Bitcoin enthusiasts were cheering on Sunday evening when their favourite cryptocurrency once again touched, kissed, or demonstratively crossed over into the promised land, the once trodden territory of $50,000. Last week’s “risk-off” red light was supposed to spell the end of Bitcoin’s recent recovery, but the King of Cryptos had something else in mind.

How many times will it take to understand that Bitcoin always dances to the beat of its internal drummer? Yes, we have more than a decade of good pricing data that often follows technical analysis predictions, but, more often than not, BTC has chosen to blaze a new path to the dismay of its so-called crypto experts. Roughly one month ago, Bitcoin had dipped below $30,000, a crucial support level, but it soon rose from the ashes in a flourish.

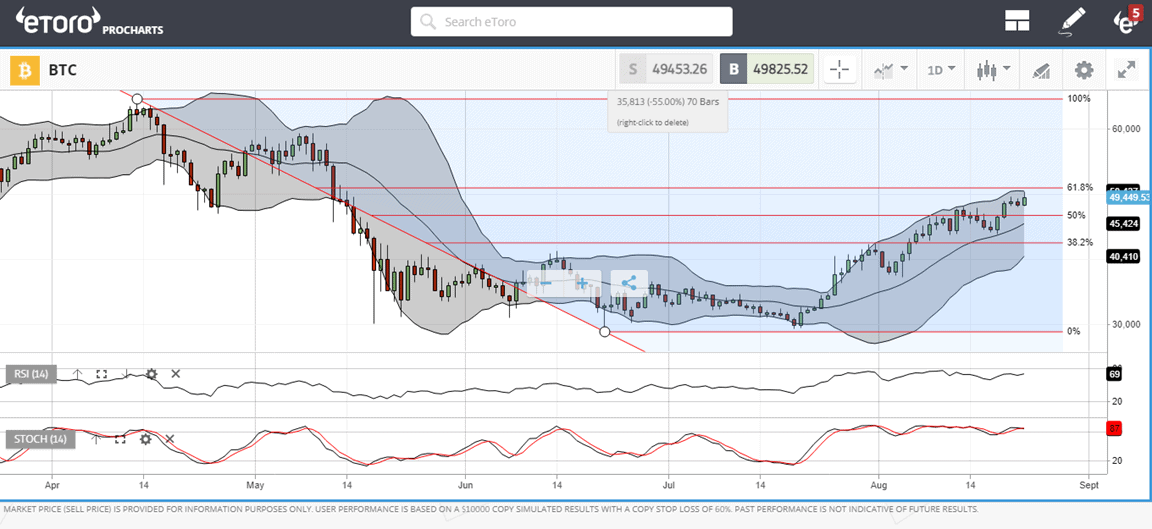

Bitcoin is now staring at $50,000 and above, but it has also come to rest in the dreaded “Decision Box”, the area between the 50% and 61.8% Fibonacci ratios. Pundits galore are rushing to the archives to find some clue as to what happens next, the proverbial question that always comes up after a Bitcoin recovery that appears to be on the verge of stalling. Three interesting hypotheses have surfaced from the situation in the quest for today’s “BTC Holy Grail”.

Source: eToro

Hypothesis #1 – Wyckoff Distribution Tea Leaves

This cute phrase applies to a sideways trading pattern that often follows an uptrend. Typically, the “Big Guys” drive the trend up, then short or sell off long positions to wash out the unsuspecting mob of retail traders who feel they missed the boat. Advocates of this highly technical pattern now claim that we have reached the “Upthrust and Distribution” phase. The “Big Guys” will now have their way with the retail mob. Under this scenario, Bitcoin is supposed to fall.

Hypothesis #2 – Bitcoin Post-Halving Extensions

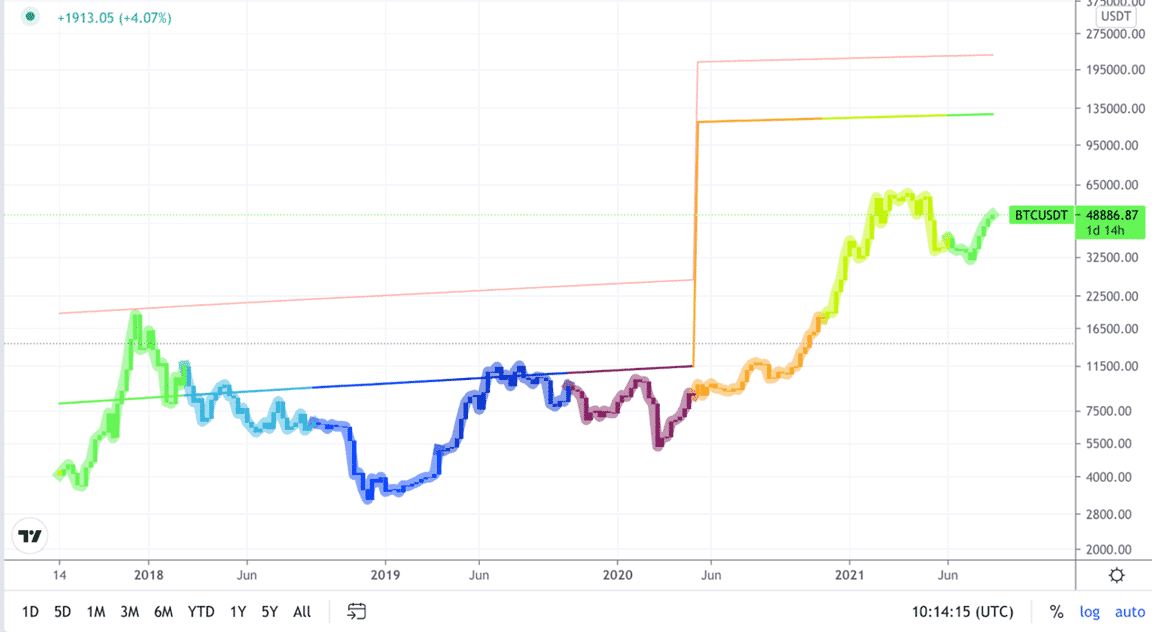

Coincidentally, Bitcoin supporters like to extend what has happened after prior “halving” events of the Bitcoin reward for miners. This event takes place every four years. The next one up is in 2024.

Source: SeekingAlpha

Colours correlate with patterns from previous analyses. The implication is that Bitcoin has more room to roam, potentially doubling or tripling in value, before its next halving. The author also cautions that 2022 and 2023 could be a repeat of Crypto Winter, as well.

Hypothesis #3 – Crypto Fear and Greed Index Repercussions

Many analysts purport that Bitcoin values are driven primarily by investor sentiment, but measures for this sentiment can vary across the map. One favoured algorithm analyses social media traffic for positive and negative comments, which produces a “Crypto Fear and Greed Index”. On a “100” scale, Fear persisted at “20” from May through July. It has shot up to “80” in two weeks, its position during BTC’s fall from grace in April and May.

Concluding Remarks

Will Bitcoin re-trace its prior pricing behaviour, whether it relates to a Wyckoff Distribution, post-halving extensions, or the implications of its latest Fear and Greed Index? Even the experts will tell you it’s anyone’s guess as to what happens next. Place your bets but be cautious.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk