Strange things are happening in the U.S. financial marketplace. The recent CPI inflation update caused a bit of a stir. The general rate may have only increased 0.1%, not that big of a deal, but the rate that most analysts follow religiously is the rate with food and energy backed out. This rate rose 0.3% for the month of June, the highest increase in this figure since January of 2018. Long-term Treasury yields immediately increased to price in inflation risk, a good thing since the yield curve inversion actually showed signs of reversing, thereby reducing the dreaded recession risk factor.

Treasury Secretary Steven Mnuchin also warned Congress that the Treasury was running out of money, a signal to all that a debt ceiling debate was imminent, if the government was to function properly. There was no admission that reckless spending and fiscal policies were the root of the problem, not that anyone expected such. Tax revenues are up, but deficits are exploding, and to compound matters, foreign entities have withdrawn their support for recent long-term Treasury offerings. The only buyers appear to be U.S. banks, hedge funds, pension funds, and mutual funds.

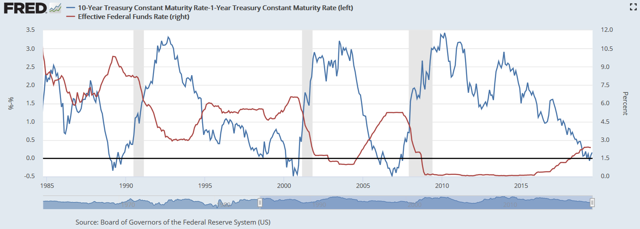

One report sums it up, as follows: “The conclusion is that the market is starting to price in inflation, budget deficits, the debt ceiling, lack of foreign buying, and lower remittances to the Treasury. We see symptoms of this emerging in the yield curve, which is turning positive again. In the final chart below, you’ll see that the Federal Reserve will start cutting rates when the yield curve turns positive again, effectively initiating a highly inflationary period.”

With both deficits and national debt on the rise, the Treasury will need to sell more and more debt over the years to come, debt which foreign governments had been eager to buy prior to 2015. According to one observer: “Since 2015, foreigners have not been buying U.S. debt as they used to do. Russia has sold all of its U.S. treasury holdings, Japan isn’t buying, and China is unwinding its holdings as well. The Federal Reserve isn’t buying either, as it is unwinding its balance sheet”.

The Fed, the U.S. central bank, has orchestrated a policy of quantitative easing by loading its balance sheet with an assortment of debt securities, many that its banking members could not sell, if not for a loss. Other central banks across the globe have followed its lead, and now they, too, have bloated balance sheets with no plans to buy external debt securities, much less proceed down a path of normalization. The Fed attempted to normalize, only to be backed into a corner by the political powers that be.

During his recent semi-annual review with Congress, Jerome Powell, the chairman of the Fed, intimated that a July interest rate cut of 25 basis points is currently his board’s “base case”. Trump has been threatening to fire Powell if he did not reduce rates soon, even though the law does not give him that power. Fed chairmen and banking members serve a specified term by law, independent, supposedly, of political influence. After his July meeting and the rate cut is announced, Powell will most probably say the cut was a pre-emptive action, designed to act as insurance or a buffer before data demanded it.

U.S. 30-year yields have risen sharply, back to 2.12%. Investors are pricing in inflation expectations, assuming that low unemployment when coupled with interest rate cuts should, under normal circumstances, ignite a fire under inflation. Trade uncertainty and tariffs do not help the situation either, nor does the Fed’s loaded balance sheet. The Dollar is stuck around 97 on the index, refusing to drop in submission, but a potential bond sell off is brewing. What about equities? The party continues for some reason.

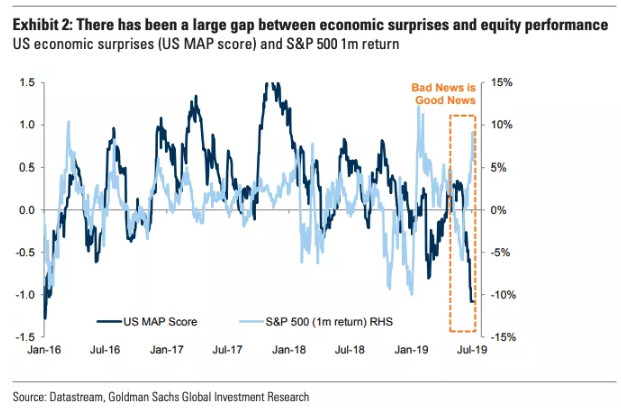

Goldman’s commentary that accompanied the above graphic was: “1H19 was mostly a ‘bad news is good news’ regime as softer global growth resulted in more central bank easing giving support both to ‘risky’ and ‘safe’ assets, which were sending conflicting bullish and bearish signals, respectively.”

One pundit wrote on this topic that: “That stocks rose even as bond yields jumped is a positive development for equity bulls. 2019 has been dominated by the “bad news is good news” dynamic, whereby lackluster data and rampant trade uncertainty were seen as desirable to the extent they underscored the need for rate cuts and a renewed commitment to stimulus by central banks”. Goldman Sachs has even produced a chart that tracks how the S&P 500 reacts to economic surprises like the present case:

Is it healthy to have stocks perform such a “disconnect” with bonds? Analysts are quickly building an argument to support such odd behavior in the market. The thinking is that earnings season is upon us, and investors and their analytical teams are performing their various present value discounting of future revenue streams AND revising their rate assumptions downward, a process that yields higher valuations. Ahah! Stock values are obviously supposed to go up under these circumstances. Imagine that?

Whatever the rationale, rising yields accompanied by rising stock prices have probably gone about as long as is permissible for such a “disconnect” to make sense. What if yields continue to rise? If too far, too fast, then we could see a very messy few days or weeks, as investors effectively unwind their positions, perhaps, out of fear of rampant inflation, which could wreak havoc on earnings and valuation presumptions down the line. Ultimately, can actions by the Fed avert a business downturn or will the economy rush toward a recession? The jury is still out on this high-wire circus act.

Concluding Remarks

Here we are again, walking on eggshells and attempting to bypass anything that resembles a hint that a recession could occur in the near term. This “New Normal”, where old rules do not apply, but no one is quite sure which rules are valid and which ones are not, is beginning to get more tedious with each passing week.

Earnings season usually reverts to rational investment judgments based on facts and cold, hard economic data. It will be interesting to see how this present situation unwinds, because it truly will morph into something else, something we may have never seen before, but which we will attempt to explain with a positive spin.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk