market? The basic tactic favoured by veteran traders when this situation sweeps the market is to rely on “Trading the Fibs”, or by their technical name, Fibonacci retracement levels. Metatrader4 software provides several tools to help in this area, and once you become familiar with the “Fibs”, you will learn to predict future support and resistance levels with uncanny accuracy. They also work best in trending markets and can act as a type of barometer that can gauge the strength of a prevailing trend in real time. Along with another indicator, the “Fibs” can simplify matters greatly.

The beauty of Fibonacci ratios, when they appear as lines correctly placed on a chart, is that they allow you to literally read the story of the market, as it unfolds. As a trader, you need to adapt to changing market conditions, and the Fibs are a sure fire method for fine tuning your intuitive prowess and assessing where the herd mentality might take the market when no signposts are clearly evident. Academics may disagree, claiming the market is random, but technical analysis and its related tools, including Fibonacci ratios, are most effective for tilting the odds in your favor when the market is not random.

What are Fibonacci ratios and what makes them so special?

You do not have to be an Italian to appreciate the beauty of the Fibonacci series or the natural elegance of the many ratios related to it. The series and ratios are named after Leonardo Fibonacci of Pisa, an Italian mathematician who lived back in the thirteenth century. The story goes that he was studying the dynamics of rabbit reproduction when he created the numerical series that went “1, 1, 2, 3, 5, 8, 13, 21, …”, each new term being the sum of the previous two.

Leonardo then noticed that these figures also exhibited several remarkable relationships. Each term divided by its predecessor yields roughly 1.618, while, when divided by its successor, it yields 0.618. Similar ratios exist between numbers two terms apart, three terms apart, and so on. The significance of the 1.618 ratio, however, had actually been recognized for eons. The Greeks called it the “Golden Ratio” or the “Golden Section”, a measure that conveyed natural beauty when the length of one side versus its width equaled that figure. There is also a “Golden Spiral” that takes these principles to three dimensions.

And it was not just the Greeks that were intrigued by this unique series. Evidence from centuries back show that both the Chinese and Persian mathematicians were interested, but the attraction does not come from the numbers alone. The standard ratios of 23.6%, 38.2%, 50%, and 61.8%, the ones we are familiar with as traders, appear in Nature in abundance.

One recent observer noted that, “The Fibonacci numbers are Nature’s numbering system. They appear everywhere in Nature, from the leaf arrangement in plants, to the pattern of the florets of a flower, the bracts of a pinecone, or the scales of a pineapple. The Fibonacci numbers are therefore applicable to the growth of every living thing, including a single cell, a grain of wheat, a hive of bees, and even all of mankind.”

Whether you are studying the double helix of the DNA molecule, the form of the human body, seashell infrastructures, physical waves, or galaxies in the Universe, these simple ratios abound so frequently in Nature that many believe that this recurring phenomenon represents one of the principal “Laws of Nature.” The reasons are unclear, but scientists have proposed that these ratios are tied to growth effectiveness as to how different shapes may optimally fill up a void over time. Coincidences, on their own, are rare in Nature. Statistical convergences of data about specific forms suggest that evolution has crafted over the millennia a specific solution that works best for survival of a species.

How do Fibonacci ratios play a roll in financial markets?

When both Ralph Nelson Elliott and W. D. Gann analyzed price behavior in our financial markets, the recurring themes that appeared time and time again in their independent works were that both waves and Fibonacci ratios kept repeating in patterns. Their recognitions of these simple relationships then formed the basis for technical analysis, as we know it today. Market forces resemble waves, and their retracements follow a system of order, more often than not, that is rooted in the ratios of Leonardo Fibonacci.

The key ratios we use are 23.6%, 38.2%, 50%, 61.8% and 100%. A simple explanation of their use follows: “Fibonacci retracements are a tool used in financial markets to find points of support and resistance on a price chart. These levels are found by first pinpointing a high and low of an asset’s original price move. Retracements denote the percentage price rebounds (retraces) from these extreme points on the graph. Trend traders often use Fibonacci retracements in conjuncture with other forms of technical analysis such as trend lines and oscillators for timing market entries.”

There is also an ancillary benefit that can be had simply by observing where prices fall during a particular retracement. In a way, these various ratio levels are like a barometer, or, as one veteran trader remarked, “For a trader, Fibonacci retracements can be a useful tool. They can be utilized as a way to measure the strength or weakness of a rally. In a strong rally the pullbacks should be shallow (no more then 38%) before a resumption of the trend. Conversely, the line in the sand is a correction of no more then 61.8%.”

How can we use this information to form a simple trading strategy?

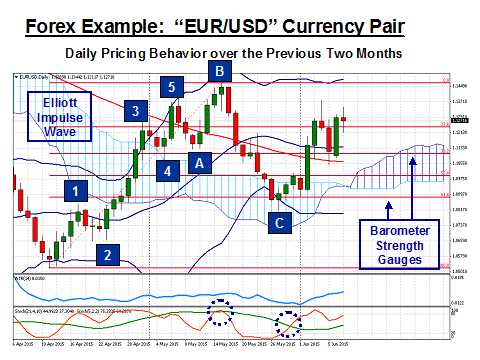

An effective trading strategy will take into account fundamental data and then apply technical indicators, pattern recognition, and observable levels of support and resistance to determine the most opportune entries and exits in a financial market. In a trending market, when higher highs and higher lows are being recorded, Fibonacci tools can instantly make sense of market directions, both current and near-term possibilities. As an example, let’s look at a recent daily chart for the “EUR/USD” currency pair:

The Euro price behavior has formed a textbook Elliott Impulse Wave. The Fibonacci tool starts and ends with the tips of the candlestick shadows for the entire trend and plots the red lines in accordance with the applicable ratios. It is recommended that you use the shadow tips, rather than the candlestick body, so that the ratios will appear consistently over different timeframes. Our task would have been to predict the depth of the “C-leg” correction. Our thought process would have gone something like this:

- From a fundamental perspective, the Dollar had weakened, based on a poor Jobs report. In other words, the Euro did not strengthen on its own merits. If it had, then we would have expected a “shallow” retracement, the 38.2% barometer setting, an indication of strong buying forces at play. Add in the fact that Greece is still a problem, and you have a set-up for a strong downward move;

- Our exit target would then become the 61.8% barometer setting, since a weaker trend force was our assessment of the pertinent data at hand;

- The double Stochastic indicator crossings, circled by blue dots, also offered confirmation for our entries and exits. Even the “Fibs” need support to be an accurate tool.

In each execution order, remember to use stop-loss orders, just in case an unexpected bit of news spoils the party. A common “Rule of Thumb” is to place the stop on the opposite side of the Fibonacci level, where the bounce occurred, roughly one-third of the way towards the Fibonacci level that follows. Trading strategies are worthy if they can be right 60% or more of the time, but perfection is never possible, especially in the forex market. There are far too many moving parts at work, but the herd does tend to move in expected ways, enough of the time to give you an “edge” in the market.

Concluding Remarks

In this two-part series, we have demonstrated a simple strategy for ranging markets called “”Bouncing the Bollies” and one for trending markets that we can call “Bouncing the Fibs”. In either case, you need to be aware of fundamental forces at work and to rely on confirmation from another indicator of your choice. In both cases, the objective is to keep it simple. There is no need for additional layers of complexity. These attempts at improvement will only render a confusing mess that defeats the purpose of a plan in the first place.

Both of these trading strategies also have their basis in statistical inferences and the natural flow of energy in natural settings. Market forces do move in waves, which behave according to specific mathematical protocols. Given the preponderance of traders and automated trading “robots” that fixate on the placement of Bollinger Bands and Fibonacci ratios, it is no wonder that statistical convergences occur on a regular basis. If the market is going to bounce in predictable ways, then take what the market gives you and bounce right along with it. Keep it simple and enjoy!

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk